Awesome Oscillator¶

Definition¶

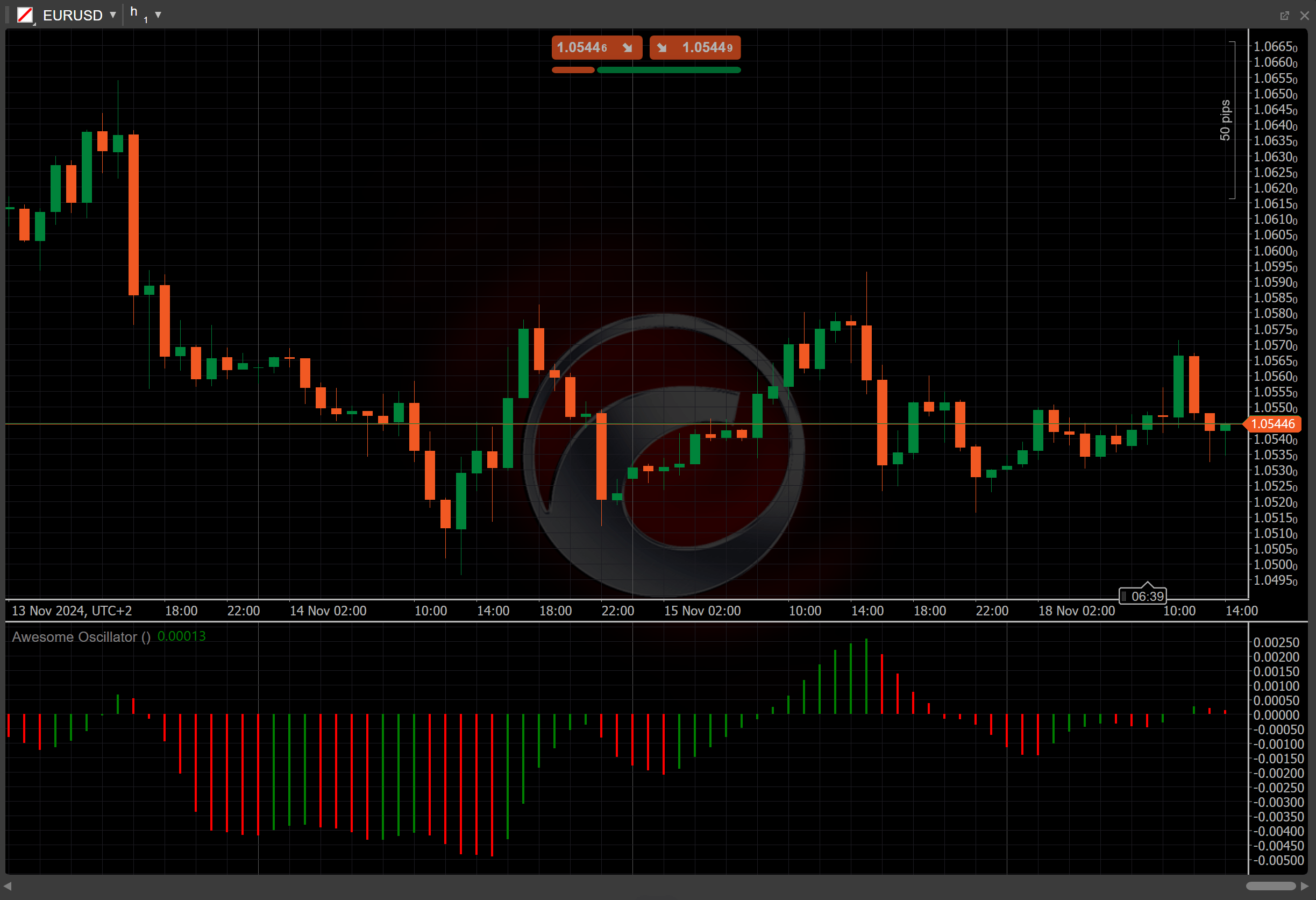

The Awesome Oscillator (AO) is a technical analysis tool designed to help traders assess market momentum and potential price reversals. A common utility for AO is to affirm the validity of trends perceived through price data. The AO is particularly useful for short-term trading strategies, such as day trading and scalping.

History¶

Bill Williams developed the Awesome Oscillator and introduced it in his book "New Trading Dimensions", published in 1998. The AO builds upon the Accelerator Oscillator (AC), an indicator Williams developed and introduced in his book "Trading Chaos", published in 1995.

Calculations¶

The Awesome Oscillator considers the Simple Moving Average of two periods: 5-period and 34-period. It then subtracts the latter from the former.

\[ AO = { SMA_5 - SMA_{34} } \]

Interpretation¶

The Median Prices are utilised in calculating the Simple Moving Averages for the AO indicator.

The main patterns of the indicator behaviour can be interpreted as follows:

-

Zero-line crossovers – the AO crossing above the zero line indicates potential upward momentum. The AO crossing below the zero line suggests potential downward momentum.

-

Divergence – when the price makes new highs while the AO makes lower highs, this can signal a potential trend reversal. When the price makes new lows while the AO makes higher lows, this may indicate a potential reversal to the upside.

Application¶

-

Buy signal – traders might consider entering a buy position when the AO crosses above the zero line, suggesting upward momentum. Confirmation from other tools like moving averages can help verify the signal.

-

Sell signal – a sell signal may occur when the AO crosses below the zero line, indicating potential downward momentum.

-

Stop-loss placement – traders might set a stop loss below significant lows when using the AO in bullish trends or above significant highs in bearish trends to manage risk.

-

Exit strategies – the AO can help confirm exit points when momentum weakens. If the AO begins to approach the zero line after a strong movement, it may indicate a loss of momentum, suggesting an opportunity to exit the trade.

Note

You can take advantage of algo trading, with cBots executing trades based on the signals from this indicator, as shown in our examples. Learn more about how to use indicators in cBots.

Limitations¶

While the AO helps assess momentum, it only measures historical data, which can result in delayed signals. Additionally, the AO does not provide exact entry or exit points and relying solely on it might lead to false signals in choppy markets.

Summary¶

The Awesome Oscillator is a momentum indicator that helps traders assess market momentum by comparing the difference between two Simple Moving Averages of different periods. It oscillates above and below a zero line, indicating bullish or bearish momentum. The AO is particularly useful in identifying potential market reversals and can be effectively combined with other indicators, such as the Bollinger Bands, to enhance trading decisions and confirm signals. When using the AO, traders should consider its limitations, such as false signals in choppy markets.