Relative Strength Index¶

Definition¶

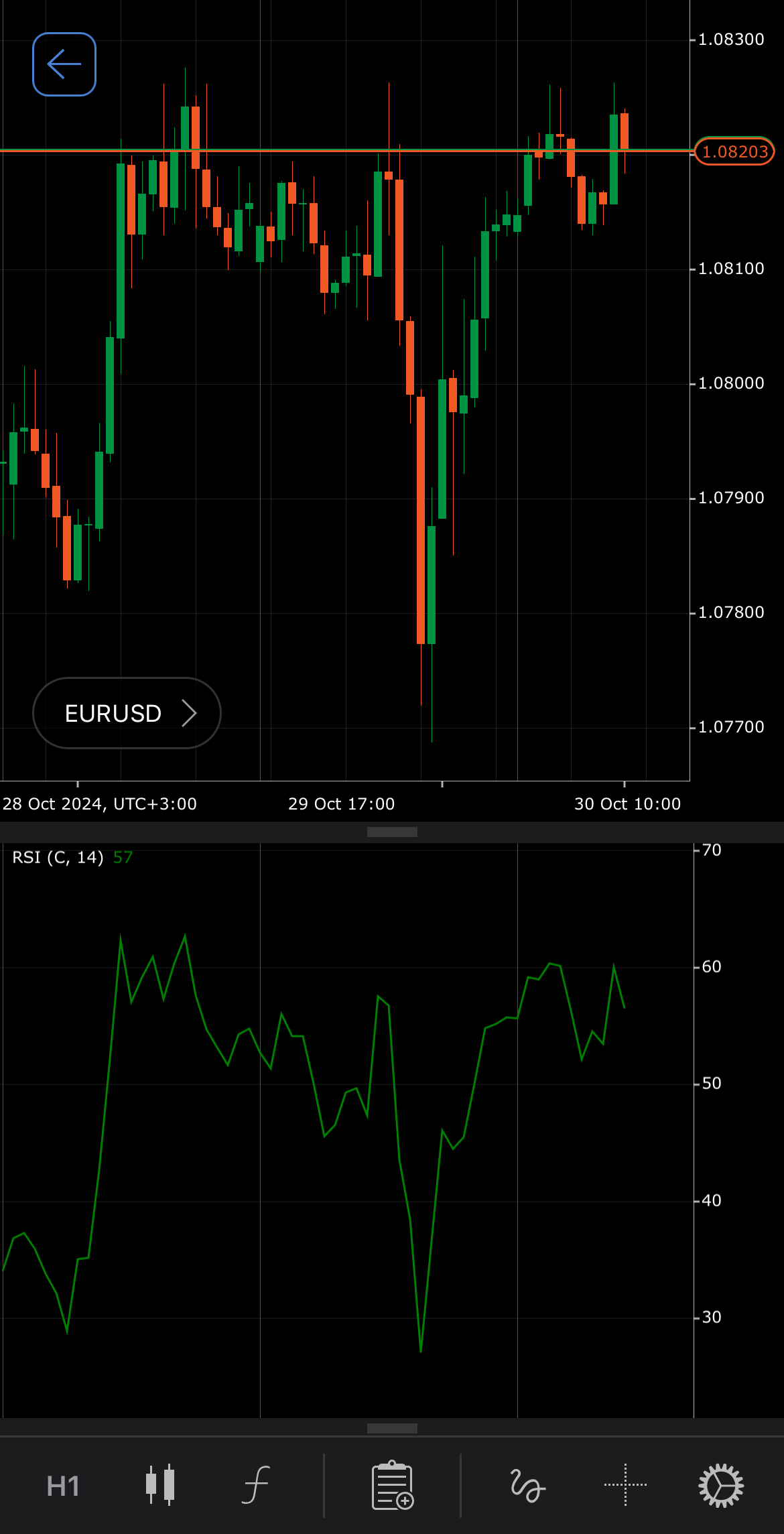

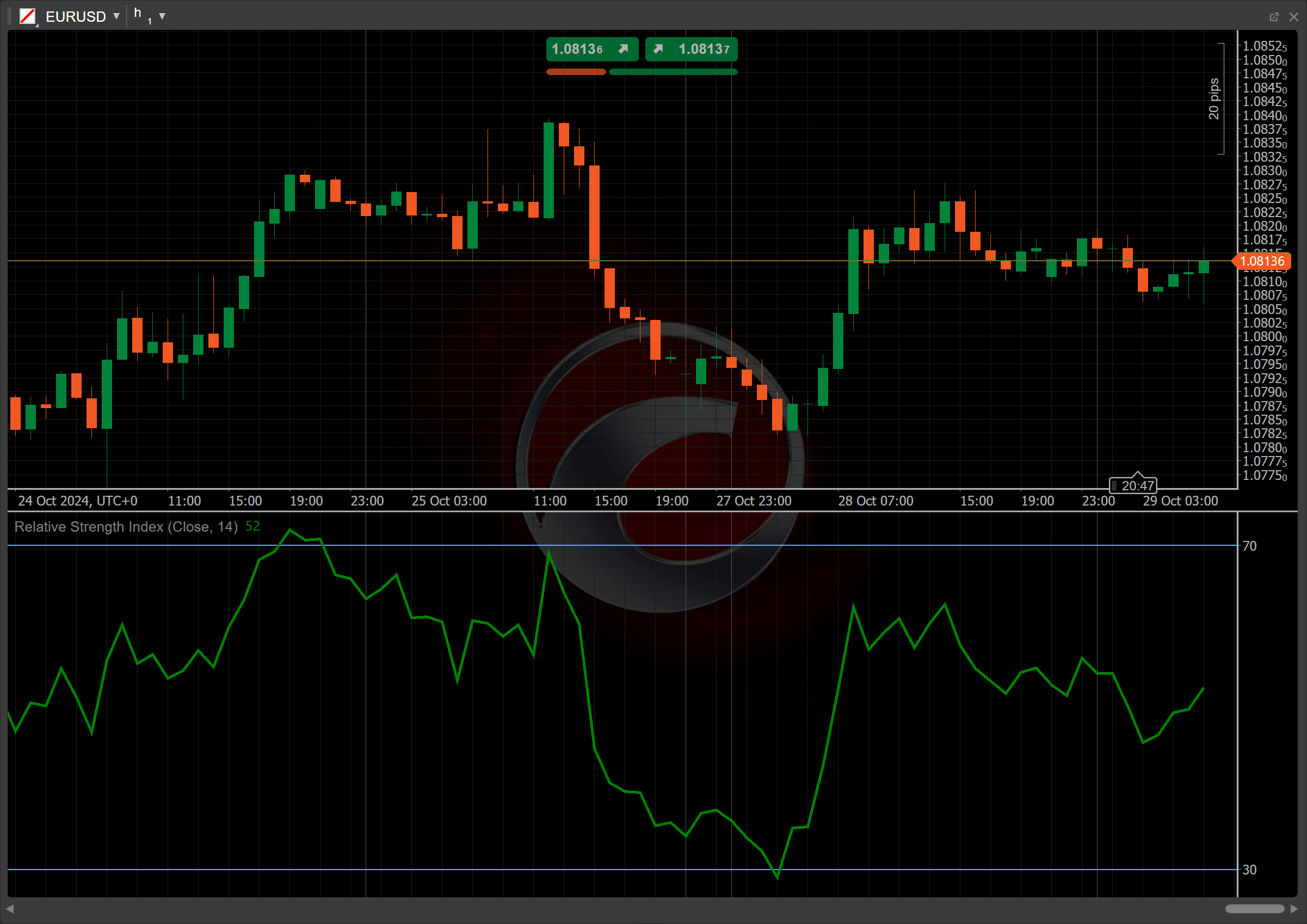

The Relative Strength Index (RSI) is a momentum oscillator that measures the strength of price movements. It calculates the ratio of recent gains to recent losses over a specified time period, producing a value that ranges from 0 to 100. The RSI helps identify extreme price levels and potential reversal points. When the RSI crosses certain threshold levels, it signals a potential change in trend direction. The indicator is often used to assess the speed and magnitude of price fluctuations.

