Renko Chart

A Renko chart is a type of chart that is built using price movement rather than both price and standardized time intervals like most charts are.

It is named after the Japanese word "renga" which means bricks since the chart looks like a series of bricks.

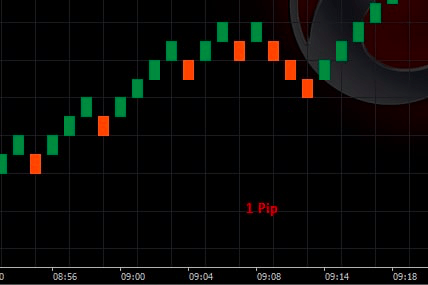

Each new brick is created when the price moves a specified price amount, and each block is positioned at a 45-degree angle (up or down) to the prior brick. In cTrader, an up brick is colored green, while a down brick is colored orange.

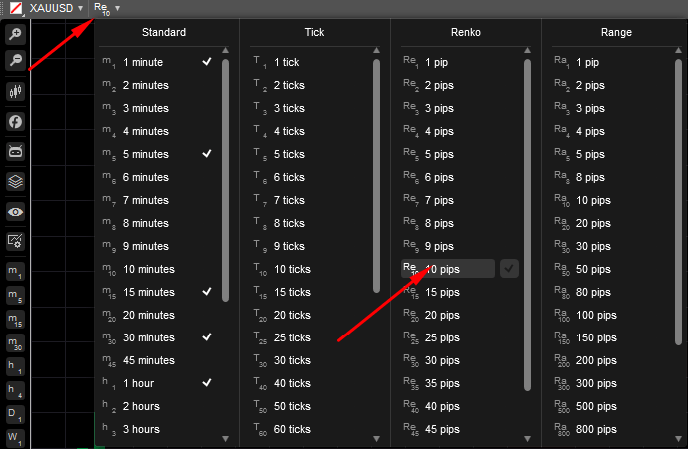

In cTrader, to display your currently opened chart in the Rengo bricks, proceed to the timeframe in the upper left, and in the Rengo section select from 1 to 100 pips.

Depending on your choice, your Rengo chart will be built considering the respective number of pips.

Renko Charts may have a similar look to Heikin Ashi in that both show sustained periods of up or down boxes that highlight the trend.

While Renko charts use a fixed box amount, Heikin Ashi charts are taking an average of the open, high, low, and close for the current and prior time period.

Therefore, the size of each box or candle is a different size and reflects the average price. Heikin Ashi charts are useful for highlighting trends in the same way that Renko charts are. Building the Renko Bricks

The Renko charts filter out the insignificant price movements and focus on the trends.

The flaw of such an approach is that some price information is lost due to the simple brick construction of Renko charts. Therefore, the first step in building a Renko chart is selecting the corresponding box size in pips.

Example

For example, a trading symbol may have a 50 pip box size. In this case, a Renko chart will be built by placing a brick in the next column once the price has surpassed the top or bottom of the previous brick by the box size amount.

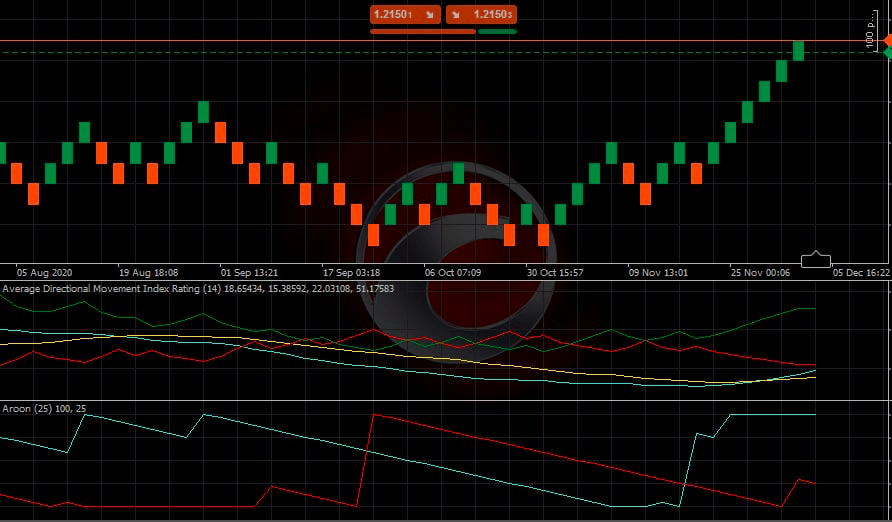

Renko charts are most useful for spotting trends, areas of support and resistance, breakouts, and reversals.

