Triangular Moving Average¶

Definition¶

The Triangular Moving Average (TMA) is a type of smoothing indicator designed to reduce noise and provide a smoother view of the trend compared to the Simple (SMA) or the Exponential (EMA) moving averages. It applies a double-smoothing process, meaning that the data is averaged twice. The result is a moving average that places more weight on the middle portion of the data. This indicator is typically used to identify trends and gauge the overall direction of the market while minimising short-term fluctuations.

History¶

The TMA emerged from early technical analysis efforts in the mid-20th century to smooth market data and identify long-term trends. Analysts sought better alternatives to simple moving averages, reducing noise while maintaining trend accuracy. The indicator was popularised by John Ehlers in the 1990s and has since gained widespread use among traders, offering a clearer picture of price movements over extended periods.

Calculations¶

The Triangular Moving Average is calculated as a double-smoothed Simple Moving Average:

\[ TMA_t = { 1 \over n } { \sum_{i=1}^{n} { SMA_i } } \]

\(SMA\) – the Simple Moving Average, which is an arithmetic moving average of closing prices over n periods

\(n\) – the number of periods

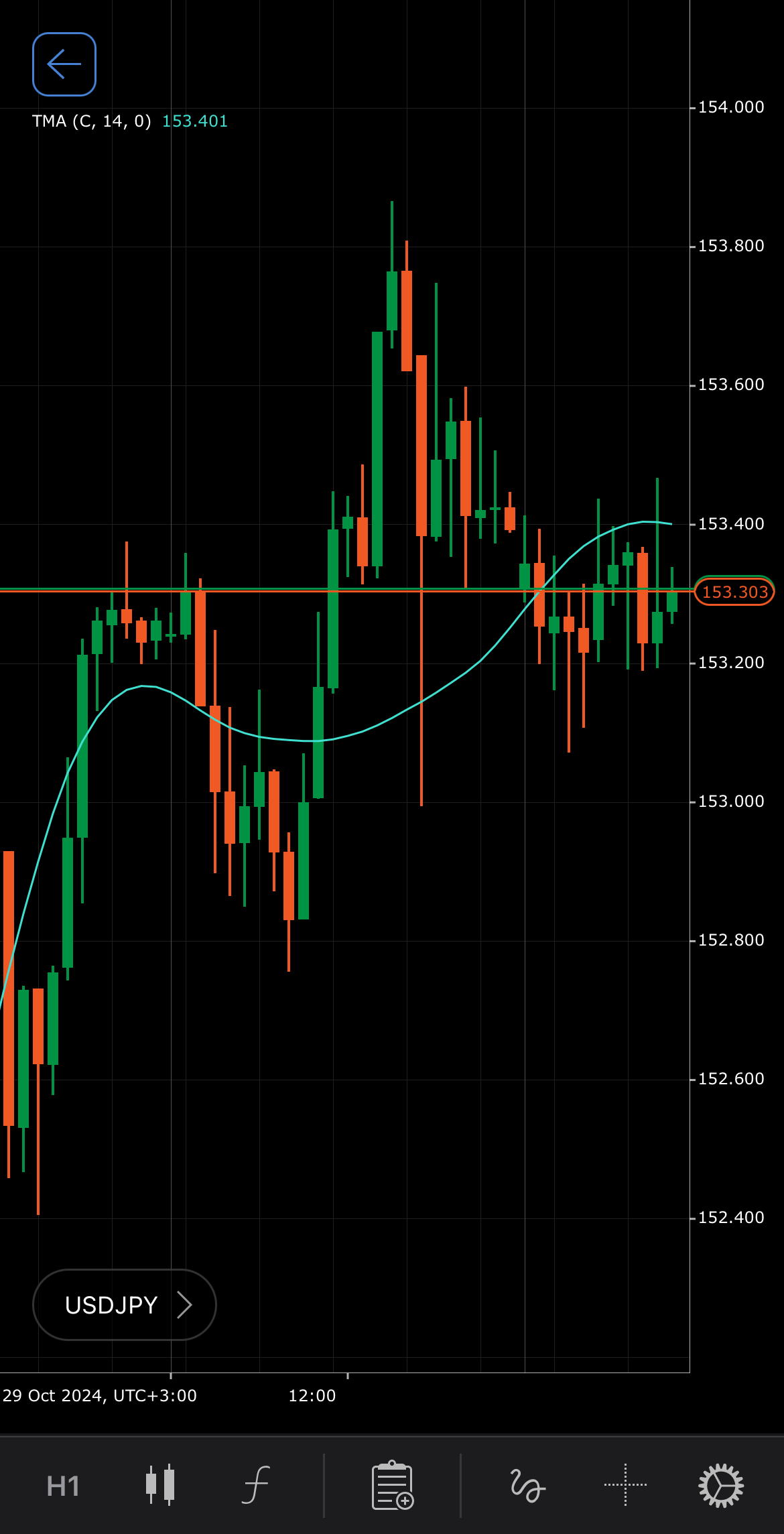

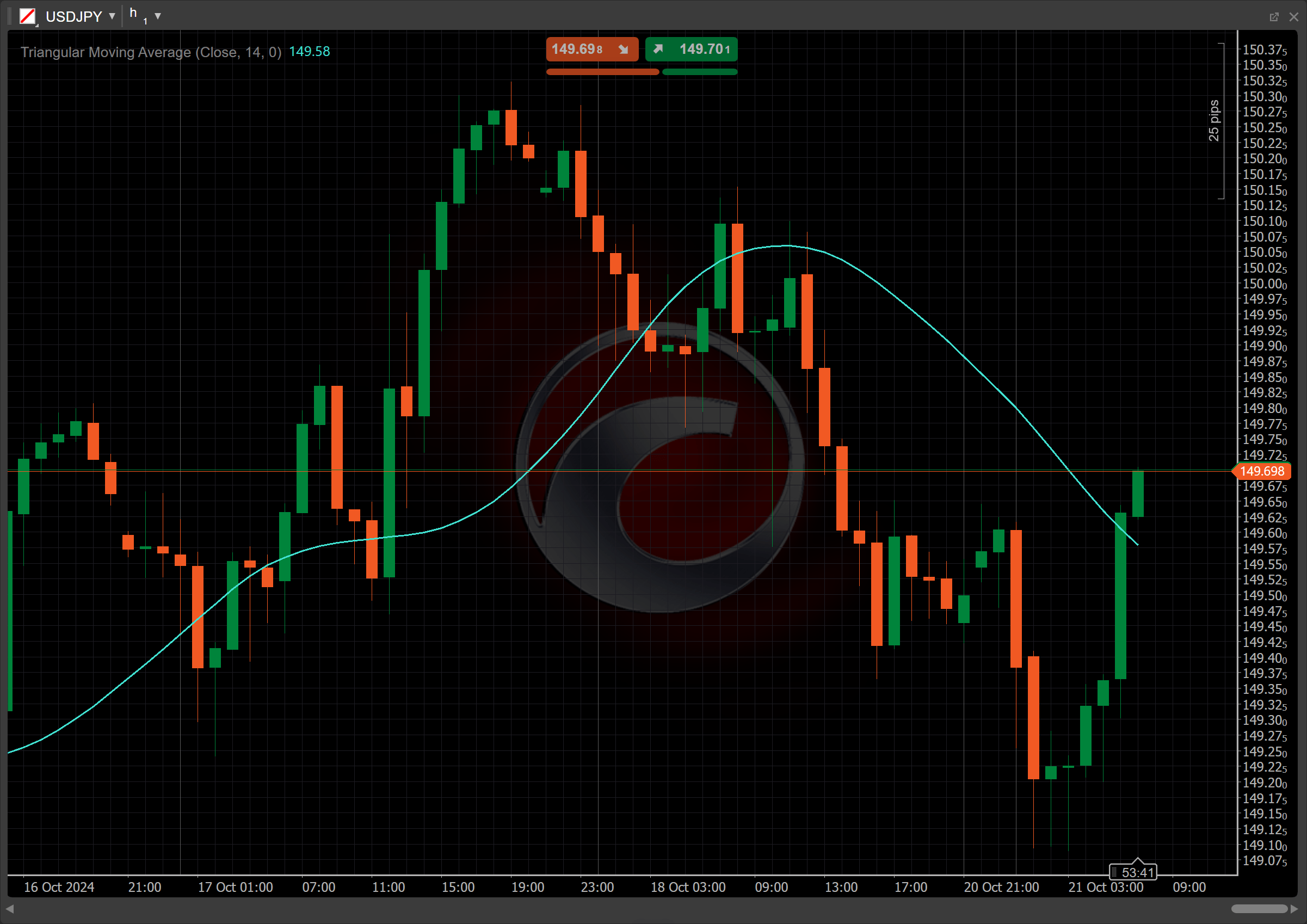

Interpretation¶

By default, the number of periods for calculating the TMA value is set to 14, but it can be adjusted across a wide range depending on the trader's strategy and the period of analysis.

The main patterns of the indicator behaviour can be interpreted as follows:

-

Crossovers – when the TMA line crosses above the price line, it may signal a bullish trend; and conversely, when the TMA crosses below the price, it could indicate a bearish trend.

-

Rising and falling – a rising TMA suggests the market is in an uptrend, with prices generally increasing, while a falling TMA points to a downtrend, indicating declining prices.

-

