Accumulative Swing Index¶

Definition¶

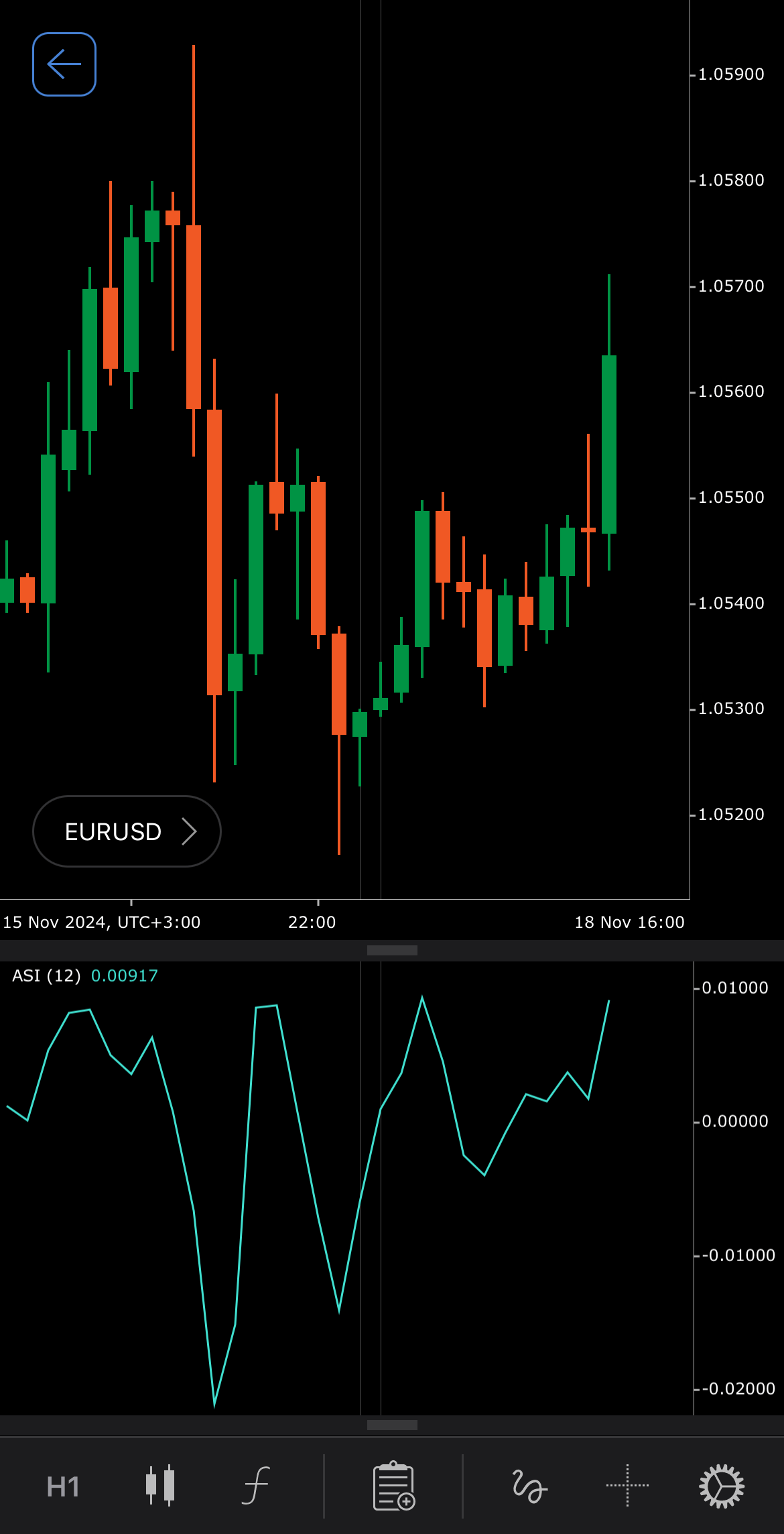

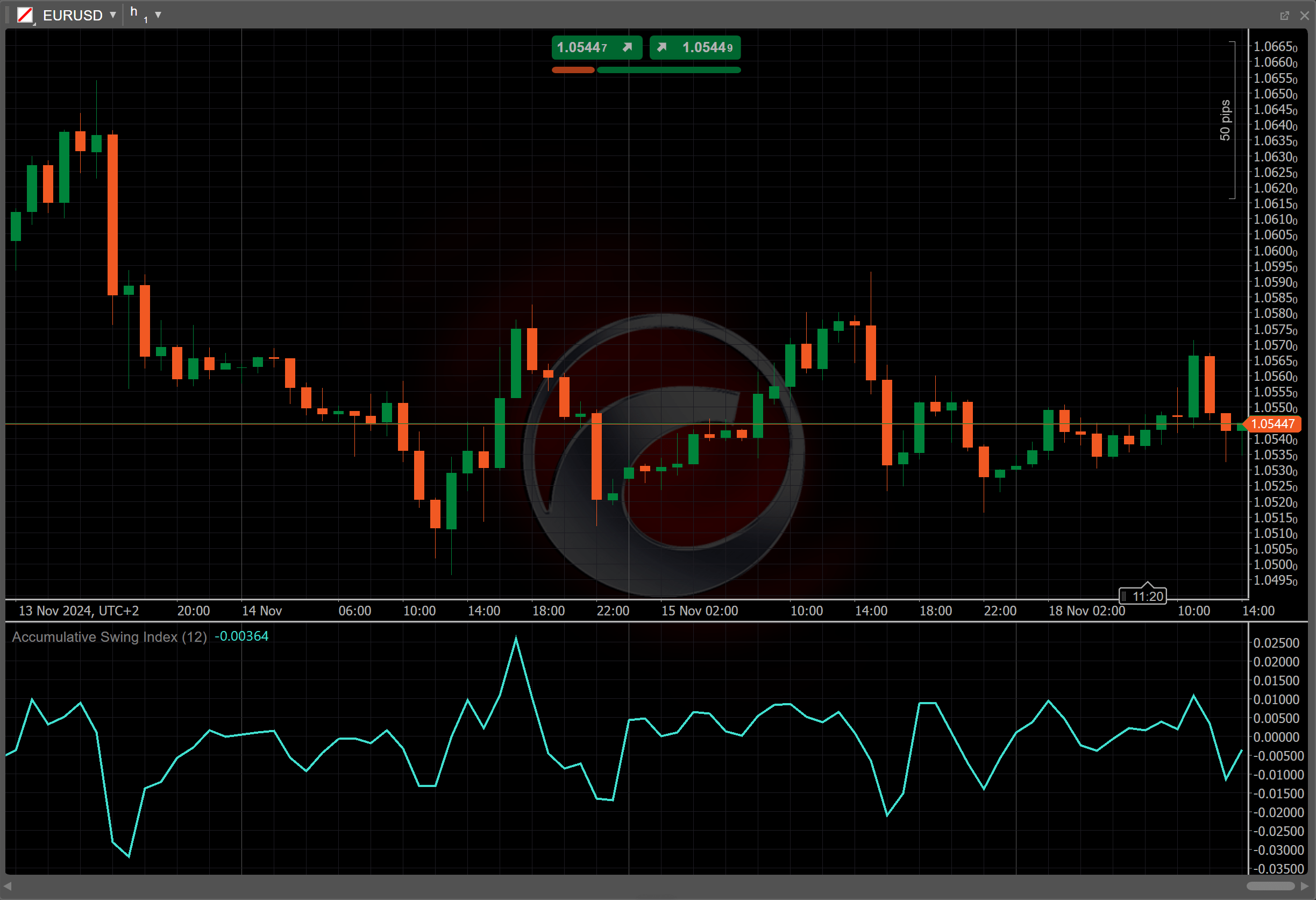

The Accumulative Swing Index (ASI) is a technical analysis indicator that measures the cumulative strength and direction of price movements over time. It is particularly useful in identifying trends and potential trend reversals, offering traders insight into market momentum by assessing cumulative swing values.

History¶

The Accumulative Swing Index was developed by J. Welles Wilder, a prominent engineer and trader known for his technical indicators. Wilder introduced the ASI in his 1978 book, "New Concepts in Technical Trading Systems", alongside other popular indicators like Relative Strength Index (RSI) and Average True Range (ATR). His work aimed to provide traders with tools to gauge market behaviour and identify trends more effectively.

Calculations¶

The Accumulative Swing Index is typically calculated using the following formula:

\[ ASI_t = { ASI_{t-1} + SI_t } \]

\(ASI_t\) – the ASI value for the current period

\(ASI_{t-1}\) – the ASI value for the previous period, starting with \(ASI_{0}\) = \(0\)

\(SI_t\) – the Swing Index for the current period, which measures each price swing strength based on price changes from one bar to the next

Interpretation¶

-

Rising and falling – when the ASI is trending upward, it suggests the security is in an uptrend, whereas a downward-trending ASI signals a potential downtrend.

-

Reversal points – sudden changes in the ASI direction may indicate an upcoming trend reversal.

Application¶

The Accumulative Swing Index provides useful signals for traders looking to assess buying and selling opportunities.

-

Buy signal – traders may consider entering a buy position when the ASI crosses above zero, indicating increasing bullish momentum. This is especially strong when the price has broken above a key resistance level and ASI confirms the breakout.

