Parabolic SAR¶

Definition¶

The Parabolic Stop and Reverse (SAR) is a trend-following indicator that helps traders identify potential reversal points in the market by placing dots above or below the price chart. The relative position of the indicator dots and the price line indicates the continuation of an uptrend or downtrend. The Parabolic SAR is calculated using the previous extreme price and an acceleration factor, allowing traders to set stop-loss orders effectively.

History¶

The Parabolic SAR was developed by J. Welles Wilder Jr., introduced in his 1978 book "New Concepts in Technical Trading Systems". Wilder aimed to create a trend-following indicator that would help traders identify potential price reversals and manage risk. Since then, it has gained popularity among traders for its simplicity and effectiveness in various markets, including stocks, commodities and forex.

Calculations¶

The indicator is calculated using the following formula, with addition used during an uptrend (rising SAR) and subtraction used during a downtrend (falling SAR):

\[ SAR_n = { SAR_{n-1} + AF \times ( EP - SAR_{n-1} ) } \]

\(SAR_n\) – the SAR value for the current period

\(SAR_{n-1}\) – the SAR value for the previous period

\(EP\) – the extreme point, the highest high in an uptrend or the lowest low in a downtrend

\(AF\) – the acceleration factor, see below

Interpretation¶

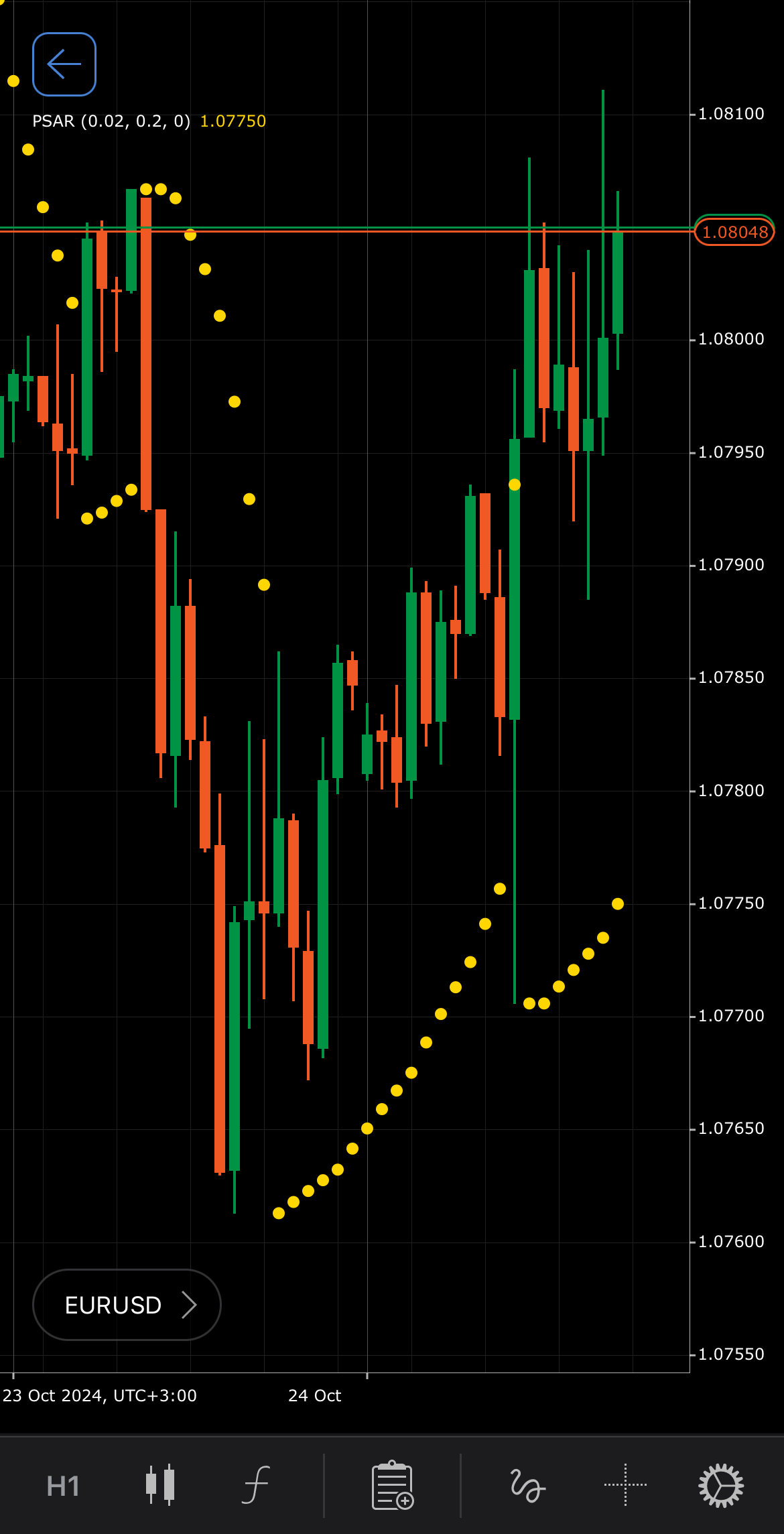

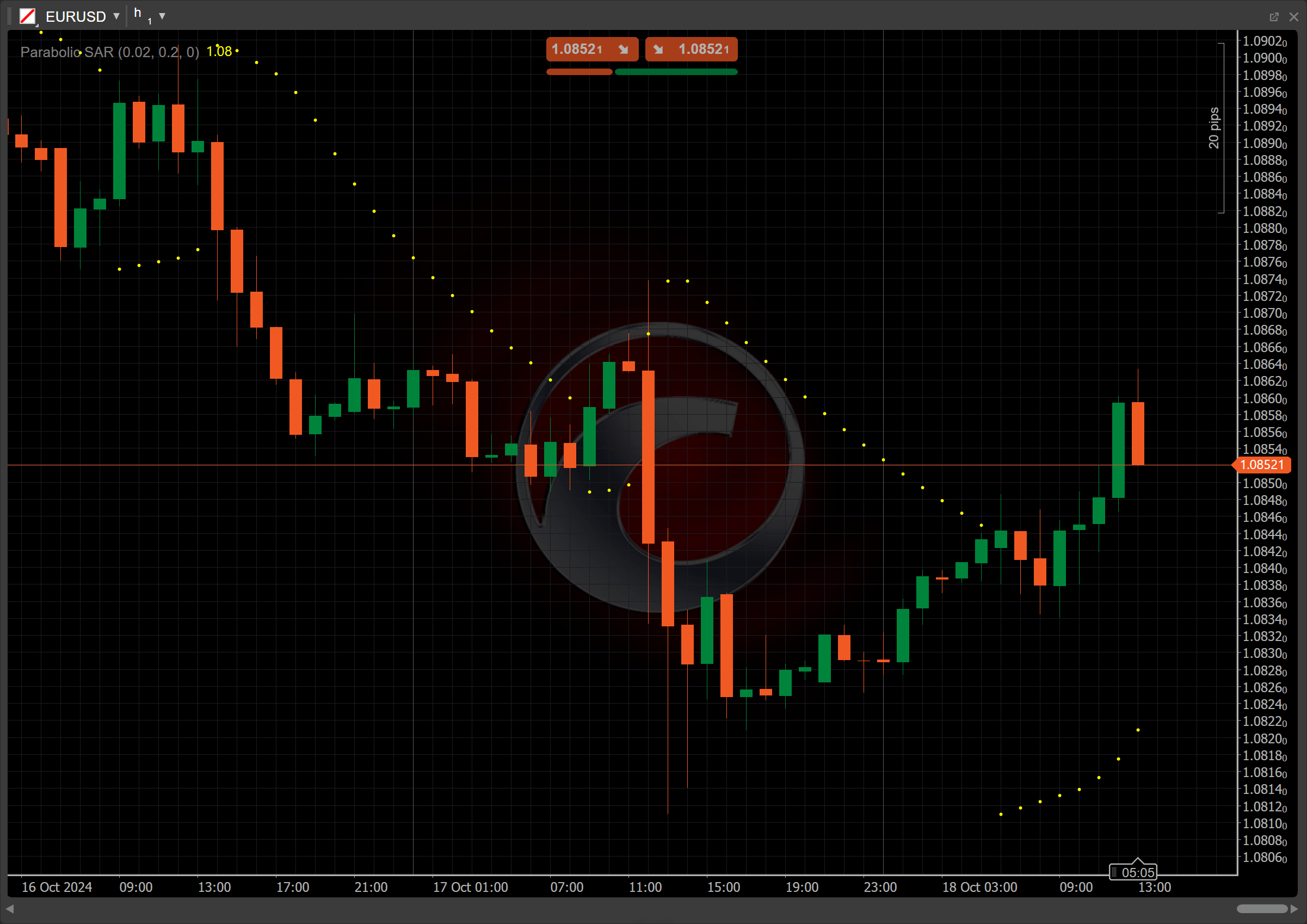

The SAR indicator is most commonly used with the acceleration factor starting at 0.02 and increasing by 0.02, up to a maximum of 0.2, each time the extreme point makes a new high in an uptrend or a new low in a downtrend.

