Fees Calculation

For Investors¶

While strategy providers can offer their strategies for copying on a free basis, it is also possible for providers to configure strategy fees in the 'Strategy Settings' window. The types of charges for investors include performance fee, management fee, and volume fee, in any combination depending on the strategy provider's preferences.

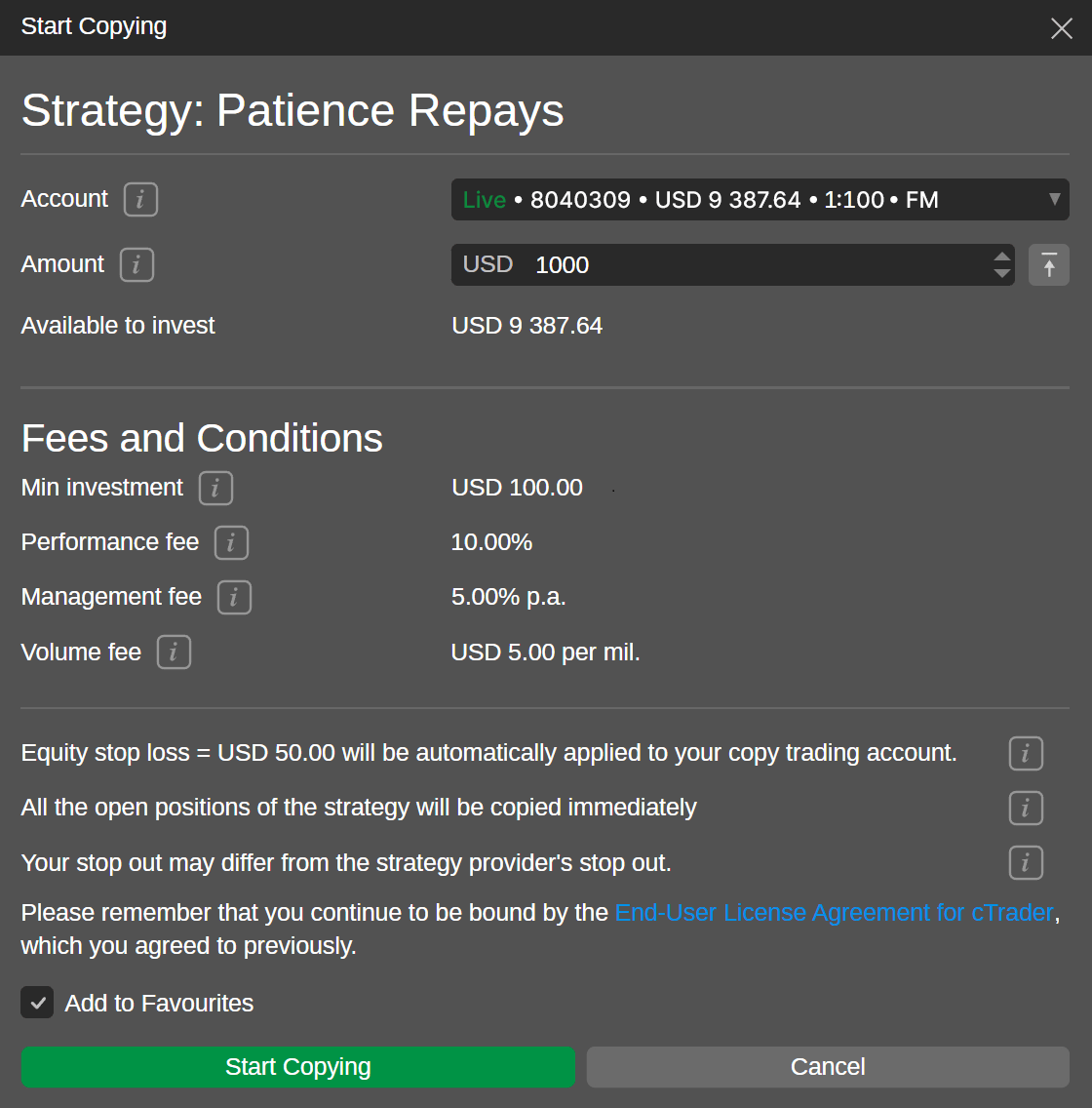

An investor can instantly face all fees to be paid on the 'Start Copying' button before copying a strategy.

Performance Fee¶

Performance fee ('P') is the amount investors will pay to the strategy provider based on the established percentage of their net profit calculated by means of the High-Water Mark (HWM) model.

