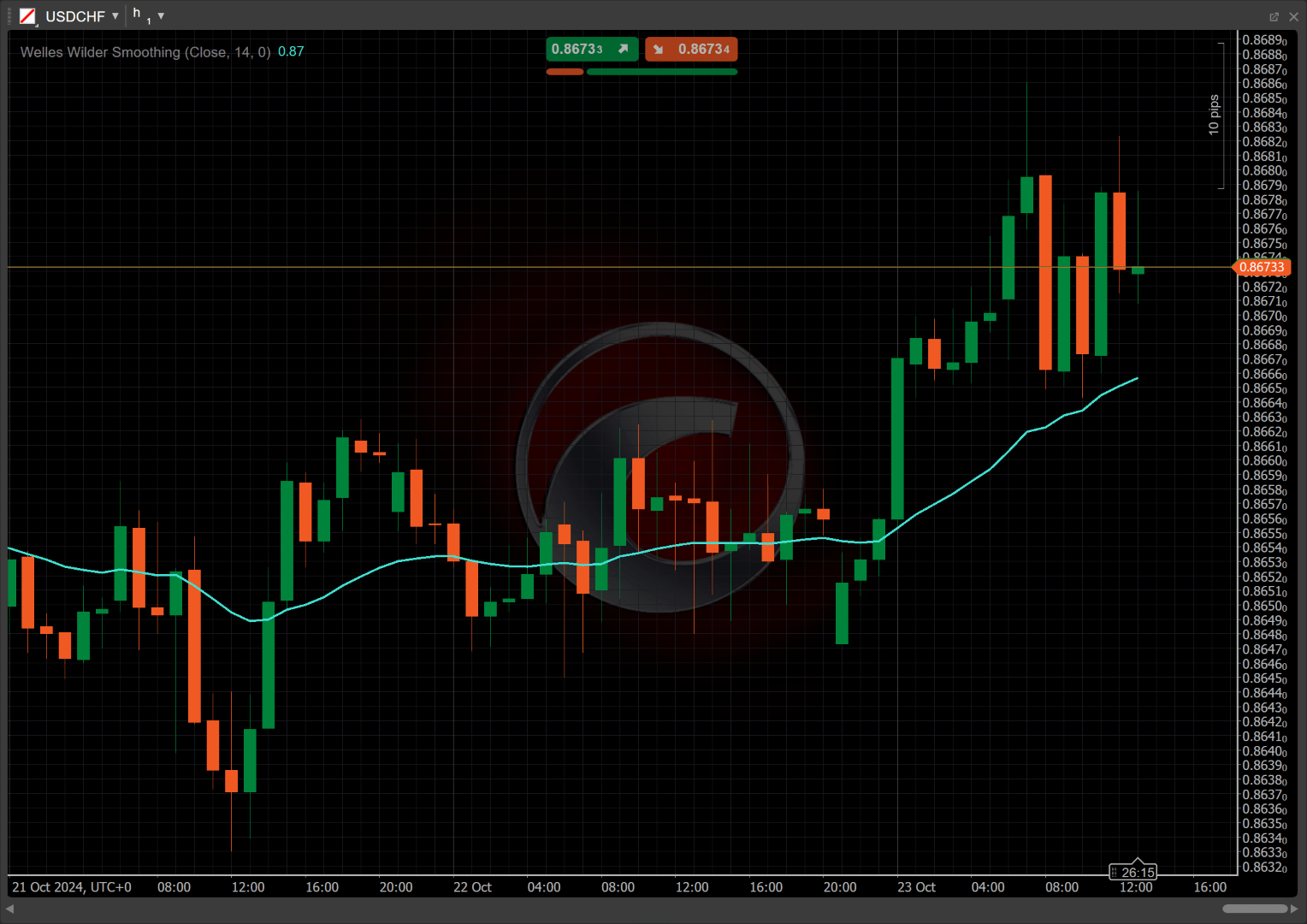

Welles Wilder Smoothing¶

Definition¶

The Welles Wilder Smoothing (WWS) is a trend-following technical indicator designed to smooth out market data by reducing the effect of short-term fluctuations. It does this by applying a recursive calculation to a series of data points, producing a smoothed line that adjusts gradually over time. The indicator helps traders observe the underlying trends in price movement without being influenced by random market noise or volatility.

