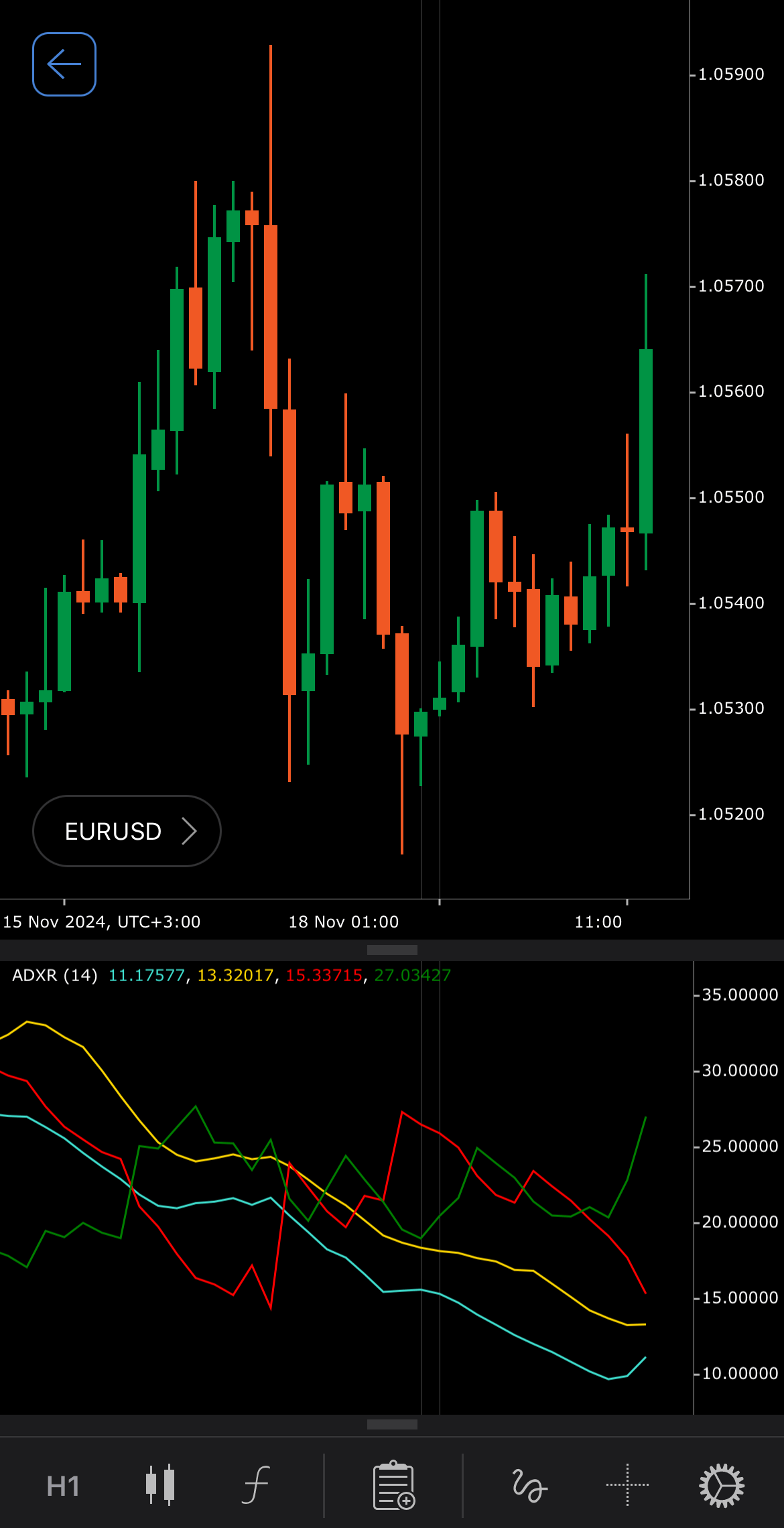

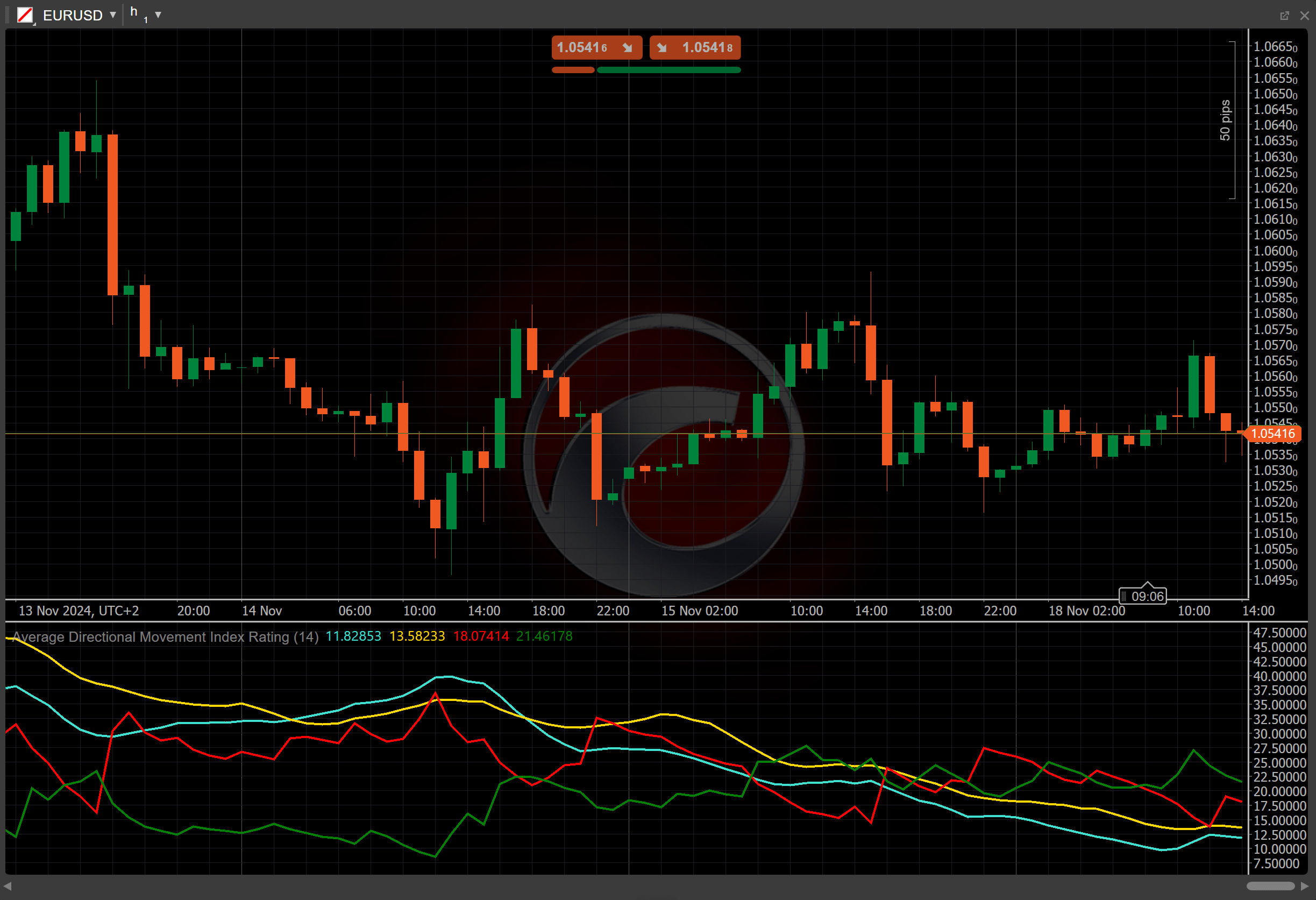

Average Directional Movement Index Rating¶

Definition¶

The Average Directional Movement Index Rating (ADXR) measures the strength of the Average Directional Movement Index (ADX). The ADX works in conjunction with two additional indicators; the Positive Directional Indicator and the Negative Directional Indicator to determine the direction of the trend.