The following interpretations of the indicator are generally applicable:

-

Rising and falling – if the dots appear below the price, it indicates the market is in an uptrend, with the trend likely to continue. Conversely, when the dots appear above the price, it signals a downtrend, suggesting the price is trending lower with a potential continuation of the downward move.

-

Reversal points – when the price crosses below the SAR dots during an uptrend, it signals a potential reversal into a downtrend. Conversely, if the price crosses above the SAR dots during a downtrend, it signals a potential reversal into an uptrend.

-

Shift – by adjusting the shift parameter to alter the alignment of the SAR indicator with price data on the chart, you can explore how the SAR readings correspond to past or future price movements.

Application¶

-

Buy signal – consider entering a long position when the Parabolic SAR dots move below the price, signalling a potential reversal from a downtrend to an uptrend.

-

Sell signal – consider entering a short position when the Parabolic SAR dots move above the price, signalling a potential reversal from an uptrend to a downtrend.

-

Stop-loss placement – you can adjust your stop loss to follow the SAR dots, which move in tandem with the trend. In an uptrend, a stop loss is placed just below the SAR dots, and in a downtrend, it is placed just above them.

-

Exit strategies – the SAR crossing the price provides a clear exit point. In a long position, traders may exit when the price falls below the SAR dots. For short positions, traders exit when the price rises above the dots.

-

Confirming trades – traders may use moving averages alongside the SAR to filter false reversals. Similarly, the Relative Strength Index (RSI) can confirm overbought or oversold conditions, such as confirming a buy signal when the RSI indicates oversold and the price crosses above the SAR dots.

Note

You can take advantage of algo trading, with cBots executing trades based on the signals from this indicator, as shown in our examples. Learn more about how to use indicators in cBots.

Limitations¶

The Parabolic SAR can generate false signals in sideways or choppy markets, leading to whipsaw losses. Its lagging nature may result in late entries or exits, reducing potential profits. Additionally, the indicator does not account for market volatility or volume, which can limit its effectiveness in dynamic trading environments. Traders should use it alongside other indicators to enhance decision-making and reduce risks.

Summary¶

The Parabolic SAR is a trend-following indicator that helps traders identify potential reversals in price direction. By placing dots above or below the price, it signals uptrends and downtrends; when the dots cross the price line, it indicates a potential reversal in the current trend direction. The indicator is calculated considering the acceleration factor and extreme points, allowing traders to gauge the strength of trends and make informed trading decisions, especially when used in conjunction with other indicators.