Charts

The trading instrument's price fluctuations are displayed in the symbol chart in real-time.

To take full advantage of the charts, select a symbol and proceed to the Symbol Details, scroll to the symbol chart, and open it by tapping the full-screen button to the upper left.

Alternatively, double-tap on the chart to open it in the full-screen mode.

The standard chart contains the Price Axis (vertical), the Time Axis (horizontal), the Ask Price Line (green), and the Bid Price Line (red).

All the Open Positions, Pending Orders, Stop Loss and Take Profit protections (if you have set any) are displayed on the chart in real-time. You can close or modify them directly from the chart.

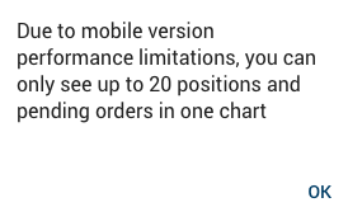

Note

Due to mobile version performance limitations, you can only see up to 20 positions and pending orders in one chart. In case if you reach this limit you will see the respective message.

You can modify the Pending Orders and Open Positions directly from the chart. Tap on the desired position and drag the Stop Loss and Take Profit tiles to the desired level to modify them.

Tap the cross to close the position or cancel a protection.

Tap on a pending order tile and drag it over the price axis up and down to modify it.

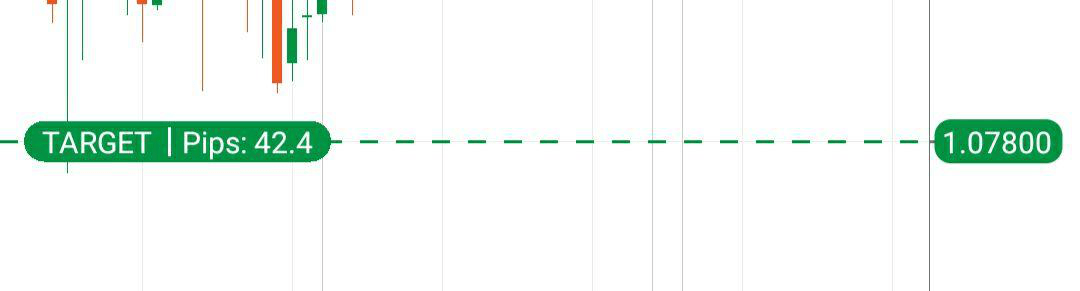

Target - the trading signal from our partner Trading Central is accessible directly in the chart as well.

Tap on the Target tile to view the details.

