Cyber Cycle¶

Definition¶

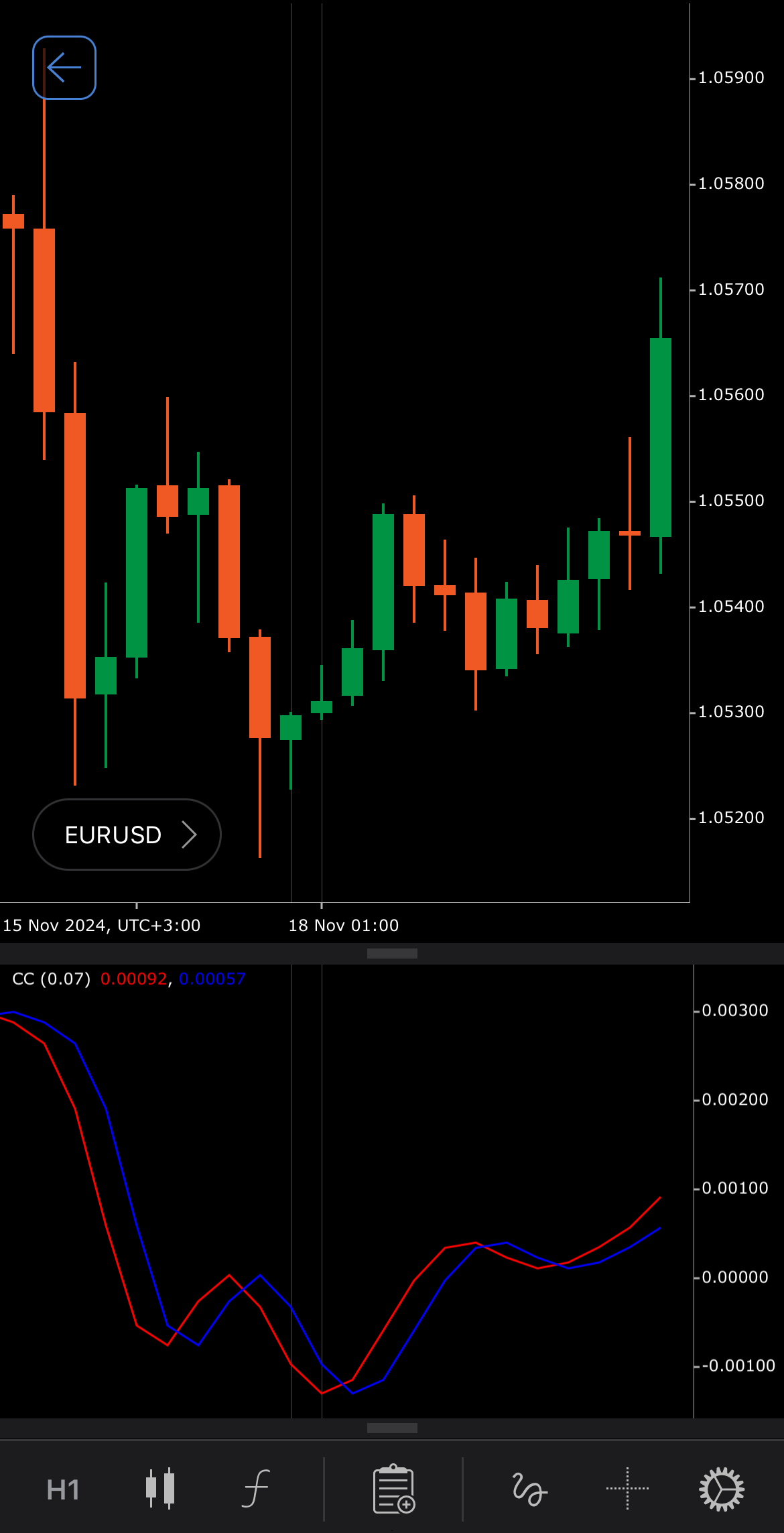

The Cyber Cycle is a technical analysis tool developed to detect price cycles and assist traders in identifying potential reversals. It uses an advanced smoothing algorithm to minimise lag, making it highly responsive to cyclical price movements. Unlike traditional momentum indicators, the Cyber Cycle adapts to changing market conditions by dynamically adjusting to price fluctuations, making it suitable for both trending and range-bound markets.

