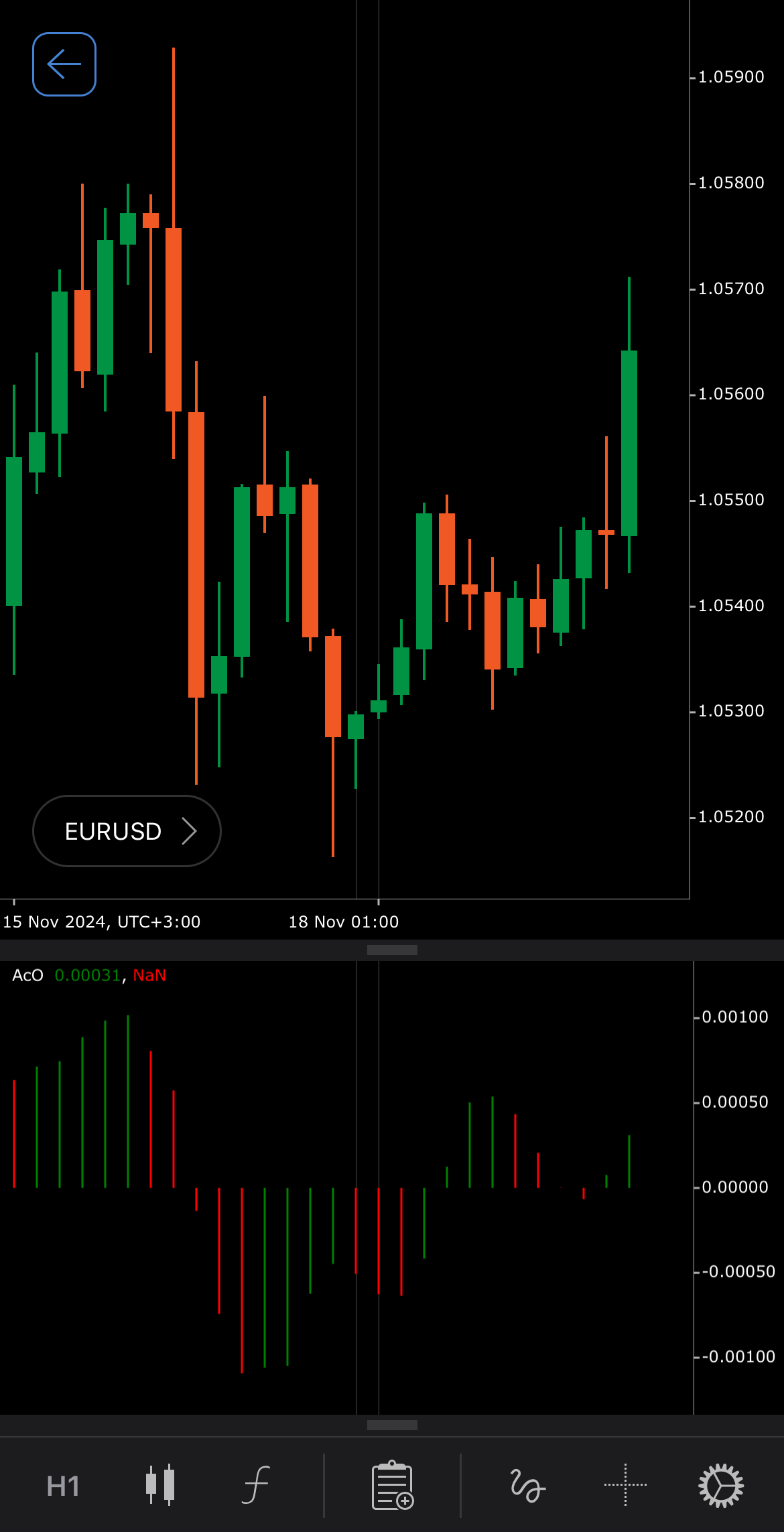

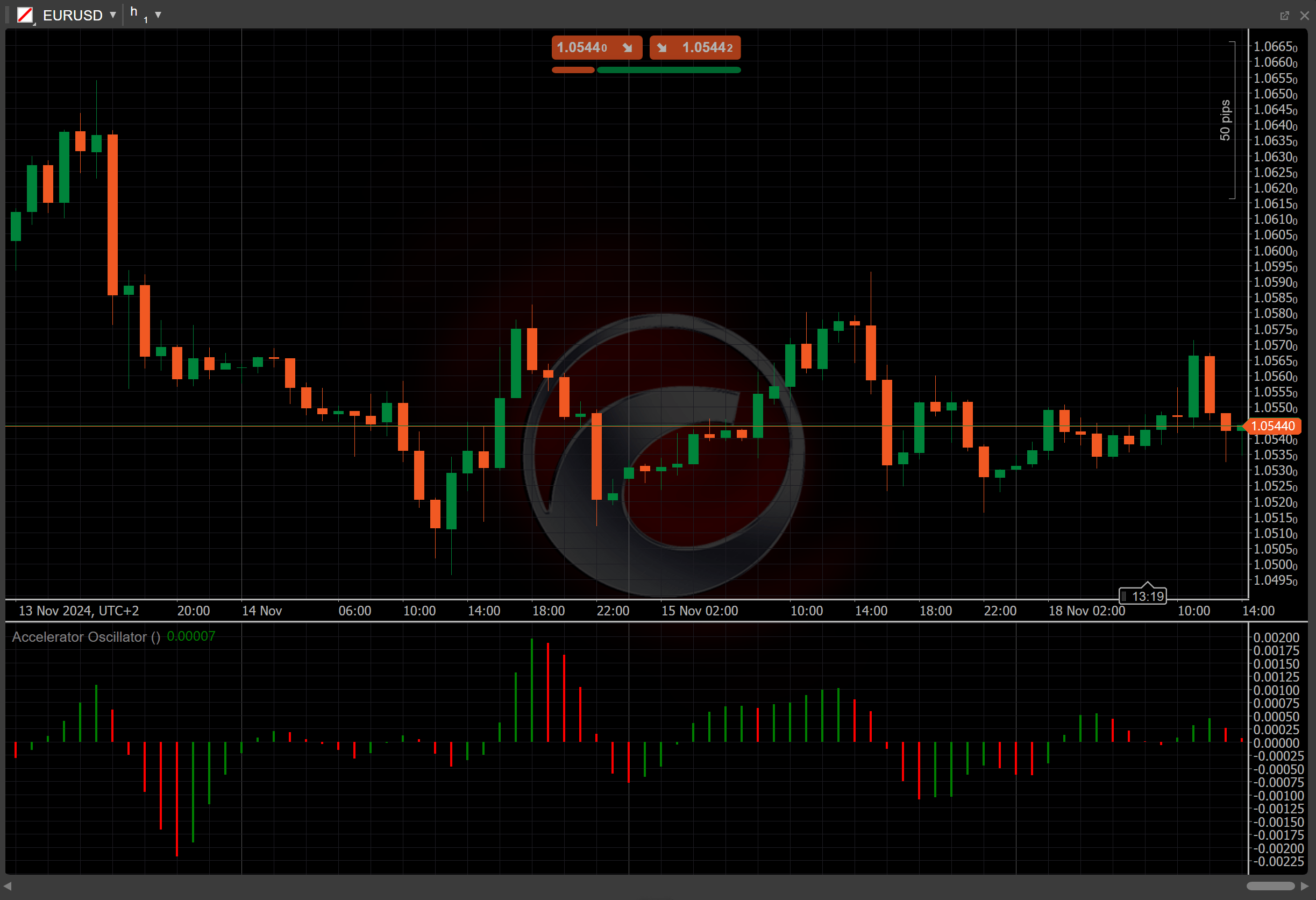

Accelerator Oscillator¶

Definition¶

The Accelerator Oscillator (AC) is a technical analysis tool that tracks the speed of changes in price momentum. It shows whether the market driving force accelerates or decelerates, helping traders anticipate potential reversals. By identifying these momentum shifts early, traders can better time their entries and exits before price changes become apparent.

History¶

Bill Williams introduced the Accelerator Oscillator in his 1995 book "Trading Chaos" as part of his broader trading methodology. Williams later developed the Awesome Oscillator (AO) and introduced it in his book "New Trading Dimensions", published in 1998. The AO builds on data provided by the AC.

Calculations¶

The Accelerator Oscillator is calculated by subtracting a 5-period Simple Moving Average (SMA) of the Awesome Oscillator from the AO itself.

\[ AC = { AO - SMA\ ( AO,\ 5 ) } \]

\(AO\) – the Awesome Oscillator, which is the difference between a 34-period and 5-period SMA applied to the Median Price

\(SMA\) ( \(AO\), \(5\) ) – the 5-period Simple Moving Average of the Awesome Oscillator

Interpretation¶

-

Zero-line crossovers – a cross above zero suggests growing bullish momentum, while a cross below signals increasing bearish momentum.

-

Growing bars – consecutive rising bars above or below zero confirm the strength of an ongoing trend (uptrend or downtrend).

Application¶

The Accelerator Oscillator can offer insights into potential buy and sell opportunities based on momentum shifts.

-