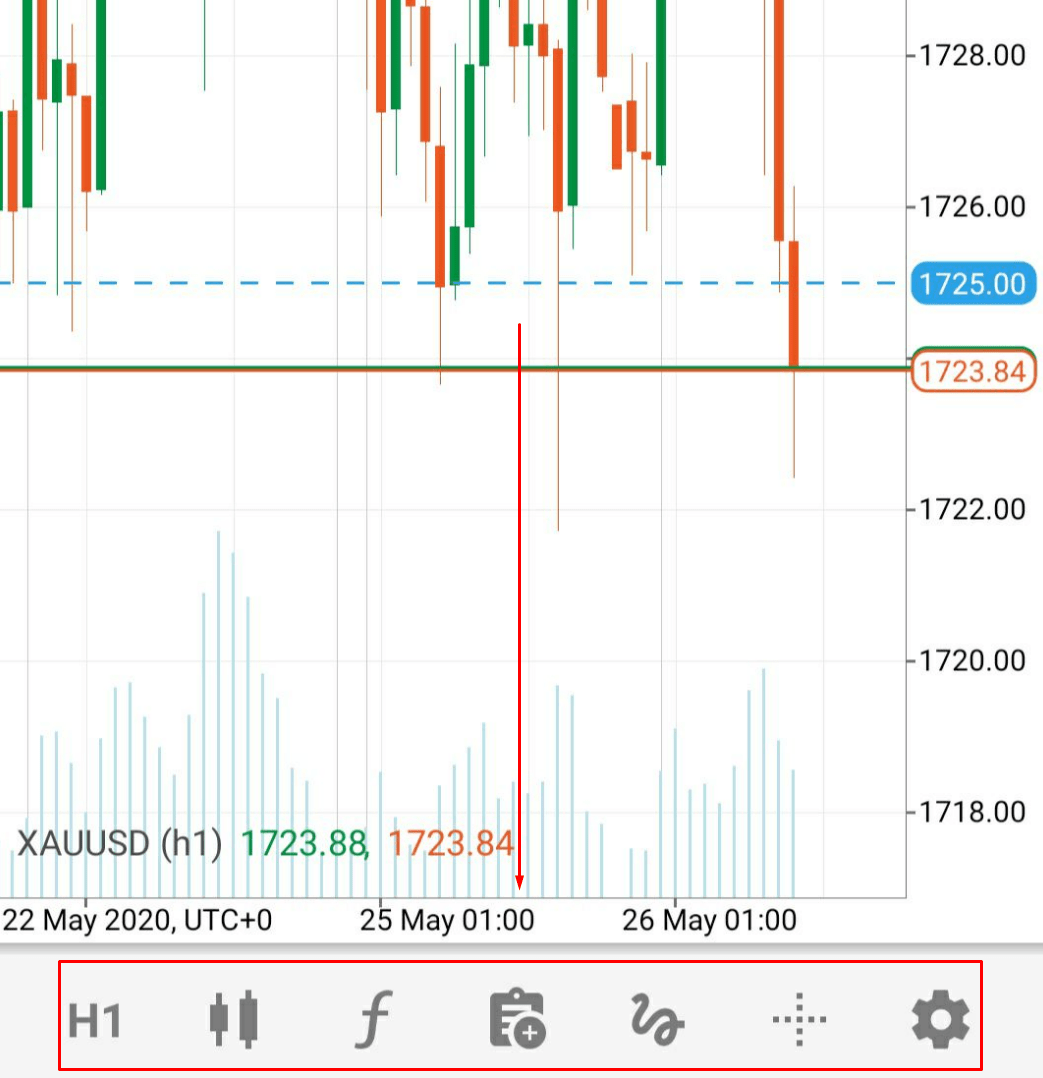

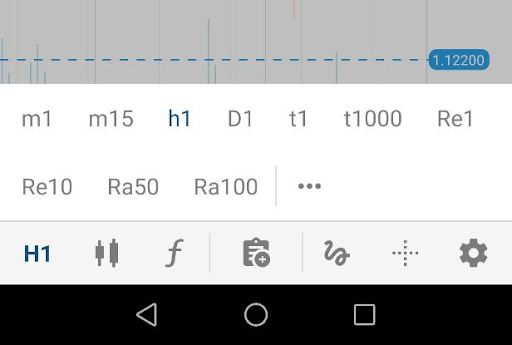

The additional chart options are available to the bottom of the chart.

