Detrended Price Oscillator¶

Definition¶

The Detrended Price Oscillator (DPO) is a technical analysis tool used to eliminate long-term trends from the price data of an asset, allowing traders to focus on short-term price cycles. The DPO compares the price of an asset to a moving average, highlighting deviations from this average, which helps traders identify overbought and oversold conditions.

History¶

The Detrended Price Oscillator was developed by John Ehlers and introduced in his book "Rocket Science for Traders" in 2001. Ehlers created the DPO to help traders remove long-term trends and focus on short-term price cycles. Known for his contributions to technical analysis, Ehlers also developed other tools like the Cyber Cycle and Fisher Transform to assist in advanced trading strategies.

Calculations¶

The DPO is calculated by subtracting a moving average from the price and shifting it back by a certain number of periods.

\[ DPO = { Price_i - MA_{i - ( { n \over 2 } + 1 ) } } \]

\(Price_i\) – the source price at \(i\) period

\( MA_i = Moving\ Average\ (Price_i, n) \) – the moving average of the source price over the specified number of periods \(n\)

\(MA_{i - ( {n \over 2} + 1 ) }\) – the moving average value lagged by \( ( { n \over 2 } + 1 ) \) periods

\(n\) – the number of periods for the moving average

Interpretation¶

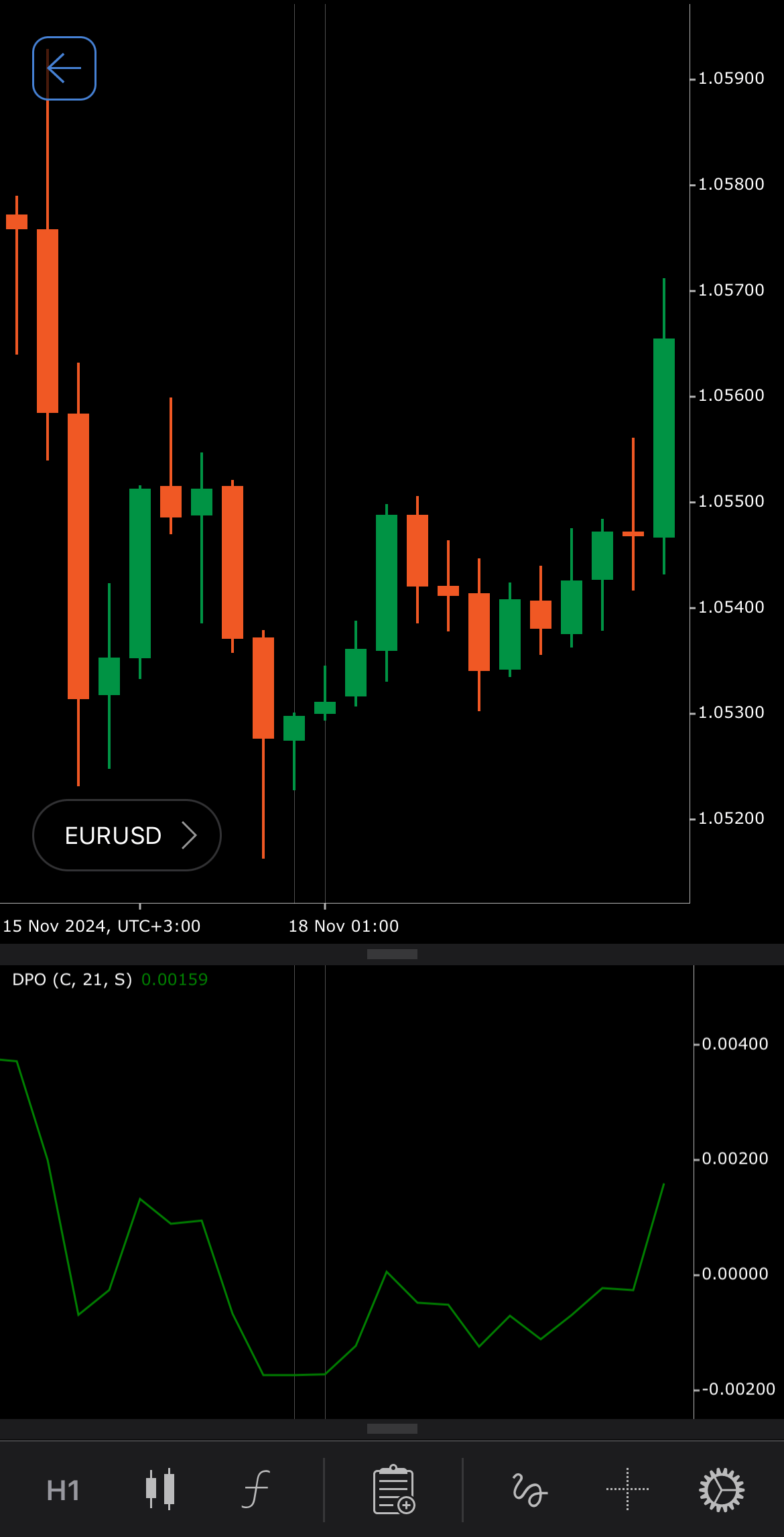

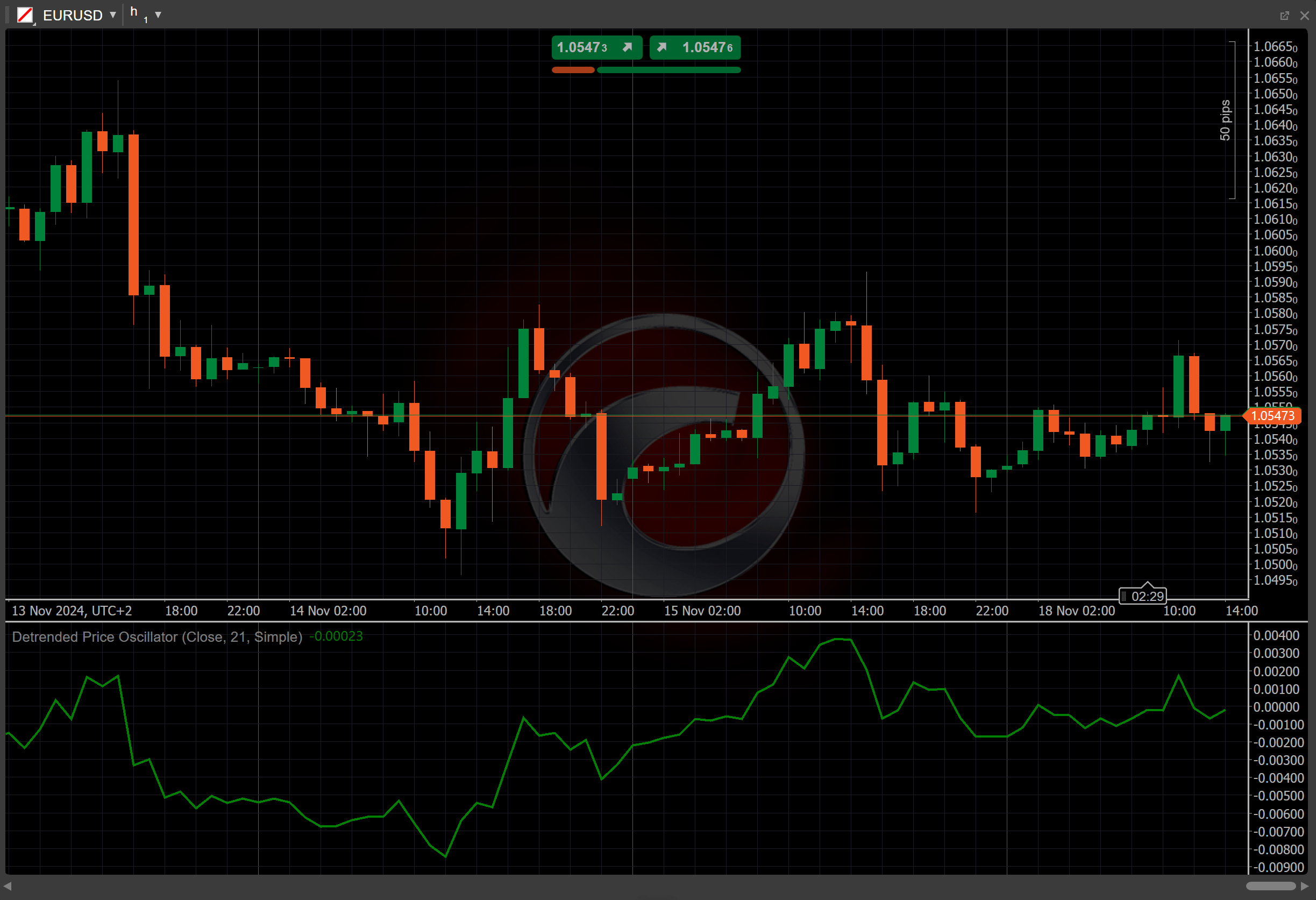

The Simple Moving Average (SMA) serves as the type of moving average by default. The 21-period and closing prices are used by default to calculate the SMA value.

The Detrended Price Oscillator helps traders identify overbought and oversold conditions by focusing on short-term price cycles. The following interpretations of the indicator are generally applicable:

-

Zero-line crossovers – when the DPO crosses above the zero line, it suggests that the price is above its moving average, indicating potential overbought conditions. When the DPO crosses below the zero line, it suggests that the price is below its moving average, indicating potential oversold conditions.

-