History¶

The Cyber Cycle was introduced by John Ehlers, a notable figure in the field of technical analysis and digital signal processing applied to markets. Ehlers introduced the Cyber Cycle in his book "Cybernetic Analysis for Stocks and Futures", published in 2004, which explores the use of modern signal processing techniques to analyse financial data and market cycles. His focus was to provide traders with an indicator that could minimise lag and accurately reflect market cycles.

Calculations¶

The Cyber Cycle uses a smoothing process to filter out price noise, which is achieved through digital signal processing. The formula for the Cyber Cycle involves multiple steps.

1. Smooth the Median Price using a weighted average.

\[ Smooth_i = { 1 \over 6 } \times ( { MedianPrice_i + 2 \times MedianPrice_{i-1} + 2 \times MedianPrice_{i-2} + MedianPrice_{i-3} } ) \]

2. Calculate the Cyber Cycle using the \(\alpha\) constant, which defaults to 0.07.

\[ Cycle_i = { (1 - { \alpha \over 2 } ) ^2 } \times (Smooth_i - 2 \times Smooth_{i-1} + Smooth_{i-2} ) + 2 \times (1 - \alpha) \times Cycle_{i-1} - (1 - \alpha) ^2 \times Cycle_{i-2} \]

3. For the first few indices (where \(i\) < 7), apply a simpler formula for the Cyber Cycle.

\[ Cycle_i = { 1 \over 4 } \times { ( MedianPrice_i - 2 \times MedianPrice_{i-1} + MedianPrice_{i-2} } \]

4. Define the Trigger line.

\[ Trigger_i = Cycle_{i-1} \]

Interpretation¶

-

Cyclical behaviour – when the Cyber Cycle is near its peak or trough, it suggests a potential market reversal. Peaks indicate a potential downturn, while troughs suggest a price rally.

-

Zero-line crossovers – crossing above zero signals a potential uptrend, with increasing upward momentum. Crossing below zero signals a potential downtrend, with growing downward momentum.

-

Divergence – when the price makes lower lows while the Cyber Cycle forms higher lows, it suggests weakening selling pressure and a potential upside reversal. When the price makes higher highs while the Cyber Cycle forms lower highs, it signals weakening buying pressure and a potential downside reversal.

Note

You can take advantage of algo trading, with cBots executing trades based on the signals from this indicator, as shown in our examples. Learn more about how to use indicators in cBots.

Application¶

The Cyber Cycle can be applied to multiple trading strategies.

-

Identifying reversals – traders can use the Cyber Cycle peaks and troughs to identify potential market reversals. A trough can signal a buying opportunity, while a peak can indicate the market is overextended, presenting a potential sell signal.

-

Zero-line crossover – crossing above the zero line signals that momentum is shifting to the upside, providing a potential buy opportunity. Crossing below the zero line suggests the onset of downward momentum, making it a potential sell signal.

-

Stop-loss placement – traders may use the Cyber Cycle turning points to adjust stop-loss orders. For example, setting a stop loss below the most recent trough in an upward cycle, or above the peak in a downward cycle, helps manage risk.

Limitations¶

The Cyber Cycle may produce false signals in choppy or low-volume markets. Additionally, the indicator reliance on historical data can lead to lag in fast-moving markets.

Summary¶

The Cyber Cycle indicator is a momentum and cycle detection tool designed to identify reversals and cyclical behaviour in the market. Developed by John Ehlers, it uses advanced smoothing techniques to filter out noise and provide a clearer view of price movements. The Cyber Cycle helps traders identify potential market tops and bottoms.