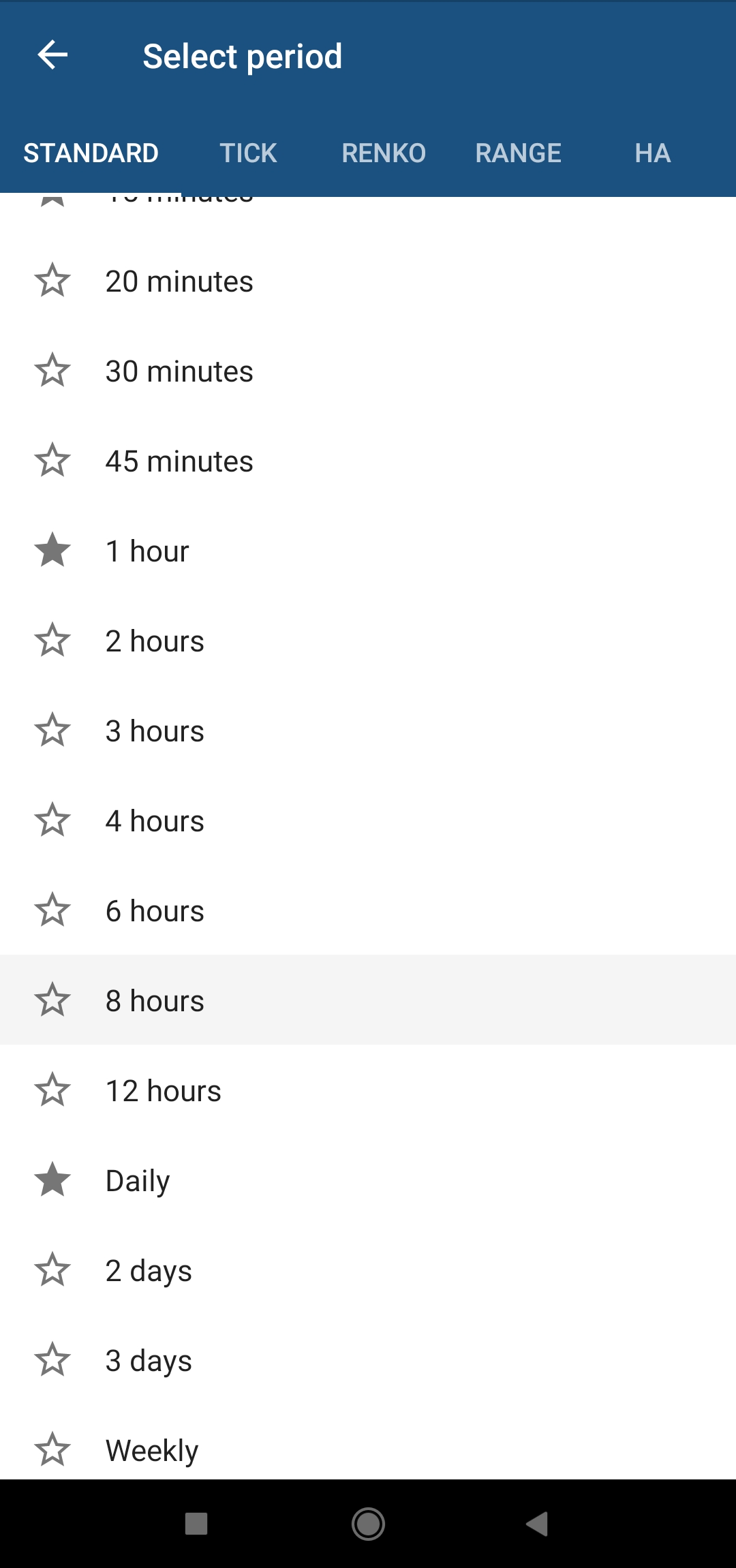

Time Period  ¶

¶

Tap and hold the Chart Period button to open the Time Period selector which allows you to set a certain time period for charts, as well as to set the chart in Ticks, Renko or Range.

Standard¶

The Standard Time Frame allows you to select the desired time period from 1 minute to 1 month to apply to the chart.

Tick¶

The Tick based bars allow you to select the desired number of ticks and construct the bars based on that. You can select the number of ticks from 1 to 1000.

Range¶

In the Range bar, all price bars are of equal length. So, for example, if you set a 10 pip range bar, then all bars are of a 10 pips range (high to low, or low to high). The close of a bar is always equal to the open of the next bar. The range is measured between the high and low price . Learn more about Range chart here.

Renko¶

In the Renko bars, every bar is of the same length (including reversals, but the price must travel two times the Renko bar in the opposite direction). Learn more about Renko chart here.

Heikin Ashi¶

Heikin-Ashi means "average bar" in Japanese and it is an offshoot of the Candlesticks technique. Heikin-Ashi Candlesticks use the open-close data from the prior period and the open-high-low-close data from the current period to create a candlestick. Learn more about Heikin Ashi chart here.

Tap on the star icon to add a time frame to your favorites (you can choose no more than 20 timeframes. If you reach this limit, you will see a respective message), tap on the time frame row to immediately apply it to the chart.

Shortly tap on Chart Period button to quickly switch between your favorites.

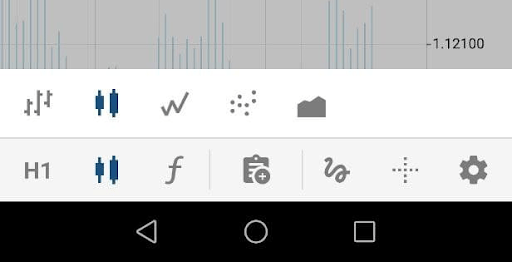

Rendering style  ¶

¶

The Charts Rendering Type options allow setting the chart style. At the moment cTrader mobile app supports the following styles:

- Bar Chart - provides the opening, closing, high, and low prices for the selected time frame in the form of bars.

- Candlesticks Chart - composed of a series of open-high-low-close (OHLC) candles set apart by a time series.

- Line Chart - a graphical representation of an asset's historical price action that connects a series of data points with a continuous line. Line charts can be used on any timeframe, but most often using day-to-day price changes.

- Dots Chart - displays only the closing prices for the selected time frame as dots.

- Area Chart - based on the line chart. The area between the axis and line is commonly emphasized with colors, textures, and hatchings.

Tap to open the Chart Style sub-menu, and tap on desired rendering type to apply changes.

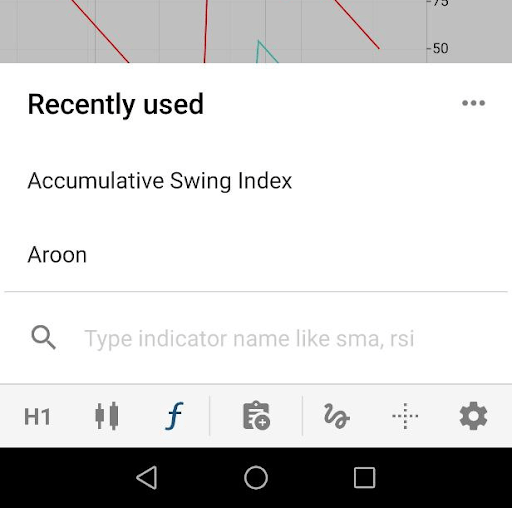

Indicators  ¶

¶

The cTrader Indicators section allows one to add or edit Indicators on the chart.

