Average True Range¶

Definition¶

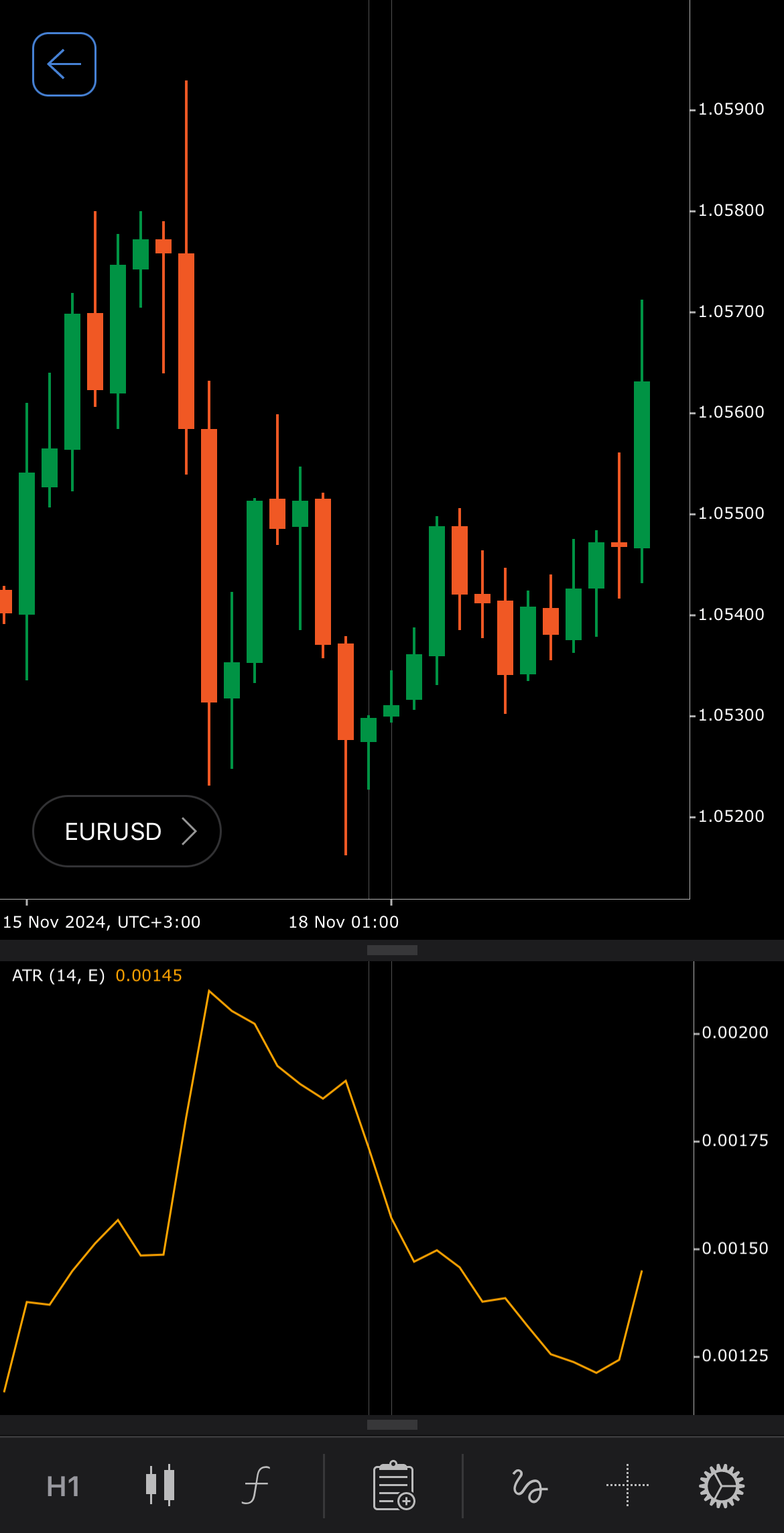

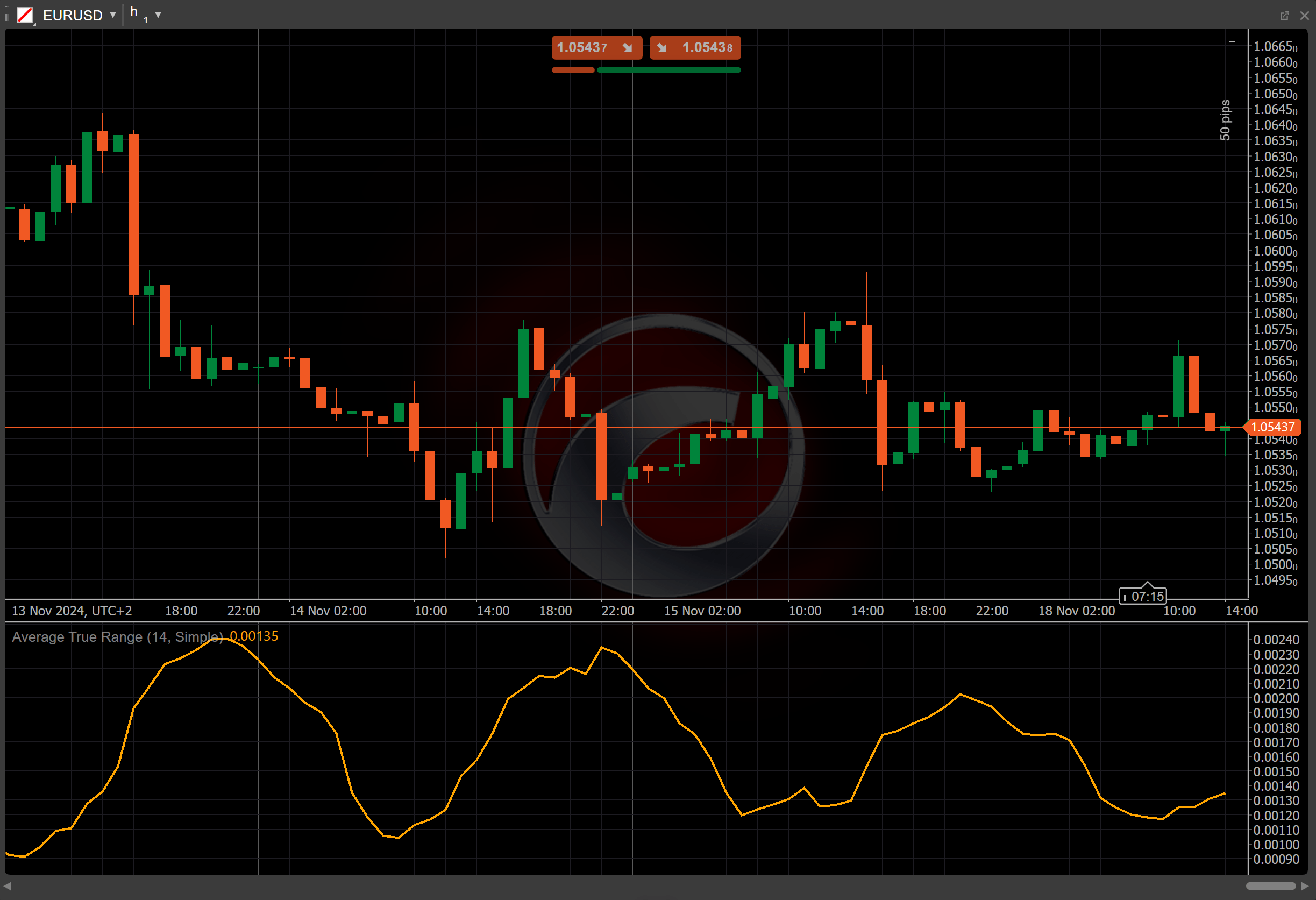

The Average True Range (ATR) is an indicator that focuses on the market volatility of a given asset. It measures market volatility by calculating the average range between the high and low prices over a specific period, typically 14 days.

History¶

In his book "New Concepts in Technical Trading Systems" J. Welles Wilder introduced the ATR, initially as a tool to measure the volatility of commodities as they are often more volatile than stocks. However, the ATR is now widely used by traders and analysts for various assets. The book published in 1978 featured other key trading indicators such as the Directional Movement Index (ADX) and the Accumulative Swing Index (ASI).

Calculations¶

The ATR value is calculated as the moving average of the True Range (TR) over a specified number of periods.

\[ ATR = { Moving\ Average\ (TR, n) } \]

\(TR\) – the current True Range value

\(n\) – the number of periods

Interpretation¶

By default, the Simple Moving Average (SMA) is used with a 14-period to calculate the ATR value.

When interpreting the ATR data, traders should focus on changes in absolute values.

-

Rising – an increasing ATR indicates growing volatility, which can signal potential breakout opportunities or significant market moves.

-

Falling – a declining ATR suggests decreasing volatility, which may indicate a consolidation phase. This can signal potential reversal points or a lack of momentum.

As different assets may carry different values and, as a result, different levels of volatility, ATR values should not be compared across multiple markets.

Application¶

The ATR is widely used in risk management and volatility analysis.

-