However, because of the basic price action nature of the Renko chart, traders often use indicators to provide additional information in their chart and either reinforce or warn against buy and sell signals.

cTrader charts have a bundle of preset Trend Indicators to use on the charts, like Average Direction Movement Index Rating, variety of Moving Average Indicators, and others. Check cTrader Indicators Help section for more information on the Indicators and how to use them.

Note that despite Renko charts showing a time axis, the time intervals are not fixed. One brick could take months to form, while several bricks may form within a day.

This varies from the Candlestick or the Bar Charts where a new candle/bar forms at specific time intervals.

When you change the Renko brick size, the "smoothness" of the chart changes. Thus, decreasing (fewer pips amount) the box size will create more swings, but will also highlight possible price reversals earlier.

A larger box size (bigger pips amount) will reduce the number of swings and noise but will be slower to signal a price reversal.

Due to the lower noise than in Candlestick chart, Renko charts are effective in identifying support and resistance levels. When a strong trend forms, Renko chart allows riding that trend for a long time before even one brick in the opposite direction forms.

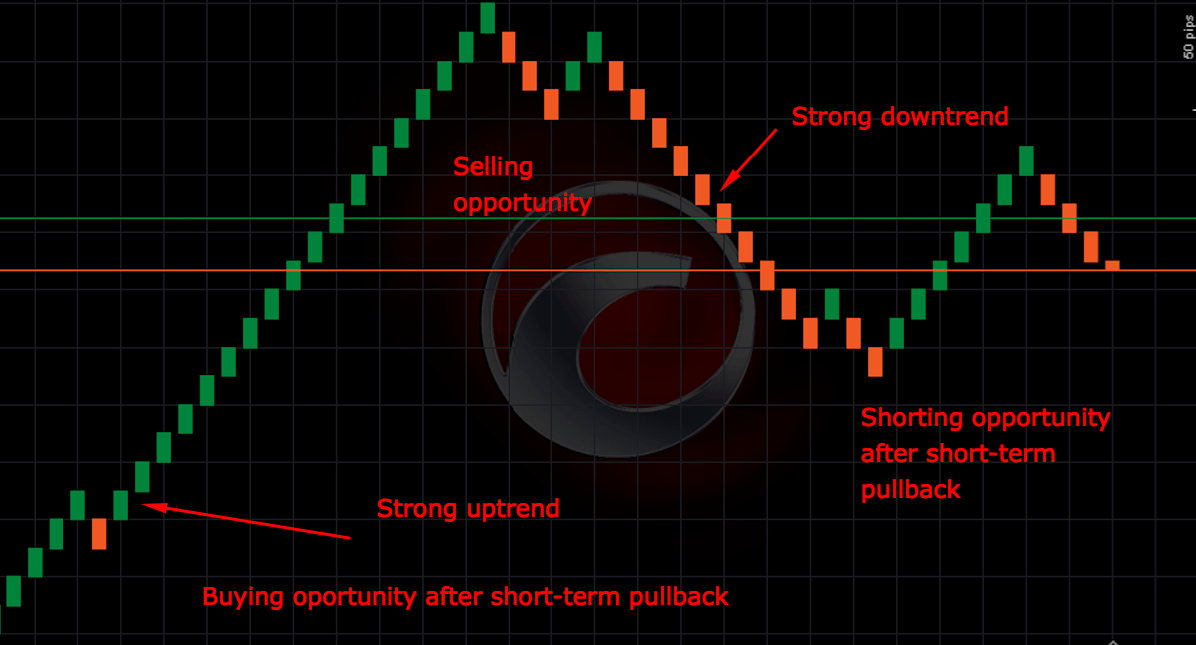

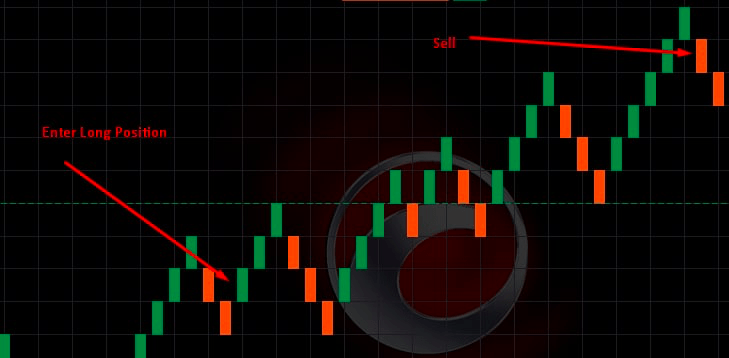

In Renko, trading signals are generated when the direction of the trend changes and the brick that is being built changes its color.

Example

For example, a trader might sell the asset when an orange box appears after a series of climbing green boxes. Otherwise, if the overall trend is up (lots of green boxes) a trader may enter a long position when an orange brick occurs after one or two orange boxes (a pullback).