Tap and hold the Indicators button (or make a short tap on the indicators button and then tap on the 3 dots icon) to add new indicators and adjust added indicators.

TTap plus + on the upper right to add the desired indicators.

All existing Indicators are grouped by functionality in the respective lists - Trend, Oscillators, Volatility, Volume, and Other Indicators.

Tap on the desired group to expand the list of indicators. All Indicators that were recently used are listed in the Recently Used list on the top.

Alternatively, you can use the search box on the top to find the desired Indicator by its name.

Tap on an Indicator to open its settings (shift, color, etc.)

When done, Tap on Back - the Indicators will appear in the chart immediately.

To remove an indicator, tap on the bin icon next to it directly in the list.

Shortly tap on the Indicators button to add indicators from the list of Recently Used or find them by name.

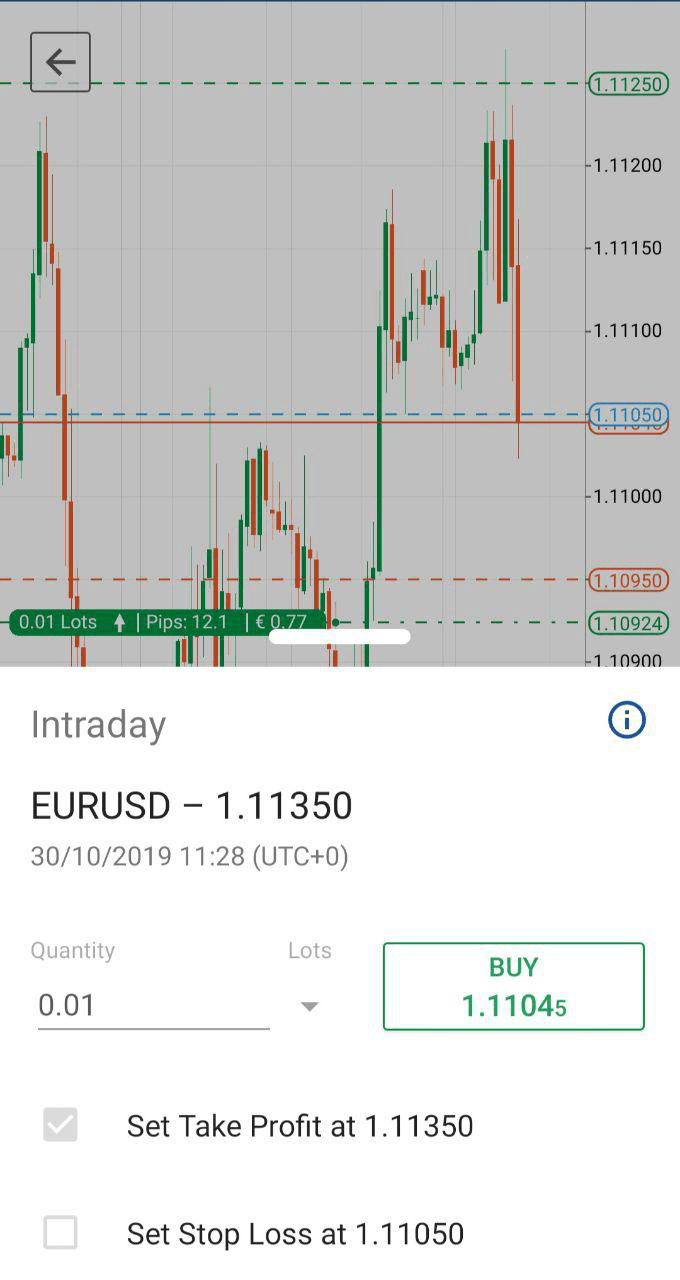

