Supertrend¶

Definition¶

The Supertrend indicator is a trend-following tool designed to calculate dynamic support and resistance levels. By combining price action with the Average True Range (ATR) values, Supertrend provides a responsive approach to trend identification. Its visual representation, typically shown as a dotted line on price charts, allows traders to quickly assess market conditions.

History¶

The Supertrend was developed by Olivier Seban and is primarily used to identify trends in the market. Introduced in the early 2000s, it gained popularity among traders for its effectiveness in signalling potential buy and sell opportunities. Over the years, the Supertrend indicator has been widely adopted in various trading strategies across different asset classes, becoming a staple in technical analysis.

Calculations¶

The Supertrend is calculated based on two lines:

\[ Upper\ band = { Average + ( Multiplier \times ATR ) } \]

\[ Lower\ band = { Average - ( Multiplier \times ATR ) } \]

\(Average\) – the average between the highest and the lowest prices during a specific period

\(Multiplier\) – a constant, making the indicator more or less sensitive to price movements

\(ATR\) – the Average True Range value, calculated over a specific period

Interpretation¶

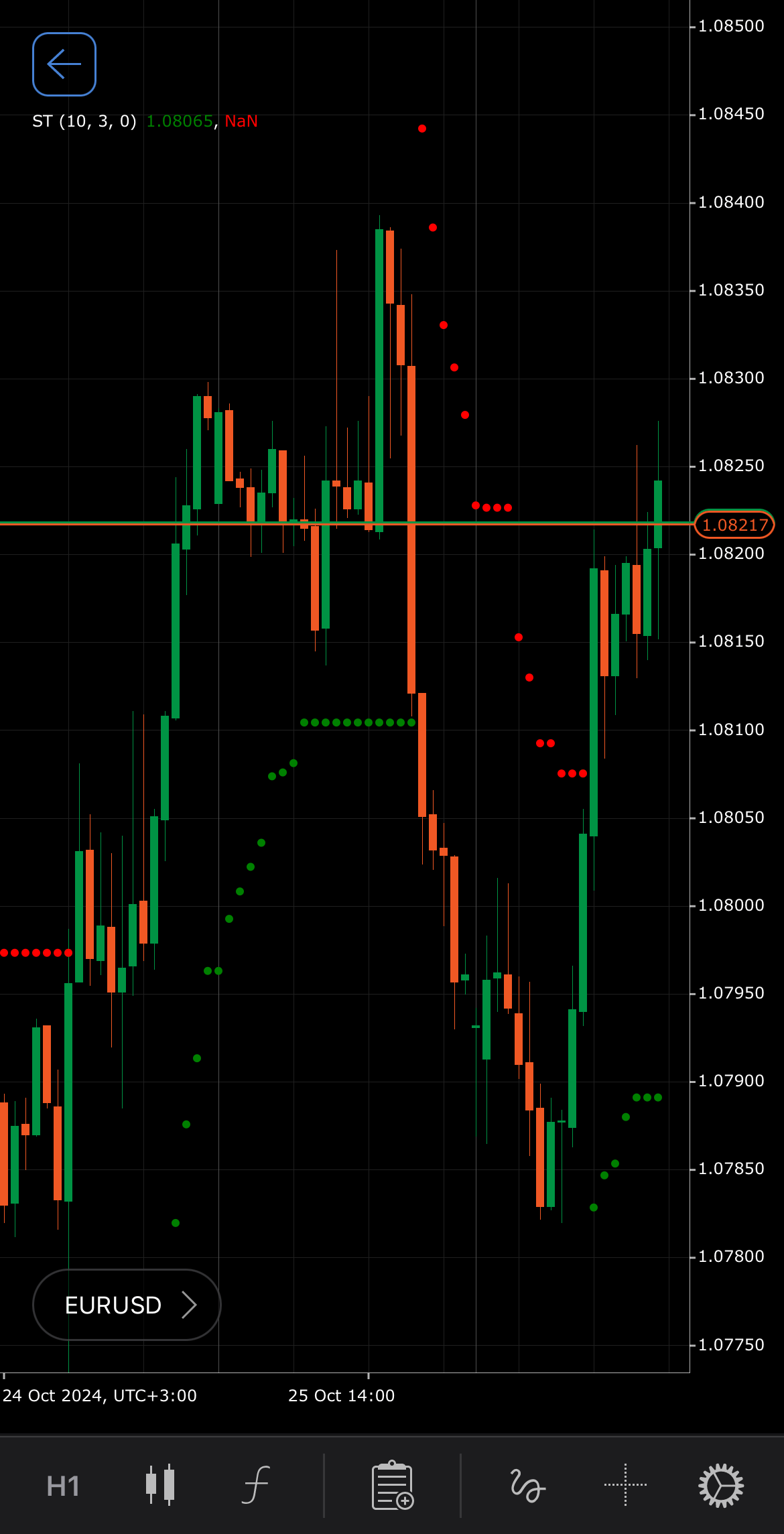

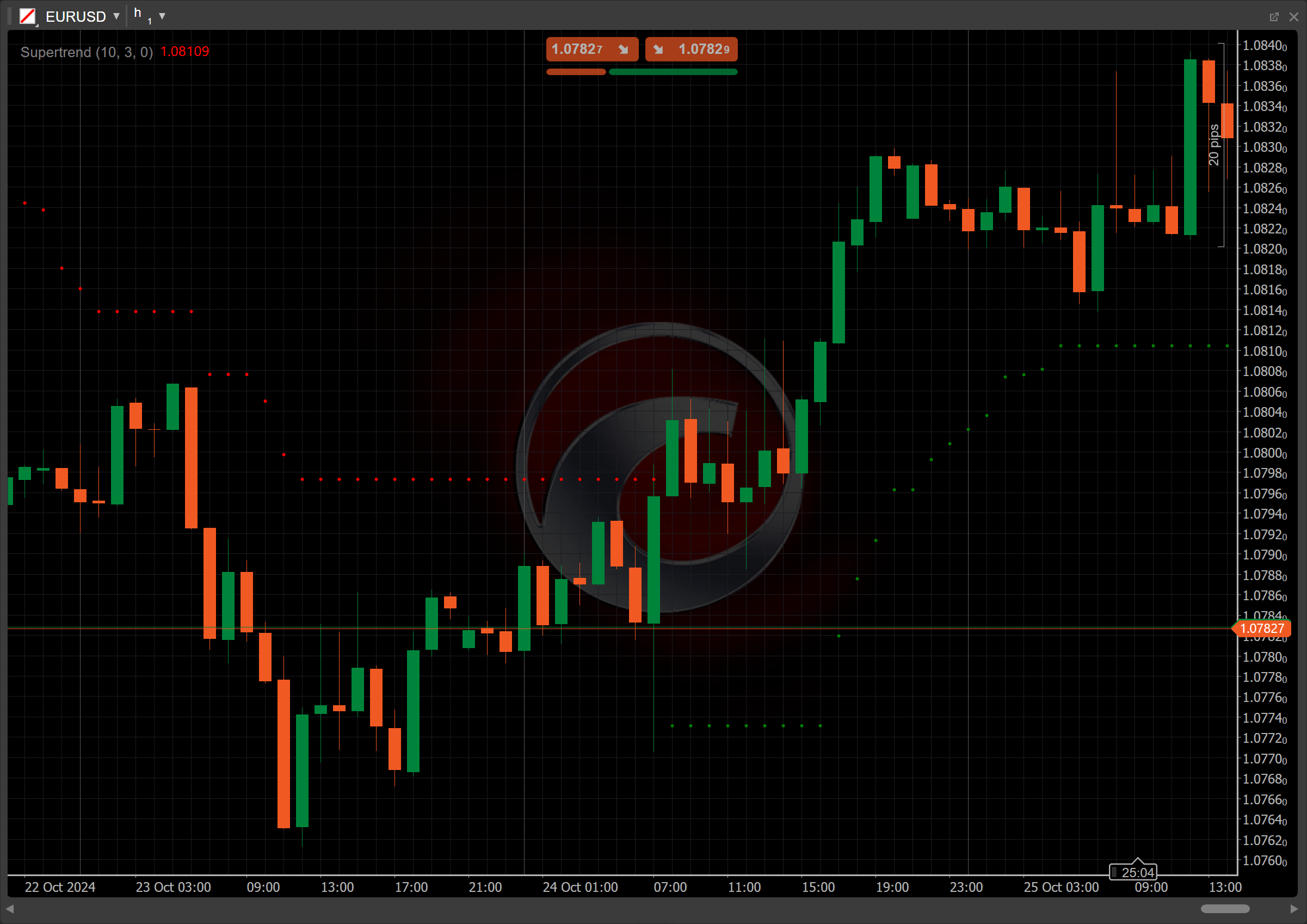

By default, the number of periods for the Supertrend indicator is set to 10 and the multiplier value is set to 3, but it can be adjusted depending on the trader strategy and the time frame of analysis.

The main patterns of the indicator behaviour can be interpreted as follows:

-

Rising and falling – the Supertrend indicator is considered rising when the price is above the Supertrend line, signalling a bullish trend. Conversely, it is falling when the price is below the Supertrend line, indicating a bearish trend.

-

Reversal points – when the Supertrend line changes from green to red or vice versa, it signals a potential reversal in market direction.

-

Shift – by adjusting the shift parameter to alter the alignment of the Supertrend line with price data on the chart, you can explore how Supertrend readings correspond to past or future price movements.

