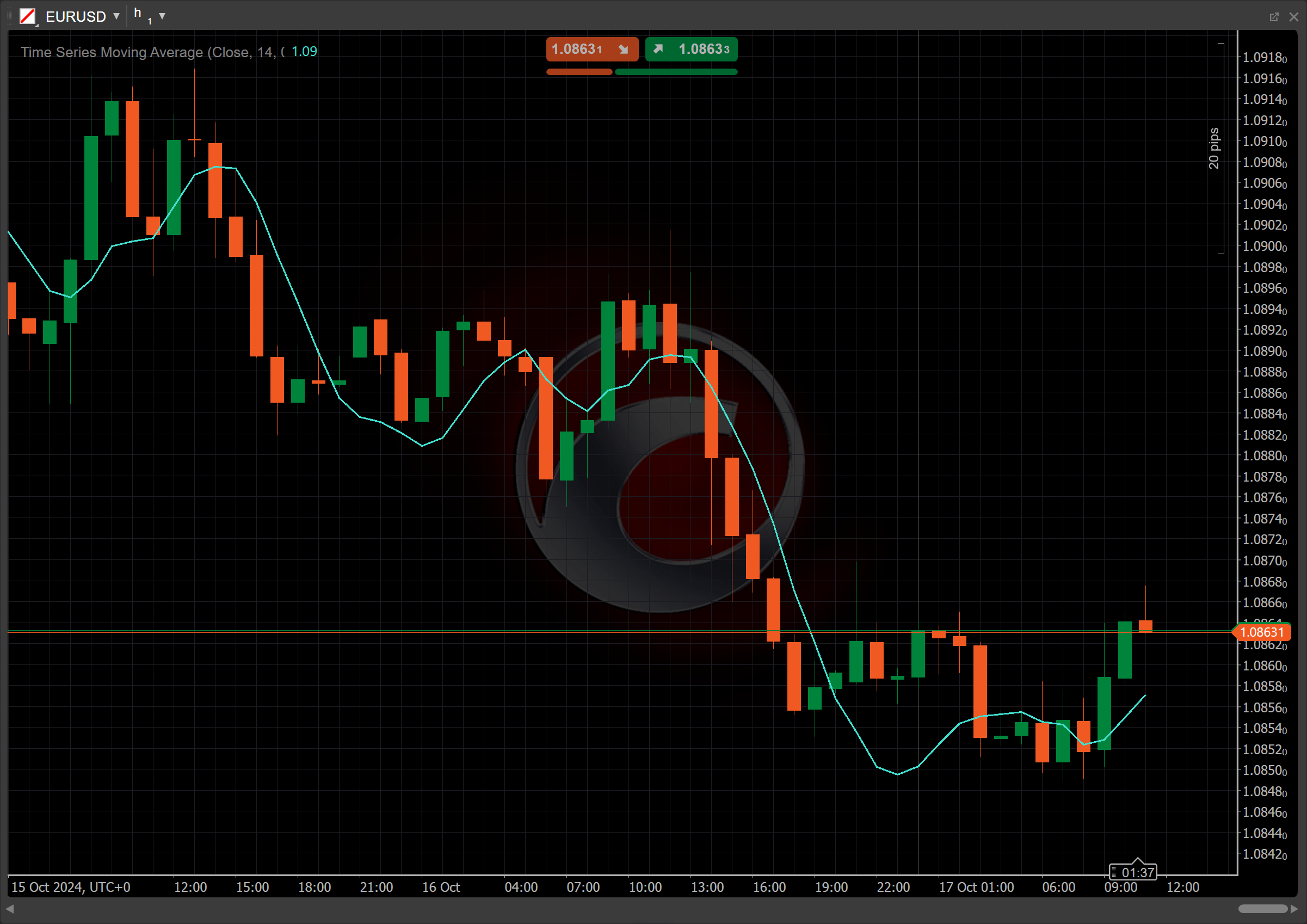

Time Series Moving Average¶

Definition¶

The Time Series Moving Average (TSMA) is a technical analysis indicator that calculates the average of prices over a specified time period, emphasising recent prices to provide a more responsive measure based on linear regression forecasting. Unlike traditional moving averages, the TSMA gives more weight to recent values, making it more responsive to price changes. It is used to identify trends and potential reversal points in price movements, aiding traders in making informed decisions.

History¶

The TSMA emerged from advancements in statistical methods used in technical analysis. Its development was influenced by the need for indicators that could adapt to rapid price changes in financial markets. By applying linear regression techniques, traders sought to create a more responsive average, leading to the adoption of the TSMA as a valuable tool for trend identification and market analysis.

Calculations¶

The Time Series Moving Average is typically calculated using the following formula:

\[ TSMA_t = { 1 \over N } { \sum_{i=0}^{N-1} { P_{t-i} } } \]

\(TSMA_t\) – the value of the Time Series Moving Average at time \(t\)

\(P_{t-i}\) – the price at time (\(t\) − \(i\)), where \(i\) ranges from \(0\) to (\(N\) − \(1\))

\(N\) – the period over which the TSMA is calculated

Interpretation¶

The 14-period and closing prices are used by default to calculate the TSMA value.

The following interpretations of the indicator are generally applicable:

-

Crossovers – when the TSMA crosses above another moving average, it can signal a bullish trend, suggesting potential buying opportunities. Conversely, a cross below indicates a bearish trend and potential selling opportunities.

-

Rising and falling – a rising TSMA indicates a strengthening uptrend, while a falling TSMA suggests a strengthening downtrend.

-

Divergence and convergence – if prices are making new highs or lows while the TSMA fails to do so, it indicates potential weakness in the trend and possible upcoming reversals. When the TSMA aligns with price movements, it can affirm the current trend's strength.

-

Reversal points – when the TSMA changes direction significantly, it may signal a potential reversal point in the market.

-

Shift – By adjusting the shift parameter to alter the alignment of the TSMA indicator with price data on the chart, you can explore how the TSMA readings correspond to past or future price movements.

Application¶

-

Buy signal – traders may enter a long position when the TSMA crosses above a slower-moving average or when the TSMA itself shows an upward trend, indicating a potential bullish market condition.

-

Sell signal– traders may enter a short position when the TSMA crosses below a slower-moving average or when the TSMA starts to trend downward, indicating a potential bearish market condition.

-

Stop-loss placement – traders often place a stop loss just below recent swing lows when buying and above recent swing highs when selling.

-

Exit strategies – exit strategies can include closing positions when the TSMA crosses in the opposite direction of the trade or when it shows signs of flattening, indicating a potential trend reversal.

-

Confirming trades – the TSMA can be effectively combined with other indicators, such as Relative Strength Index (RSI) or MACD, to confirm trade signals. For instance, if both the TSMA (fast and slow) indicates a buy signal and the RSI is not overbought, this can provide stronger confirmation for entering a long position.

Note

You can take advantage of algo trading, with cBots executing trades based on the signals from this indicator, as shown in our examples. Learn more about how to use indicators in cBots.

Limitations¶

The Time Series Moving Average can lag behind price movements due to its reliance on historical data, potentially leading to delayed signals. It may also generate false signals during sideways or choppy market conditions, reducing its effectiveness. Additionally, relying solely on the TSMA can overlook important market context.

Summary¶

The Time Series Moving Average is a valuable technical analysis tool that calculates the average of prices over a specified period while emphasising more recent values. This responsiveness makes it particularly effective for identifying trends and potential reversal points in the market. Traders often use the TSMA to generate buy and sell signals based on crossovers with other moving averages, assess market strength and refine entry and exit strategies, enhancing their overall trading decisions.