Reversal points – sharp changes in the slope of the TMA may signal a potential trend reversal, warning traders of possible shifts in market direction.

-

Shift – by adjusting the shift parameter to alter the alignment of the TMA indicator with price data on the chart, you can explore how the TMA readings correspond to past or future price movements.

Application¶

-

Buy signal – traders may enter a long position when the price crosses above the TMA, suggesting the start of a potential uptrend.

-

Sell signal – traders may enter a short position when the price crosses below the TMA, indicating the beginning of a potential downtrend.

-

Exit strategies – a crossover in the opposite direction (for example, the price crossing below the TMA during a long trade) can be considered as an exit signal to lock in profits or minimise losses.

-

Confirming trades – the TMA works well with momentum indicators like the MACD or the Relative Strength Index (RSI) to confirm trend strength. For example, a TMA crossover with a positive RSI reading can increase the confidence in a trade decision.

Note

You can take advantage of algo trading, with cBots executing trades based on the signals from this indicator, as shown in our examples. Learn more about how to use indicators in cBots.

Limitations¶

The primary limitation of the TMA is its inherent lag due to double smoothing, which can delay signals and potentially lead to missed opportunities in fast-moving markets. Additionally, it may generate false signals during sideways price action, making it less effective in ranging conditions. Traders should use the TMA in conjunction with other indicators for improved accuracy.

Summary¶

The Triangular Moving Average is a double-smoothed moving average that provides a clearer view of price trends by reducing noise. It calculates the average of the SMA applied twice over a defined period. The TMA is effective for identifying long-term trends and smoothing out price fluctuations. However, its responsiveness can be slower compared to other moving averages, which may affect timely decision-making in dynamic market conditions.