-

Sell signal – a sell position might be considered when the ASI crosses below zero, indicating a shift towards bearish momentum. This may align with the price breaking below support, suggesting a stronger downtrend.

-

Stop-loss placement – traders could place stop-losses just below the last low in the ASI for long positions or above the last high for short positions, to manage risk in case the market reverses.

-

Exit strategies – the ASI can help confirm exit points in a trade. If ASI starts to flatten or fall while in a long position, it may indicate weakening momentum, prompting traders to consider taking profits. The opposite applies for short positions if the ASI shows signs of rising.

Note

You can take advantage of algo trading, with cBots executing trades based on the signals from this indicator, as shown in our examples. Learn more about how to use indicators in cBots.

Limitations¶

The Accumulative Swing Index has a lagging nature, which can cause it to confirm trends after significant price changes have already occurred. The formula is relatively complex, making it less user-friendly compared to simpler indicators. Additionally, the ASI can produce misleading signals in highly volatile markets. Finally, it does not inherently indicate overall trend direction.

Summary¶

The Accumulative Swing Index is a cumulative indicator used to determine price trends, leveraging individual price swings (such as differences between high, low and closing prices) to provide a broader trend perspective. It is useful for trend-following strategies and can indicate potential reversals when it diverges from price action. However, its reliance on historical data can result in delayed signals, making it beneficial to use in conjunction with other indicators for improved accuracy.