History¶

The Relative Strength Index was developed by J. Welles Wilder in 1978 and introduced in his book "New Concepts in Technical Trading Systems". Wilder designed the RSI to help traders identify overbought and oversold conditions in markets. Over time, the RSI gained widespread popularity due to its versatility in various markets and time frames. It is now one of the most commonly used indicators for technical analysis, applied to stocks, commodities and forex.

Calculations¶

The Relative Strength Index is calculated using the following formula:

\[ RSI = 100 - { 100 \over { 1 + RS } } \]

\( RS = { AvgGain \over AvgLoss } \) – the relation between average gain over \(n\) periods and average loss over \(n\) periods

Interpretation¶

-

Crossovers – the RSI is often used with two key threshold levels (70 and 30). When the RSI crosses above 70, it suggests that the symbol is potentially overbought, indicating a possible reversal or pullback in price. When the RSI crosses below 30, it suggests the symbol might be oversold, signalling a potential buying opportunity or upward reversal.

-

Rising and falling – a rising RSI indicates strengthening momentum, suggesting that the price trend is gaining strength. Conversely, a falling RSI suggests weakening momentum, indicating that the trend may be losing steam or reversing soon.

-

Divergence – divergence occurs when the price makes a new high or low, but the RSI does not confirm this movement. A bearish divergence happens when the price reaches a higher high, but the RSI forms a lower high, signalling potential weakening of the uptrend. A bullish divergence occurs when the price hits a lower low, but the RSI makes a higher low, indicating a possible reversal in a downtrend.

-

Reversal points – when the RSI reaches extreme levels (overbought above 70 or oversold below 30), these are often seen as reversal points. Traders look for potential trend changes when the RSI crosses these thresholds and exits the extreme zone, signalling that the current price trend may be reversing.

Application¶

-

Buy signal – consider entering a long position when the RSI crosses below 30 (indicating oversold conditions) and then moves back above 30. This suggests that the downward momentum may be weakening, and the price could reverse upward.

-

Sell signal – consider entering a short position when the RSI crosses above 70 (indicating overbought conditions) and then moves back below 70. This signals that the upward momentum may be fading, and a price drop could be imminent.

-

Stop-loss placement – for a long trade, a stop loss might be placed just below the most recent swing low, in case the RSI gives a false buy signal. Conversely, for a short trade, a stop loss might be placed just above the most recent swing high after the RSI signals a sell.

-

Exit strategies – an exit strategy can be built around the RSI returning to neutral levels (around 50) after reaching overbought or oversold zones. For long trades, exiting when the RSI nears 50 after crossing up from 30 can secure gains before a potential reversal. In short trades, closing a position when the RSI approaches 50 after falling from overbought levels helps capture profit.

-

Confirming trades – traders may use the RSI with moving averages (MAs) to validate trends. For instance, if the RSI gives a buy signal and the price is above the 50-day MA, it strengthens the signal. Similarly, the RSI combined with the Moving Average Convergence Divergence (MACD) can confirm momentum changes. If both indicators align, it reinforces the trade decision, reducing the likelihood of false signals.

Note

You can take advantage of algo trading, with cBots executing trades based on the signals from this indicator, as shown in our examples. Learn more about how to use indicators in cBots.

Limitations¶

The RSI, while useful, can give false signals in strong trending markets. Overbought or oversold conditions may persist for extended periods without a reversal. It is also sensitive to period settings, requiring adjustments for different market conditions, and works best when combined with other indicators.

Summary¶

The Relative Strength Index is a widely used momentum oscillator that measures the speed and change of price movements, helping traders identify potential reversal points and assess market conditions. Ranging from 0 to 100, it indicates overbought or oversold levels, providing buy and sell signals. With its ability to highlight market strength and trends, the RSI remains a valuable tool in technical analysis for traders across various financial markets, aiding in decision-making and risk management.