Improve conversion rate¶

The prime purpose of networkers and affiliates is to generate traffic to partnered brokers’ online resources. While marketers can attract leads, it is difficult to guarantee that a lead will become an active live trader making regular deposits and remaining loyal to the broker. A trader’s journey can be interrupted by numerous factors that are out of networkers’ and affiliates’ control, such as UX disruptions along the way, communication breaches and unrealistic expectations.

Although solutions to this problem do not lie on the surface, it is still possible to optimise conversion by giving a more pronounced call to action, using personalised marketing communications and sending only trustworthy signals across all channels. This guide will familiarise you with specific features of cTrader that allow you to drastically improve conversion optimisation.

Example

Suppose you attract 2,000 leads from all your promotional channels every month. Out of this number, 40 traders open live accounts and deposit real funds to the broker. By doubling the conversion rate, you could generate 80 active traders each month. At the same time, your promotional budget will not change but profits will definitely increase.

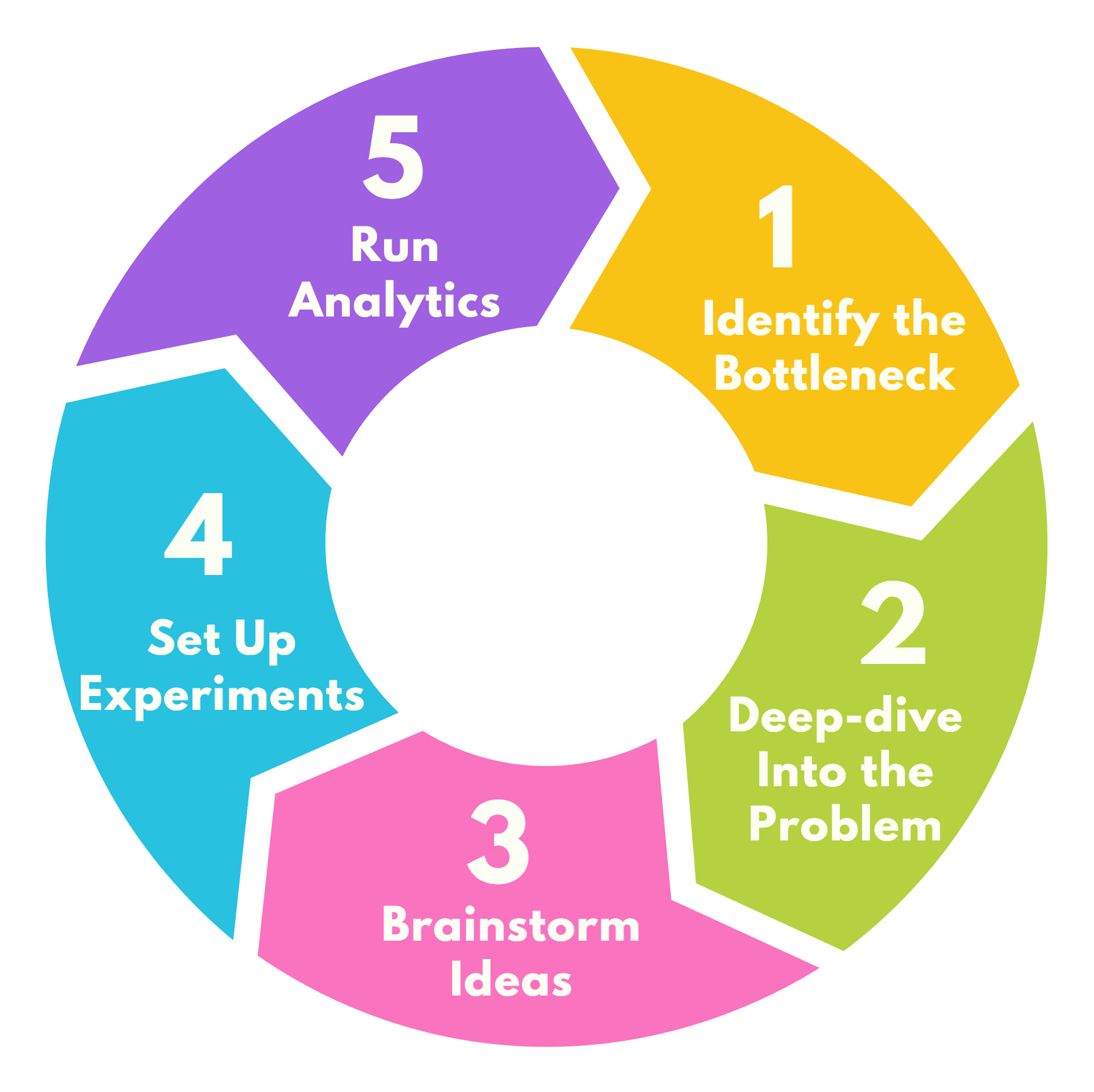

From this perspective, conversion rate optimisation is a silver bullet you should equip your marketing arsenal with. The process of conversion optimisation consists of five consecutive steps, namely bottleneck identification, deep-diving into the problem, ideas brainstorming, setting up experiments and running analytics.

Identify the bottleneck¶

Have you ever calculated your conversion rate?

You can do so by means of this simple formula:

- Conversion rate = Active traders / Number of leads

You should clarify the definition of "active traders" with your partnered broker, but usually these are traders who have opened live accounts and deposited real funds. We would like to avoid speculating about what conversion rate is considered a norm in the industry. A reasonable practice would be to benchmark against your own past performance and that of other networkers and affiliates.