Buy signals – a rising ATR can signal a potential breakout, indicating an increase in volatility that may offer buying opportunities. Traders may look for confirmation from other indicators before entering a position.

-

Sell signals – if the ATR is falling, it could suggest a period of low volatility and consolidation. Traders might use this as a signal to exit positions or prepare for potential reversals.

-

Stop-loss placement – the ATR is commonly used to set stop losses at multiples of the ATR value (such as 2x ATR), helping traders accommodate the expected price fluctuations and protect against sudden market reversals.

-

Exit strategies – a falling ATR may suggest that volatility is decreasing, potentially indicating an end to a trend. Traders can use the ATR values to plan their exit points from trades.

Note

You can take advantage of algo trading, with cBots executing trades based on the signals from this indicator, as shown in our examples. Learn more about how to use indicators in cBots.

Limitations¶

The ATR does not indicate the direction of price movement, only the degree of volatility. The ATR reflects past market volatility, which may not always accurately predict future market conditions. Additionally, the ATR may provide less meaningful information in low-volume or illiquid markets, where price movements can be erratic.

Summary¶

The Average True Range indicator measures market volatility by focusing on price changes of a specific asset over a period. The ATR data is always absolute, meaning it does not account for the direction of price movements. A rising ATR indicates increasing volatility, which may signal potential breakout opportunities. A falling ATR indicates decreasing volatility, which may signal potential reversal points.