Overbought and oversold levels – extreme positive values indicate overbought conditions, suggesting a potential price pullback. Extreme negative values indicate oversold conditions, suggesting a potential price rally.

-

Divergences – a bullish divergence occurs when the price makes a lower low while the DPO makes a higher low, indicating weakening selling pressure. A bearish divergence occurs when the price makes a higher high while the DPO makes a lower high, signalling weakening buying pressure.

Application¶

The Detrended Price Oscillator can be applied in several trading strategies.

-

Identifying overbought and oversold conditions – when the DPO reaches extreme positive levels, traders may consider selling, as the price may be overbought. When the DPO reaches extreme negative levels, traders may consider buying, as the price may be oversold.

-

Zero-line crossover – a crossover above zero suggests bullish momentum, while a crossover below zero suggests bearish momentum.

-

Stop-loss placement – traders often place stop losses near extreme levels of the DPO. For instance, stop losses for sell positions can be placed at the overbought level, while for buy positions, they can be placed at the oversold level.

Note

You can take advantage of algo trading, with cBots executing trades based on the signals from this indicator, as shown in our examples. Learn more about how to use indicators in cBots.

Limitations¶

The Detrended Price Oscillator focuses on short-term price movements, which makes it less effective for detecting long-term trends. The DPO may generate false signals during periods of high volatility or sudden price changes, especially when the market is trending strongly.

Summary¶

The Detrended Price Oscillator, developed as part of the innovations by John Ehlers in his book "Rocket Science for Traders" (2001), helps traders isolate short-term price cycles by removing the influence of long-term trends. It highlights overbought and oversold conditions by comparing the price of an asset to a moving average, highlighting deviations from this average, making it a useful tool for short-term trading strategies.