Hull Moving Average¶

Definition¶

The Hull Moving Average (HMA) is a technical analysis indicator that reduces lag and increases responsiveness compared to traditional moving averages. It achieves this by using the Weighted Moving Averages (WMA) and applying a unique calculation to smooth out the data while still reflecting recent price changes, making it a valuable tool for trend identification and reversals.

History¶

The Hull Moving Average was developed by Alan Hull, an Australian trader and mathematician, as an improvement to conventional moving averages. The goal was to create a more responsive moving average that could filter out noise in price data without introducing significant lag. Since its development, the HMA has been widely adopted by traders looking for a more efficient trend-following tool.

Calculations¶

The Hull Moving Average is calculated through a series of weighted moving averages and involves a specific process to enhance responsiveness while maintaining smoothness.

1. Intermediate WMA calculations.

- Computing the first WMA over half the period:

\[ WMA_1 = { WMA\ (Source,\ { Periods / 2 } ) } \]

- Computing the second WMA over the full period:

\[ WMA_2 = { WMA\ (Source,\ Periods ) } \]

2. Intermediate series. Combining the two WMAs to generate an intermediate series:

\[ I = { 2 \times WMA_1 - WMA_2 } \]

3. Final WMA calculation. Applying a WMA to the intermediate series over the square root of the period:

\[ HMA = { WMA\ ( I, \sqrt{Periods} ) } \]

