Weighted Moving Average¶

Definition¶

The Weighted Moving Average (WMA) is a type of moving average that assigns different weights to each data point, emphasising more recent prices. This characteristic allows the WMA to respond more quickly to price changes compared to simple moving averages. It is calculated by multiplying each price by its respective weight and dividing the total by the sum of the weights. The result smooths out price data, helping traders identify trends and potential reversal points effectively.

History¶

The concept of weighted moving averages has been utilised in technical analysis for decades, evolving from early price analysis techniques. While specific authors and dates are often debated, influential figures in the field of technical analysis, like J. Welles Wilder in the 1970s, popularised moving averages in his work. These methods have since been adopted in various trading systems and platforms.

Calculations¶

The Weighted Moving Average is typically calculated using the following formula:

\[ WMA = { { \sum_{i=1}^{n} { ( P_i \times W_i ) } } \over { \sum_{i=1}^{n} { W_i } } } \]

\(P_i\) – the price at period \(i\)

\(W_i\) – the weight assigned to period \(i\) (with weights increasing by an enumerable range)

\(n\) – the total number of periods being considered for the WMA

Interpretation¶

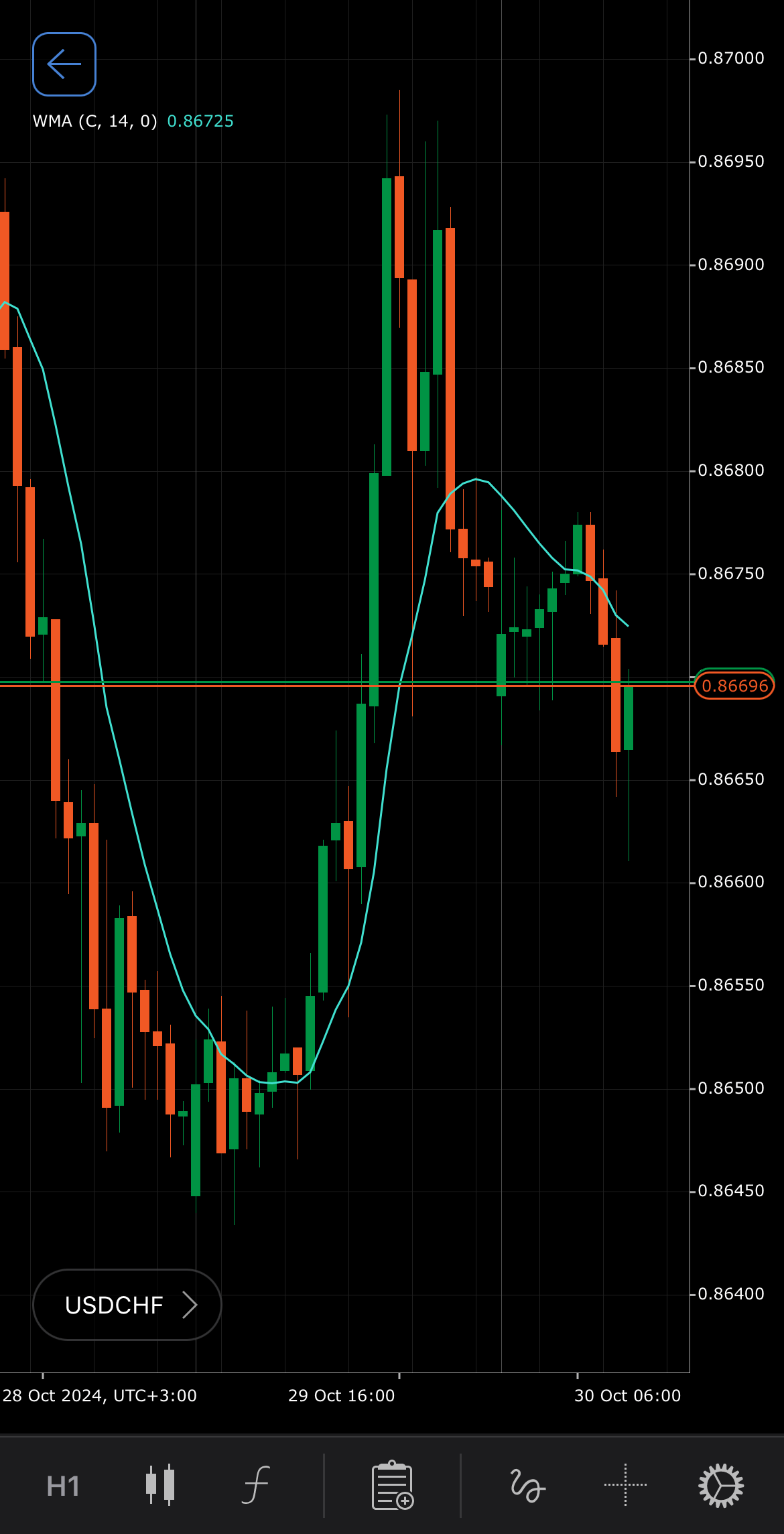

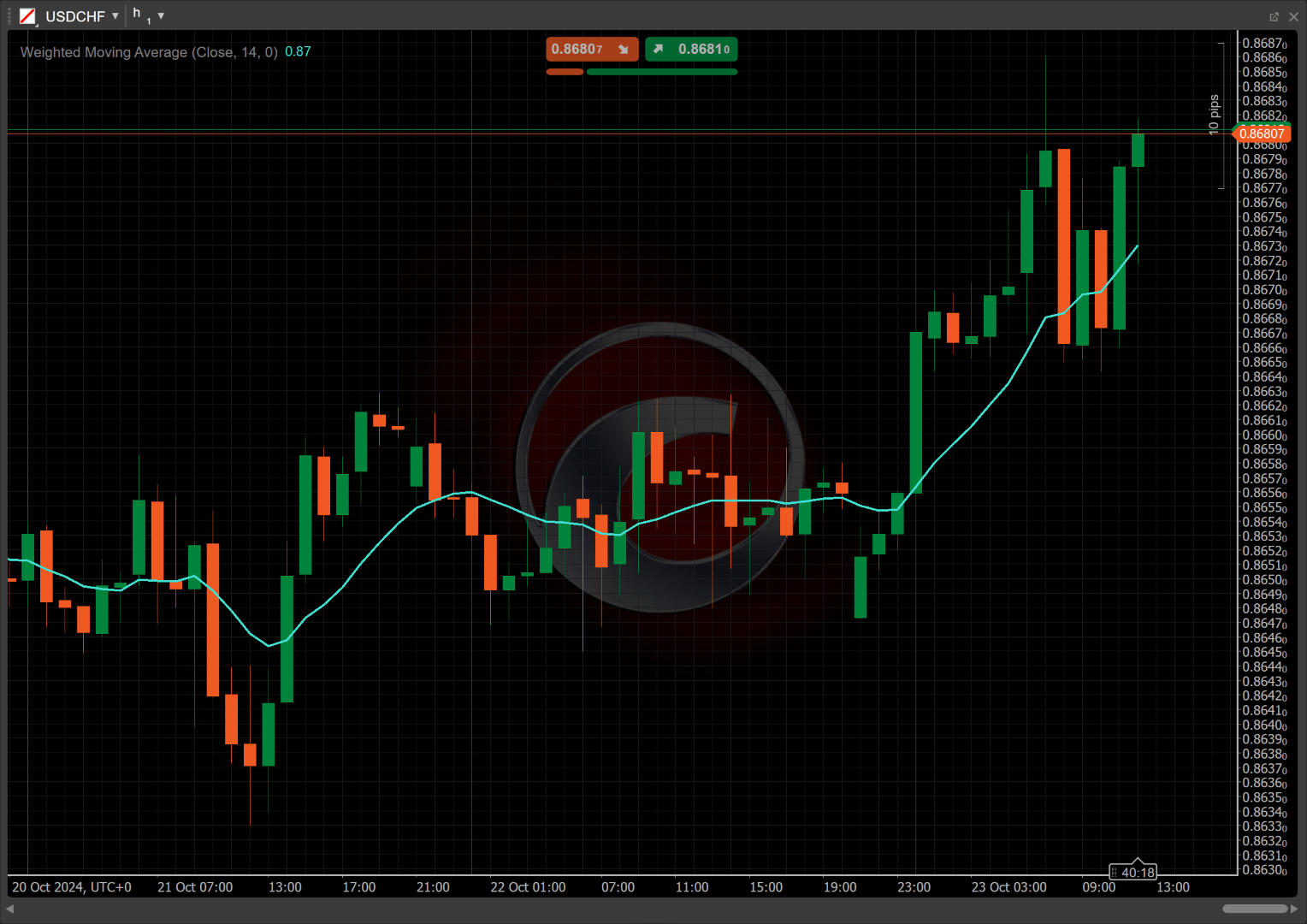

The 14-period and closing prices are used by default to calculate the WMA value.

The following interpretations of the indicator are generally applicable:

-

Crossovers – when a shorter-period WMA crosses above a longer-period WMA, it may indicate a bullish trend, while a shorter-period WMA crossing below a longer-period WMA may signal a bearish trend.

-

Rising and falling – an upward slope in the WMA indicates a bullish trend, while a downward slope suggests a bearish trend.

-

Reversal points – the WMA can help identify potential reversal points when the price approaches the moving average and shows signs of bouncing off it. A price bounce off the WMA, especially after a significant trend, may signal a possible change in direction.

-

Shift – by adjusting the shift parameter to alter the alignment of the WMA indicator with price data on the chart, you can explore how the WMA readings correspond to past or future price movements.