Flaws¶

Besides all the advantages of tracking the price trends, Renko charts don't show as many details as Candlesticks or Bars, as they deal with the time in a different way.

A symbol that has been ranging for a long time may be represented with a single box, which doesn't convey everything that occurred during that period. This may be beneficial for some traders and for many cases, but not for all.

As mentioned above, highs and lows are also ignored in Renko, only closing prices are applied. That's why a lot of price data is left out since high and low prices can vary greatly from closing prices.

The use of only closing prices reduces the extra noise, but it also means the price could break significantly before a new box forms, and it could be too late to get out with a manageable loss.

Therefore, when using Renko charts, the good practice is to use stop-loss orders at fixed prices.

Example

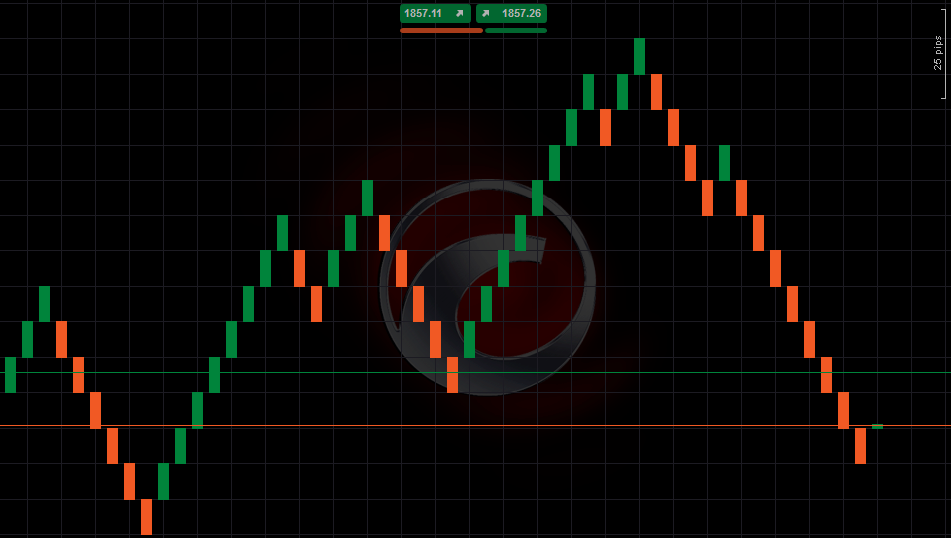

The chart below shows a strong uptrend in a symbol with the 10 pips box size. Boxes are drawn based on closing prices, so highs and lows, as well as moves smaller than 10 pips, are ignored.

There is a brief pullback, marked by an orange box, but then the green boxes emerge again. Given the strong uptrend, this shows an opportunity to open a long position. Consider an exit when another orange (down) box forms.

After the uptrend, a strong downtrend forms. A similar tactic could be used to open a short position. Wait for a pullback marked by the green (up) box.

When an orange (down) brick forms, enter a short position, as the price could be heading lower again in alignment with the longer-term downtrend. Exit when up brick occurs.

These are sample guidelines, but note that sometimes you should see two or more bricks in a particular direction before deciding to enter or exit.