History¶

Trader, engineer and author J. Welles Wilder Jr. developed the Average Directional Movement Index Rating and introduced it in his influential book "New Concepts in Technical Trading Systems", published in 1978. In the same book, Wilder also introduced the Accumulative Swing Index, a powerful indicator that measures the strength of price movements over time.

Calculations¶

The ADXR value is calculated using the following steps:

1. The Positive and Negative Directional Movements (DM+ and DM-) are determined by the difference between the current and previous highs or lows.

- If the current high minus the previous high is greater than the current low minus the previous low, DM+ is the difference between the current high and the previous high. Otherwise, DM+ is zero.

\[ DM^+ = { Current\ High - Previous\ High } \]

- If the current low minus the previous low is greater than the current high minus the previous high, DM- is the difference between the previous low and the current low. Otherwise, DM- is zero.

\[ DM^- = { Previous\ Low - Current\ Low } \]

2. The Positive and Negative Directional Indicators (DI+ and DI-) are collected as the ratio of smoothed directional movements to the Average True Range.

\[ DI^± = { { Smoothed\ (DM^±) \over ATR } \times 100 } \]

3. The Directional Movement Index (DX) is the ratio of the difference between DI+ and DI- to their sum.

\[ DX = { { { | DI^+ - DI^- | } \over { DI^+ + DI^- } } \times 100 } \]

4. The Average Directional Movement Index (ADX) is calculated as a moving average of the DX over \(n\) periods.

\[ ADX = { MA_{n} (DX) } \]

5. The Average Directional Movement Index Rating is the average value of the current ADX and the ADX value \(n\)-periods ago.

\[ ADXR = { { ADX + ADX_{-n} } \over 2 } \]

Interpretation¶

To calculate ADX, a typical lookback of 14 periods is used. The Wilder Smoothing Moving Average serves as a type of moving average.

The following interpretations of the indicator are generally applicable:

-

Crossovers – when the ADXR crosses above the ADX, it may signal a strengthening trend, reinforcing the potential for continuation in the current direction. The ADXR crossing below the ADX suggests a weakening trend, indicating that the current market momentum may be slowing down.

-

Divergence – look for divergences between the ADXR and the price movement. For example, if the price is making new highs but the ADXR is falling, this could indicate a weakening trend and a potential reversal.

Application¶

-

Buy signals – traders may consider entering a buy position when the ADXR is rising, suggesting that the trend is gaining strength. Confirmation from the ADX, as well as checking +DI and -DI, helps ensure the trend direction.

-

Sell signals – a falling ADXR could signal weakening momentum in an existing trend, making it a good time to consider selling or exiting positions, particularly if the ADXR crosses below the ADX.

-

Stop-loss placement – traders might set a stop loss based on the ADXR crossovers. For example, when the ADXR begins to fall from a high point, a stop loss could be used to protect profits in case the trend reverses.

-

Exit strategies – if the ADXR begins to decline, traders may consider exiting positions as the trend loses strength. This is particularly useful in trend-following strategies where momentum is a key factor in holding a position.

Note

You can take advantage of algo trading with cBots executing trades based on the signals from this indicator, as shown in our examples. Learn more about how to use indicators in cBots.

Limitations¶

The Average Directional Movement Index Rating does not indicate the direction of the trend on its own. Its reliance on historical data can result in delayed signals, especially in fast-moving markets. Furthermore, the ADXR alone may not give a full picture of market dynamics, requiring additional context to interpret signals accurately.

Summary¶

The Average Directional Movement Index Rating is a smoothed extension of the Average Directional Movement Index that measures trend strength over a specified period. Ranging from 0 to 100, higher values indicate stronger trends, while lower values suggest weaker trends or market consolidation. The ADXR is commonly used to confirm trends identified by ADX and to assess potential reversals. It is advised to use the ADXR in combination with the Positive Directional Indicator and the Negative Directional Indicator to determine the direction of the trend.