History¶

Developed by J. Welles Wilder Jr. in 1978, the Welles Wilder Smoothing method was introduced in his book "New Concepts in Technical Trading Systems". This smoothing technique is often used in his other indicators, such as the Relative Strength Index (RSI), to enhance the ability to detect long-term market trends.

Calculations¶

The Welles Wilder Smoothing follows this recursive formula:

\[ WWS_t = { WWS_{t-1} + { { Source_t - WWS_{t-1} } \over { Periods } } } \]

\(WWS_t\) – the current WWS value

\(WWS_{t-1}\) – the previous WWS value

\(Source_t\) – the current price

\(Periods\) – the number of periods for smoothing

Interpretation¶

The 14-period and closing prices are used by default to calculate the WWS value.

The following interpretations of the indicator are generally applicable:

-

Rising and falling – a rising WWS line indicates a strengthening uptrend, suggesting that prices are generally increasing over time. Conversely, a falling WWS line points to a weakening market, signalling a downtrend in price movement.

-

Reversal points – when the WWS line changes direction after a sustained rise or fall, it may signal a potential market reversal. A shift from rising to falling could indicate that an uptrend is losing momentum, while a shift from falling to rising may suggest that a downtrend is ending.

-

Breakouts – sudden sharp changes in price that significantly deviate from the smoothed WWS line might signal breakouts, where the price is breaking away from its historical trends. These breakouts can be an early indication of increased volatility or a significant shift in the market.

-

Shift – by adjusting the shift parameter to alter the alignment of the WWS indicator with price data on the chart, you can explore how the WWS readings correspond to past or future price movements.

Application¶

-

Buy signal – traders often enter long positions when the WWS rises after a decline, especially if the price consistently remains above the rising line, signalling sustained upward momentum and a potential trend reversal.

-

Sell signal – traders may enter short positions when the WWS starts to fall after a period of rising, especially if the price drops below the falling line, signalling continued weakness and a potential reversal to a downtrend.

-

Stop-loss placement – a stop loss can be placed just below the WWS line in an uptrend to protect against a sudden price drop. In a downtrend, a stop loss can be positioned slightly above the WWS line to safeguard against unexpected upward price movements.

-

Exit strategies – traders can consider exiting their positions when the WWS line begins to flatten after a period of strong movement, indicating that the current trend is losing strength. Exiting may also be appropriate when the WWS reverses direction, signalling a possible trend shift.

-

Confirming trades – the WWS can be effectively combined with momentum indicators, such as the Relative Strength Index (RSI) or the MACD, to confirm trend strength. For instance, using the WWS alongside the RSI divergence may reinforce buy or sell signals by confirming potential trend reversals.

Note

You can take advantage of algo trading, with cBots executing trades based on the signals from this indicator, as shown in our examples. Learn more about how to use indicators in cBots.

Limitations¶

The Welles Wilder Smoothing, due to its recursive nature, can lag behind the actual price movement, making it slower to respond to sharp changes or sudden reversals. This lag can make it less effective in fast-moving or volatile markets where quick adjustments are necessary. Additionally, its reliance on historical data may obscure current market conditions in highly volatile scenarios.

Summary¶

The Welles Wilder Smoothing indicator is a tool used in technical analysis to smooth out price data, providing a clearer view of long-term market trends. By applying a recursive calculation, it gradually adjusts to changes in price, helping traders identify sustained movements while filtering out short-term fluctuations. This smoothing process allows traders to focus on broader trends and gain insights into potential shifts in market direction over time.