The performance fee cannot exceed 30%.

Management Fee¶

Management fee ('M') involves a periodic payment to the strategy provider for managing investors' funds regardless of the strategy performance. Management fees are accrued on a daily basis and set by the strategy provider as an annual percentage of the investor's equity.

The management fee cannot exceed 10%.

Volume Fee¶

Volume fee ('V') is the amount investors will pay to the strategy provider per one million of volume copied. It is calculated per side and added to each position. If a strategy provider charges, for example, USD 10 per million, and an investor copies the volume of one million, they will pay USD 10 to the strategy provider upon opening the position and USD 10 upon closing the position.

The volume fee is charged only in case of the strategy provider's trading actions and is not charged in case of the provider's balance operation (deposit or withdrawal).

The volume fee cannot exceed USD 10.

Example

Let us assume that an investor is planning to allocate USD 1,000 for copying a strategy with the following fees preset by the strategy provider.

- Performance fee: 10%

- Management fee: 5%

- Volume fee: USD 5

This means that:

- The investor will incur a fee amounting to 10% of the total net profit generated by the strategy. For instance, if the copy-trading account generates USD 700 as the total net profit, its holder will pay USD 70 for performance.

- The investor will incur a charge of 5% of the total equity allocated to their copy-trading account annually, equating to USD 50 out of the allocated USD 1,000 per year. The management fee will constitute

1,000.00 * 0.05 / 365 = 0.14per day. - The investor will be charged USD 5 for each USD million of the copied volume from the strategy, or USD 0.5 for one lot copied. The calculation of the volume fee for one lot of EURUSD will look as follows:

Volume fee = 1.19 * 100,000 / 10^6 * 5 * 2 = 1.19This calculation is valid if:1 lot = 100,000Current quote = 1.19/1.19EUR 100,000 = 1.19 * USD 100,00010^6 = 1 million2 = position sides (opening and closing)

Fee Logs¶

Investors can locate the applied performance and management fees on their copy-trading account page in the 'Transactions' tab.

The volume fee log entry is available in the 'History' tab. The unrealised volume fee can be found in the 'Positions' tab.

Note

The 'Volume fee' and the 'Unr. volume fee' columns are disabled by default. Investors and strategy providers can right-click on any column heading in the 'History' and 'Positions' tabs and enable these columns for viewing in the dropdown menu.

For Strategy Providers¶

A strategy provider is free to decide whether to establish zero fees for copying their strategy by live and demo accounts, or charge fees in any combination but within the allowed boundaries discussed above.

The copy-trading commission is the sum of all three types of fees (i.e., performance, management, and volume) charged to the investor's account.

Warning

Any of the fees can be adjusted by the strategy provider only after the strategy is stopped and no investors are copying it. New fees will be applied to the investors only after they restart copying the strategy.

Fees are paid to the strategy provider in the form of a deposit from the broker to one of the accounts specified by the provider earlier. The copy-trading commission is automatically converted to the provider's account currency. All fees paid by investors are deposited to the provider's account with a separate transaction per investor.

The broker will immediately reimburse the strategy provider for any realised performance or management fees applied to any investor. The volume fee will be charged to the investor's copy-trading account when the deals are executed, but it will be deposited to the provider's account along with the performance or management fee.

When fees are deposited to the provider's account, the strategy provider will automatically receive an email with a detailed description of the fees paid per strategy.

Fee Payment Time and Terms (Triggers)¶

All fees regardless of their type are charged to the investor's copy-trading account on the 1st of each month. The payout to the strategy provider's account will be made immediately after the investor is charged.

Additionally, the following events trigger the application of fees.

- The strategy provider stops providing their strategy. In this case, all investors automatically stop copying it, and all open positions within the strategy will be automatically closed for the investors, and all unrealised fees will be charged after the positions are closed.

- The investor stops copying the strategy themselves.

- The investor withdraws funds from their copy-trading account (i.e., removes funds to their main trading account). In this case, the platform also automatically recalculates the equity and adjusts the current and future trades according to the equity-to-equity model. If the investor removes funds while copying the strategy, all fees will be charged at once and in full.

Note

When the provider adds own funds to the strategy account, the platform automatically decreases the investor's positions; and when the provider withdraws funds decreasing their balance, the platform automatically increases the investor's positions. Depositing the investor's fees to the provider's account does not trigger the recalculation of the investor's volume, to avoid any unplanned volume corrections.

If the investor is copying several strategies, fees will be applied to each dedicated copy-trading account independently.