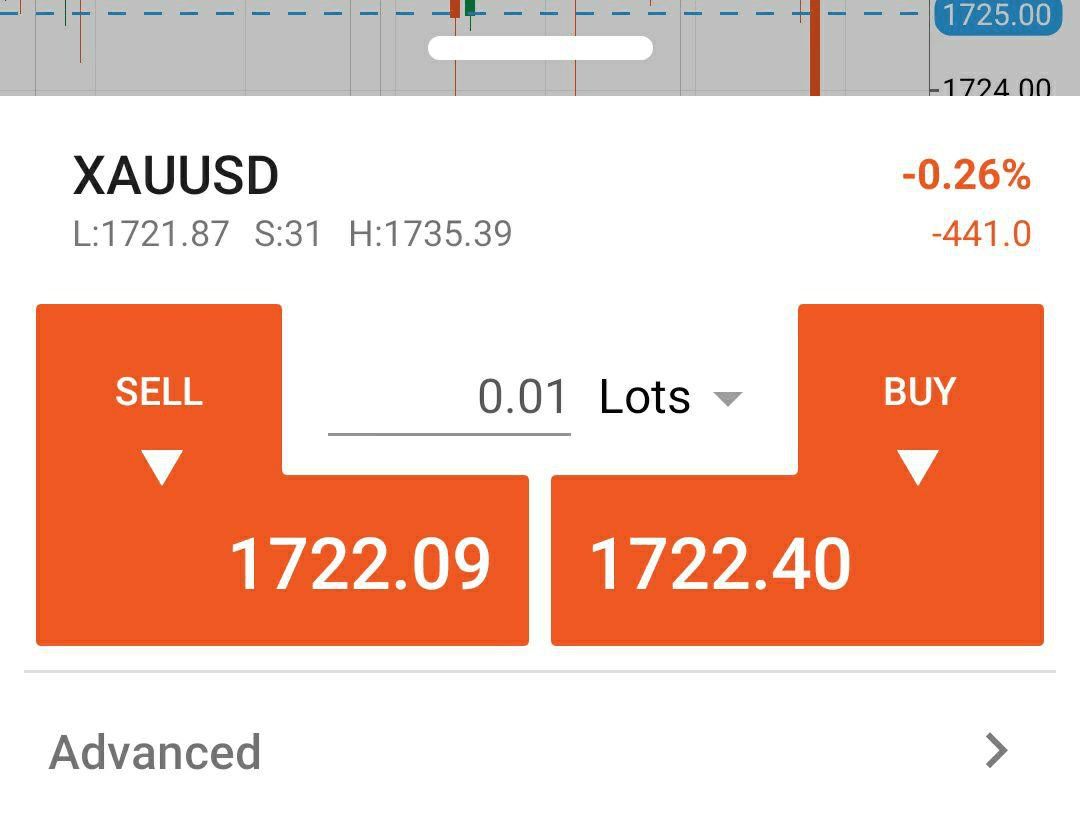

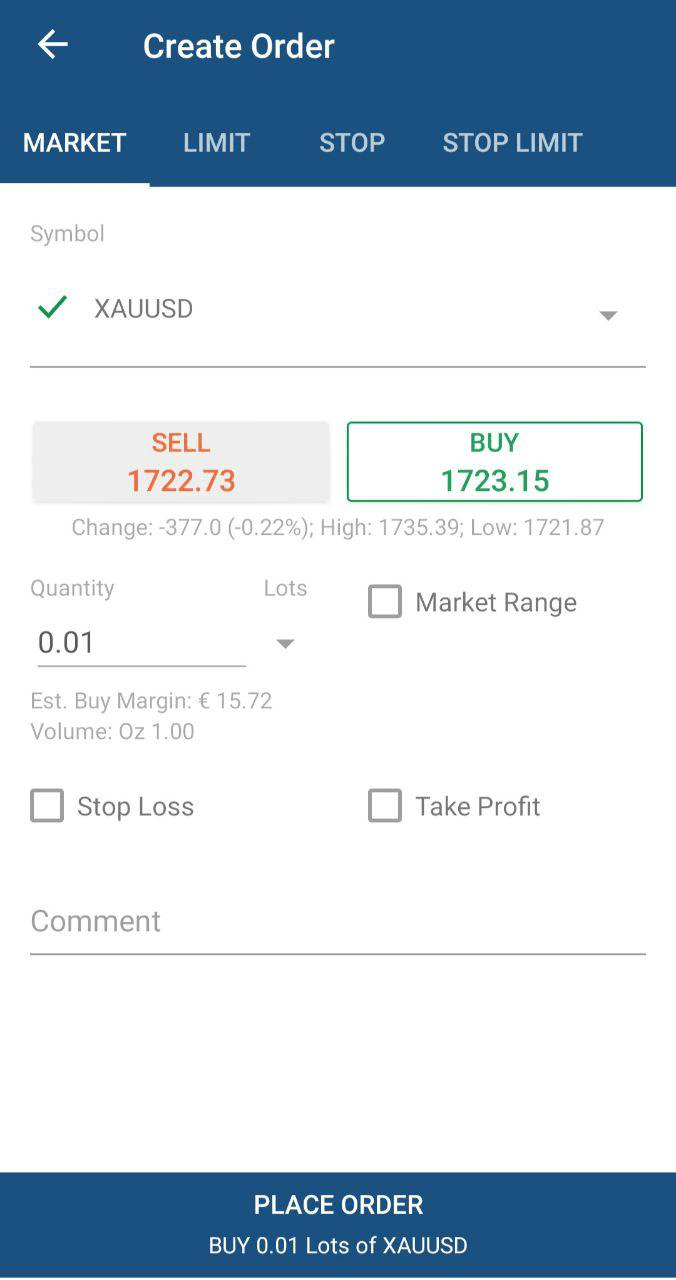

New Order  ¶

¶

Use the New Order button directly from the chart to fill the market orders or create any other types of orders.

Tap the New Order icon to open the New Order menu. Tap the Lots selector to set the desired amount of lots to trade, and tap the Sell or Buy button to place a Sell or Buy Market Order respectively.

Tap Advanced to open the Create Order menu to create the desired type of order.

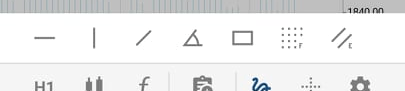

Line Studies and Chart Objects  ¶

¶

cTrader mobile app offers a comprehensive set of line studies and chart objects for advanced technical analysis. Tap the Drawings icon to proceed to the Line Studies menu.

Tap plus (+) to proceed to the objects selector.

The following lines and chart objects are available here:

- Horizontal Line - the line parallel to the time axis, can be placed anywhere in the chart. Often used to mark the support and resistance levels on the chart.