Application¶

-

Buy signal – a potential buying opportunity occurs when the price crosses above the Supertrend line, which typically changes to green.

-

Sell signal – a potential selling opportunity occurs when the price crosses below the Supertrend line, which changes to red.

-

Stop-loss placement – for long positions, a stop loss is usually set just below the Supertrend line to protect against adverse price movements. Conversely, for short positions, a stop loss can be placed just above the Supertrend line.

-

Exit strategies – traders may exit long positions when the Supertrend line changes from green to red, indicating a potential trend reversal. For short positions, exiting may occur when the Supertrend line changes from red to green.

-

Confirming trades – the Supertrend indicator can be effectively combined with other indicators, such as Relative Strength Index (RSI) or moving averages, to confirm trade signals. For example, a buy signal from the Supertrend can be confirmed if the RSI is above a certain level (such as 50), indicating bullish momentum.

Note

You can take advantage of algo trading, with cBots executing trades based on the signals from this indicator, as shown in our examples. Learn more about how to use indicators in cBots.

Limitations¶

The Supertrend can produce false signals in choppy or sideways markets, leading to potential losses. Additionally, its lagging nature means it may react slowly to price changes, causing missed opportunities or delayed entries and exits. The effectiveness of the Supertrend can also vary depending on the chosen parameters and market conditions.

Summary¶

The Supertrend indicator is a powerful tool in technical analysis, designed to help traders identify market trends and make informed trading decisions. Unlike many traditional indicators, the Supertrend is relatively new but is continuously gaining trust and popularity among traders. It utilises the values of the Average True Range to calculate dynamic support and resistance levels. By providing clear buy and sell signals based on price action relative to its two calculated bands, it effectively guides traders through various market conditions and enhances their strategy execution.