Application¶

-

Buy signal – when a shorter-period WMA crosses above a longer-period WMA, indicating a potential upward trend, it indicates a potential buying opportunity, especially if confirmed by other bullish indicators.

-

Sell signal – when a shorter-period WMA crosses below a longer-period WMA, suggesting a potential downward trend, it indicates a potential selling opportunity, particularly if supported by bearish indicators.

-

Stop-loss placement – traders often place a stop loss slightly below the WMA when in a long position, using it as a dynamic support level. For short positions, a stop loss can be placed above the WMA, treating it as a resistance level.

-

Exit strategies – traders may exit long positions if the price falls below the WMA or if a bearish crossover occurs. For short positions, exiting may be prompted by the price moving above the WMA or a bullish crossover, allowing traders to secure profits or minimise losses.

-

Confirming trades – the WMA can be effectively combined with other indicators, such as Relative Strength Index (RSI) or MACD, to confirm signals. For instance, a bullish crossover of the WMAs coupled with the RSI showing oversold conditions can strengthen the buy signal, enhancing the likelihood of a successful trade.

Note

You can take advantage of algo trading, with cBots executing trades based on the signals from this indicator, as shown in our examples. Learn more about how to use indicators in cBots.

Limitations¶

The WMA can be overly sensitive to recent price movements, leading to potential whipsaws in volatile markets. Additionally, like other moving averages, it lags behind price changes, which may cause traders to react too late. The choice of period length can also significantly impact the indicator's effectiveness, and improper settings may yield misleading signals.

Summary¶

The Weighted Moving Average is a powerful tool in technical analysis that assigns varying weights to recent data, allowing it to react more swiftly to price changes. This feature helps traders identify trends and potential reversal points effectively. By smoothing price fluctuations, the WMA enhances the clarity of market signals. It is widely used in trading strategies, making it essential for informed decision-making and analysis in various market conditions.