- Vertical Line - the line parallel to the price axis, can be set anywhere in the chart. Often used to mark certain areas on the chart, for example, the correlation between the price and indicators below.

- Trend Line - bounding line for the price movement of a symbol that allows marking the price trends.

- Ray - very similar to the Trendlines, but they make it easier not only marking a trend but predicting its further movement.

- Rectangle - allows placing the rectangle shape on the chart.

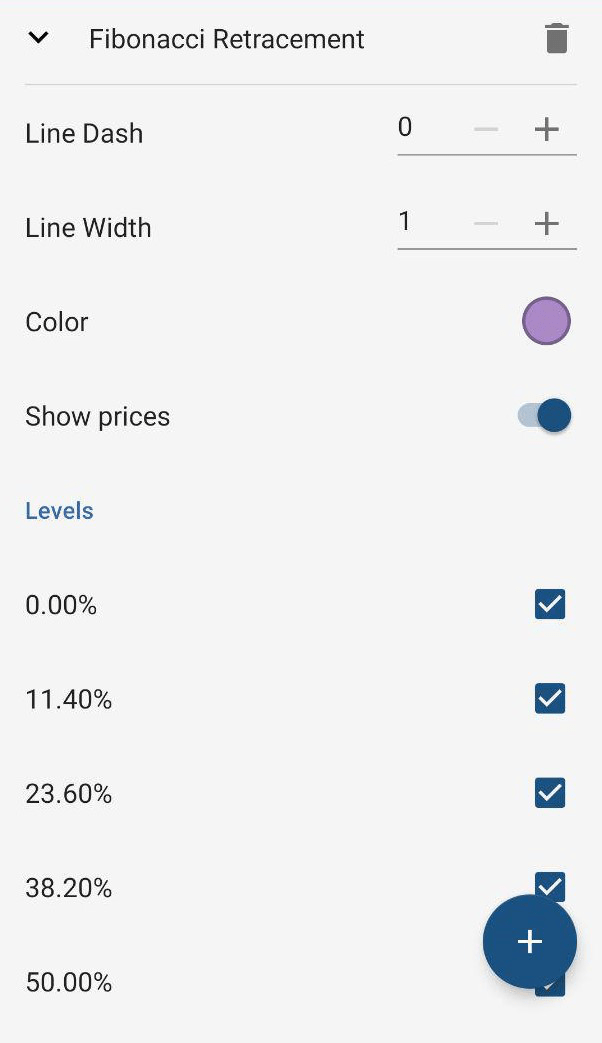

- Fibonacci Retracement - a charting technique that uses horizontal lines to indicate areas of support or resistance at the key Fibonacci levels before the trend continues in the original direction. Fibonacci Retracement price levels can be used as buy triggers on pullbacks during an uptrend.

- Equidistant Price Channel - allows drawing two precisely parallel lines on the chart.