Buy signal – traders might consider entering a buy position when the AC crosses above the zero line, which could indicate increasing bullish momentum. Growing green bars may further suggest sustained upward momentum, potentially confirming the trade.

-

Sell signal – a sell position could be considered when the AC crosses below the zero line, signalling the possibility of increasing bearish momentum. Falling red bars might suggest continued downward pressure, offering additional confirmation.

-

Stop-loss placement – traders may choose to place a stop loss just below the zero line for buy positions or just above the zero line for sell positions, as a way to manage risk in case of a momentum reversal.

-

Confirming trades – to improve the reliability of signals, traders may opt to combine the AC with other indicators, such as moving averages, the Relative Strength Index (RSI) or MACD, to help confirm the direction and strength of momentum before entering a position.

Note

You can take advantage of algo trading, with cBots executing trades based on the signals from this indicator, as shown in our examples. Learn more about how to use indicators in cBots.

Limitations¶

The Accelerator Oscillator tends to produce false signals in choppy or range-bound markets. Additionally, it does not indicate trend direction. The indicator can also lag in highly volatile conditions.

Summary¶

The Accelerator Oscillator helps identify early momentum shifts to predict potential reversals. It signals bullish or bearish momentum based on its position relative to the zero line, calculated by subtracting a 5-period Simple Moving Average of the Awesome Oscillator from the AO itself. The AC is an effective and popular tool that helps identify accelerations or decelerations in the market driving force.