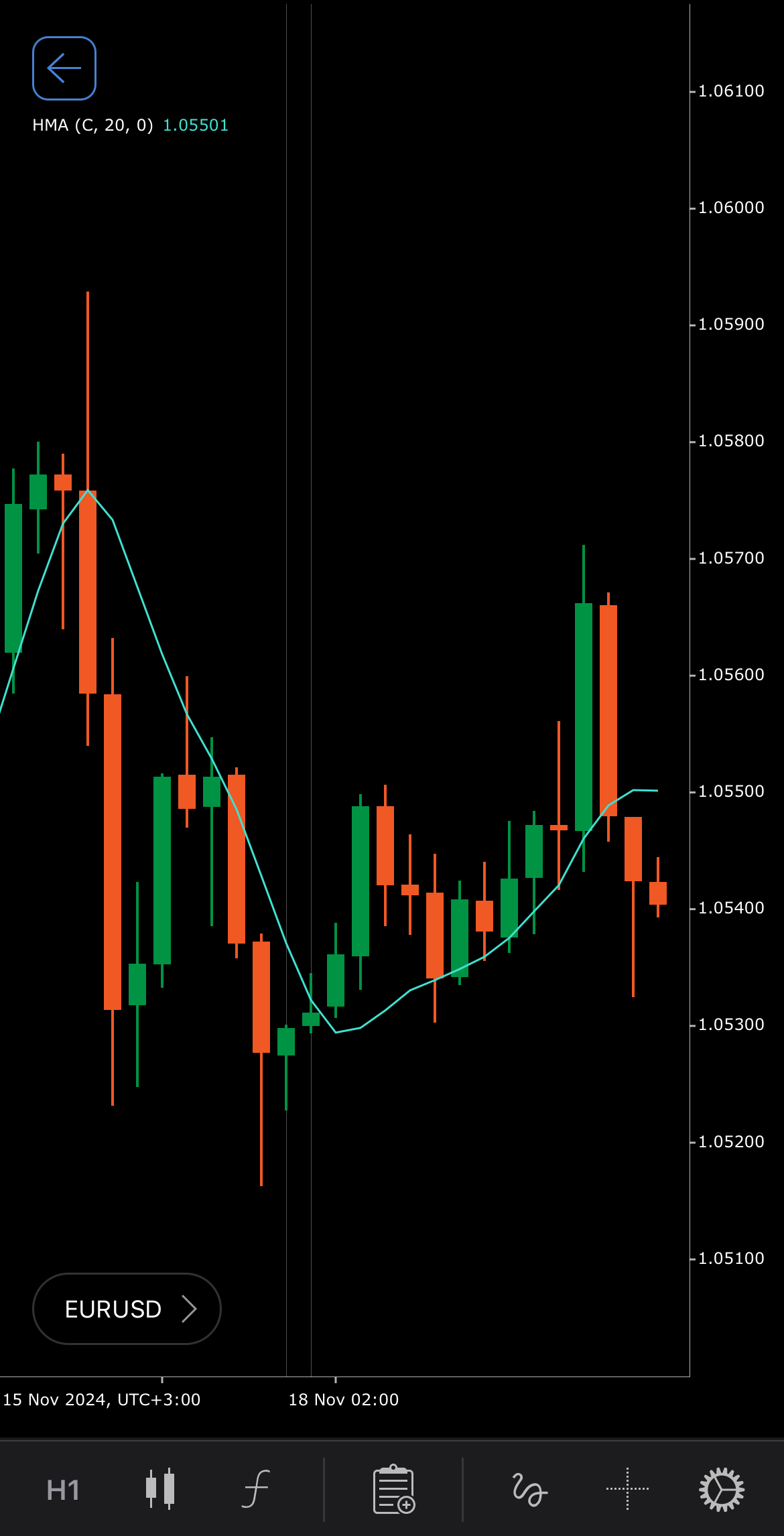

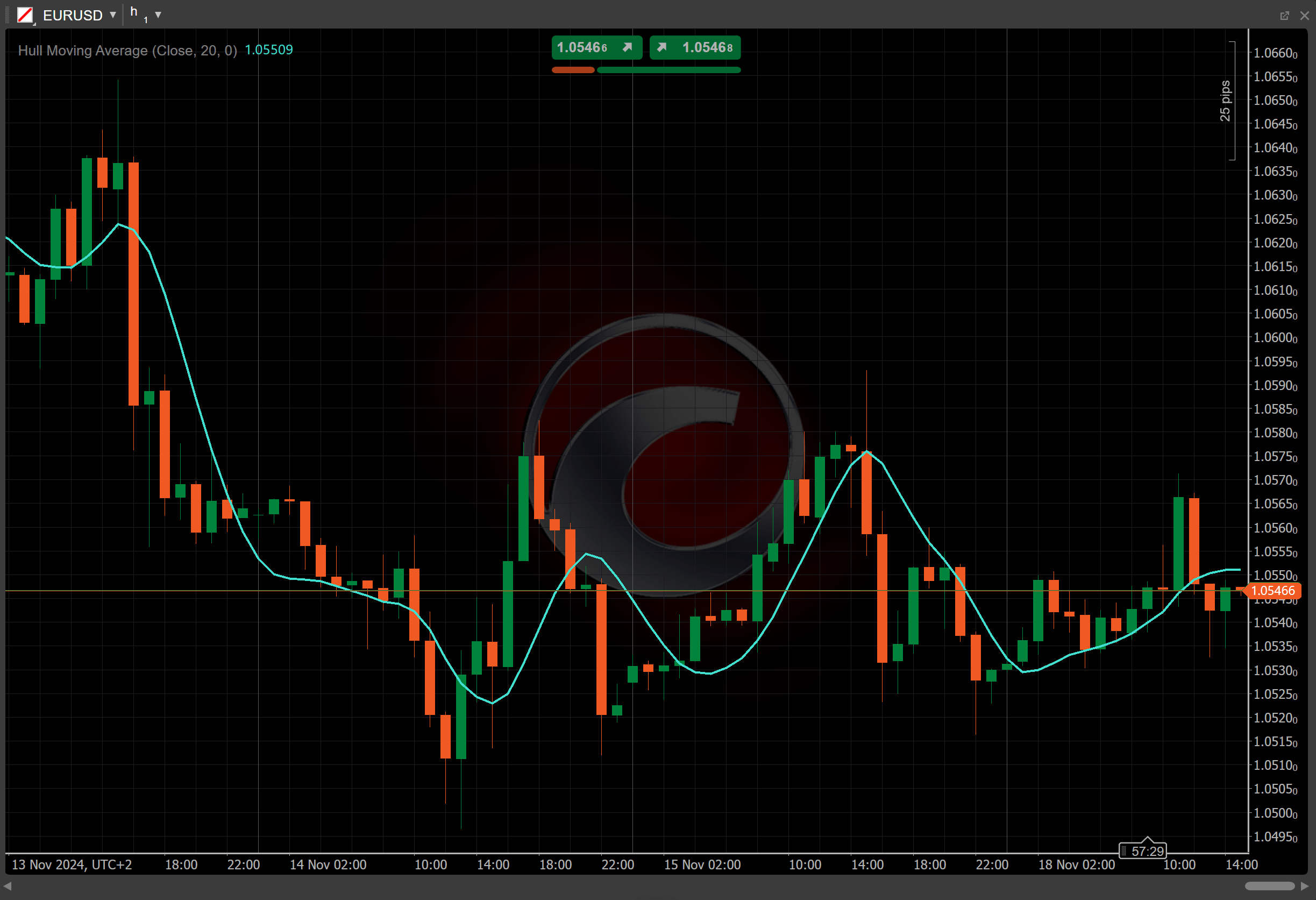

Interpretation¶

-

Rising and falling – a rising HMA indicates a potential uptrend or bullish market condition. A falling HMA suggests a downtrend or bearish market condition.

-

Crossovers – when the price crosses above the HMA it signals a potential buy signal as it may indicate the start of an uptrend. When the price crosses below the HMA it is a possible sell signal, suggesting a downtrend.

-

Smoothing and lag – The HMA smooths price data more effectively than traditional moving averages, reducing noise and providing clearer trend signals.

-

Shift – by adjusting the shift parameter to alter the alignment of the HMA indicator with price data on the chart, you can explore how the HMA readings correspond to past or future price movements.

Application¶

-

Buy signal – consider a buy position when the price crosses above the HMA, indicating a potential shift to an uptrend. Confirm with other trend or momentum indicators for stronger validation.

-

Sell signal – a sell position may be considered when the price crosses below the HMA, suggesting a potential shift to a downtrend.

-

Stop-loss placement – traders can use the HMA line as a dynamic stop-loss guide, placing stops slightly below the HMA in an uptrend or above it in a downtrend to manage risk.

Note

You can take advantage of algo trading, with cBots executing trades based on the signals from this indicator, as shown in our examples. Learn more about how to use indicators in cBots.

Limitations¶

The Hull Moving Average is based on historical data and remains a lagging indicator, meaning it cannot predict future price movements with certainty. It may generate false signals during periods of low volatility or erratic price movements. Additionally, the choice of the period parameter can affect the responsiveness and accuracy of the HMA.

Summary¶

The Hull Moving Average, developed by Alan Hull, is a powerful trend-following indicator that minimises lag and improves responsiveness compared to traditional moving averages. It uses a combination of the Weighted Moving Averages to achieve smooth yet quick reactions to price changes, helping traders identify trends and potential reversals with greater accuracy. The HMA creates a moving average that could filter out noise in price data without introducing significant lag.