Context Panel¶

After adding an object on the chart, the object becomes selectable. On selecting the object, the context panel will appear

The context panel provides the following options:

- Rotate Anti-Clockwise. Rotates the object in an anti-clockwise direction

- Rotate Clockwise. Rotates the object in a clockwise direction

- Copy. Create a copy of the selected object.

- Edit. Opens the editing panel that allows you to edit the chart objects.

- Lock. Locks the selected object to its current position.

- Delete. Deletes the object.

Managing Objects¶

By clicking on the Edit button inside the context menu, you will get the objects list where you can edit your chart's objects.

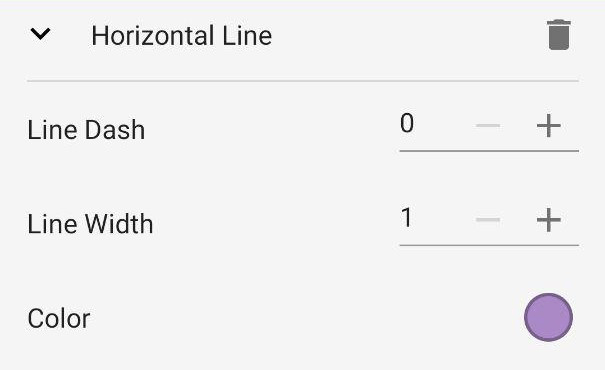

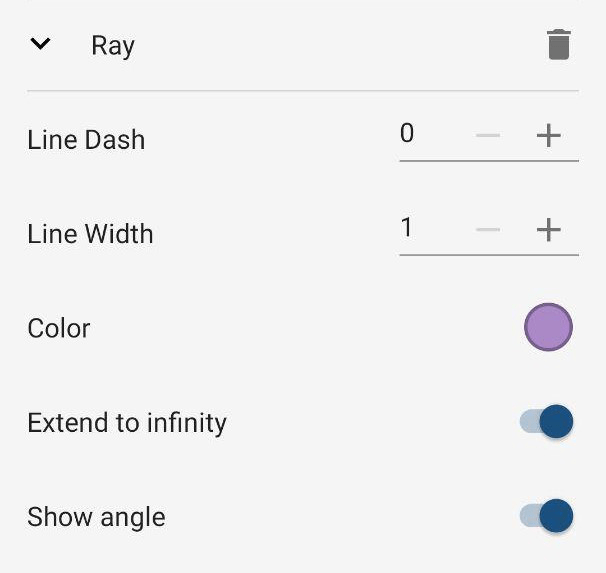

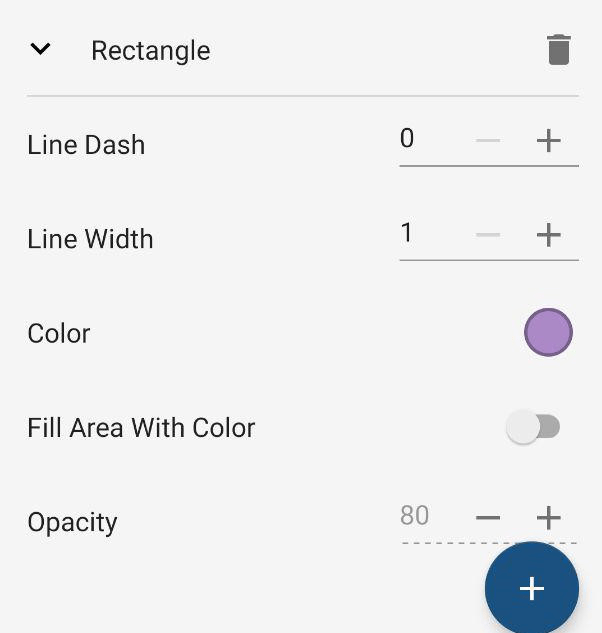

To edit a line or a ray, expand its details from the Drawings list. You can set Line Dash and Line Width, and Colour.

For the Trend Lines, Rays, and Equidistant Channel, you can also set the extending to infinity and displaying the angle.

For the Fibonacci Retracement, you can also hide or show prices, and set the levels in percent.

For the rectangle shape, you can also set the filling of the shape and its opacity.

The changes will apply immediately. Just exit the Drawings section to view the changes on the chart.

Crosshair  ¶

¶

The Crosshair cursor makes it easier to see the exact price at the exact time on the chart. Tap to enable the Crosshair cursor on the chart.

Move the cursor to any point on the chart to see the price and time differences between the points.

Tap the triangle to the bottom of the screen to place the second crosshair to check the difference between two points on the chart.

Charts Settings  ¶

¶

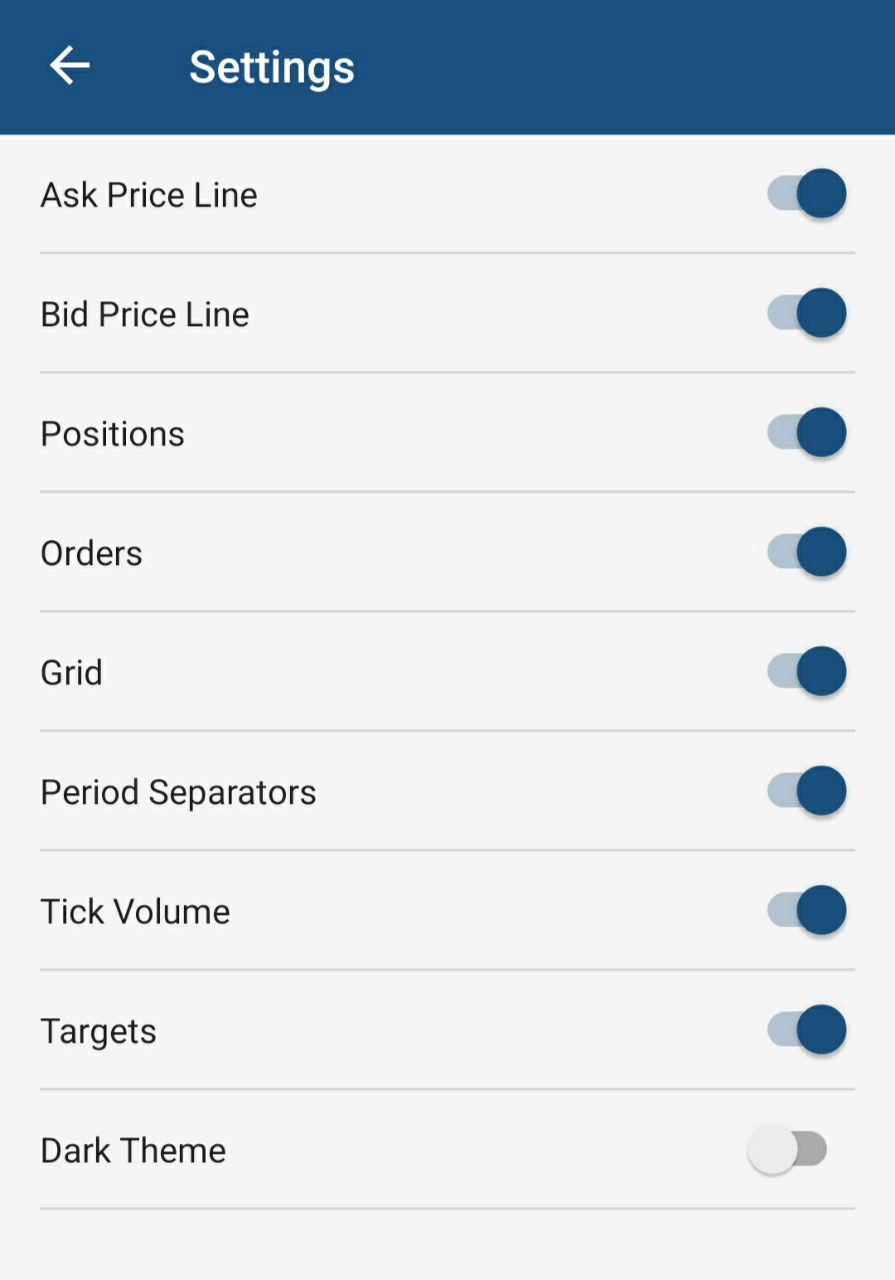

Shortly tap the cog icon to proceed to the chart viewing settings menu. The following settings are available in cTrader mobile app:

- Hide or show the Ask Price Line - the green line on the chart displaying the Ask price level in real-time.

- Hide or show the Bid Price Line - the orange line on the chart displaying the Bid price level in real-time.

- Hide or show the Positions - the position badge and line on the chart (if any positions are opened for the symbol).

- Hide or show the Orders - the pending order badge on the chart (if any pending orders are placed for the symbol).

- Hide or show Grid - the grid on the chart background.

- Hide or show the Period Separators - the vertical line separating the time periods on the chart.

- Hide or show the Tick Volume - the tick volume bars to the bottom of the chart.

- Hide or show Targets - the indicator displaying the Trading Central data on the chart.

- Switch between the dark and light themes.

- Run Chart Panel tips - runs a tooltip to show or remind you how to use the chart panel (You can also run it via Setting Fullscreen, by tapping on the help icon).

You can also open the Settings Screen with a tap and hold on the cog icon.

Tap the Back arrow to the upper left to exit the full-screen chart mode.