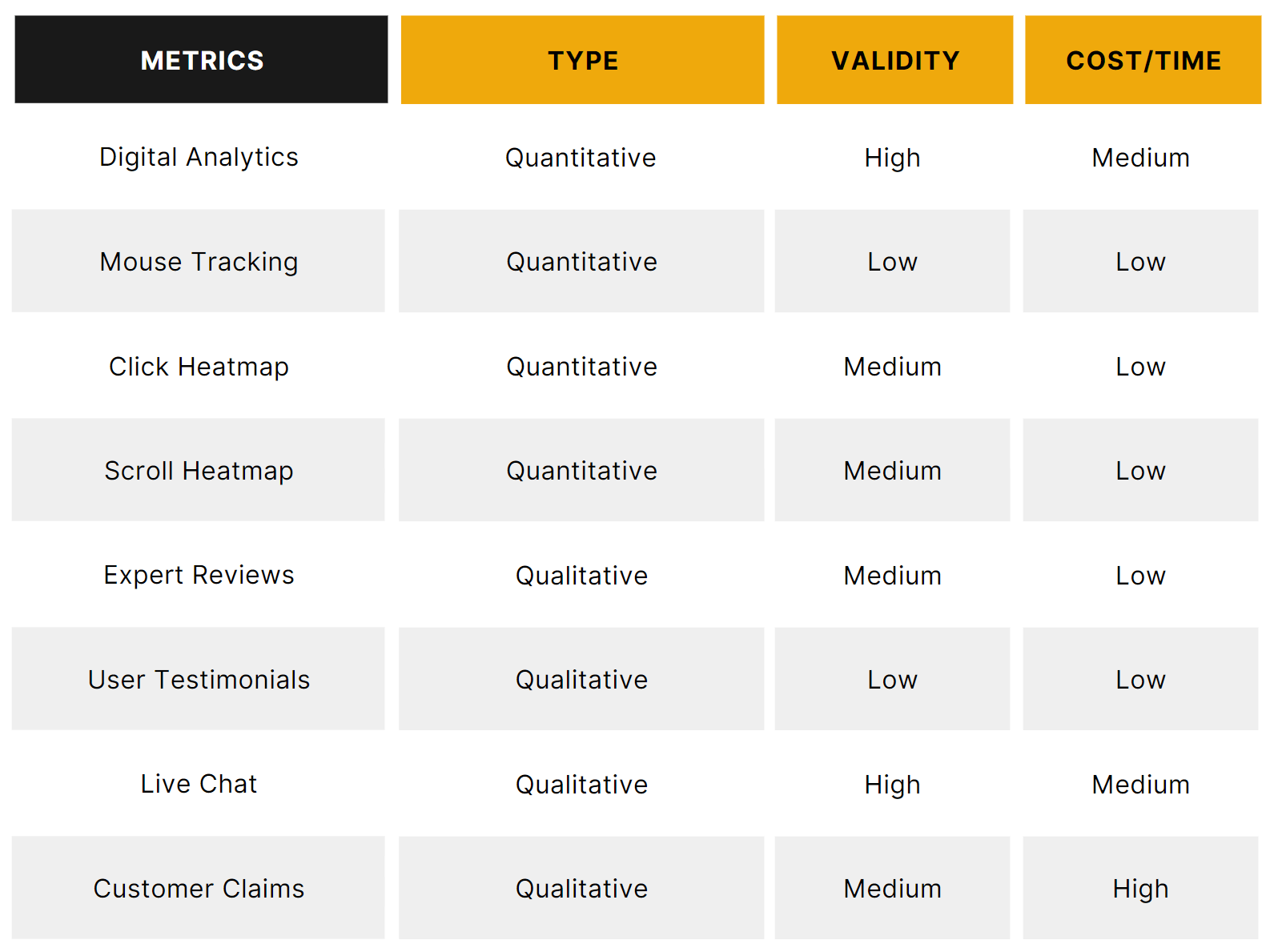

To spot bottlenecks, you first need to ensure that your marketing measurability is in order. Quantitative measurements will allow you to detect the most threatening bottlenecks, while qualitative research will provide you with insight into why they exist.

The following cases illustrate real bottlenecks you may encounter in the conversion process from leads to active traders. These fictitious examples show common behaviours among leads:

- Henrik would be interested to have a look at the platform but he avoids the registration process.

- Having opened a demo account, Abdullah does not take any specific actions on the cTrader platform.

- Michael does not deposit real funds into his live account.

- Yasmin avoids trading with real funds even having a positive balance.

- Xiang trades from time to time but this happens rarely, and the invested amount is small.

Deep-dive into the problem¶

Each of the typical behaviours exemplified by your leads should be analysed in detail to reveal the possible motives and decision-making behind it. Here, qualitative analytics would be more appropriate as they examine the causes of leads’ withdrawal at every stage. Let us try to dive deeper into each case.

It is likely that Henrik expects the platform to have an exhausting registration process with tons of personal information to be requested, complex KYC and even prolonged waiting for approval. These expected difficulties outweigh the interest to see the platform.

In turn, Abdullah has satisfied his initial interest by opening a demo account. However, he has not yet received any specific call to action from networkers and affiliates, such as creating an order for a specific symbol, modifying the position and others.

It is highly probable that Michael has not deposited any funds because he is not inspired by real-life examples of successful trading, or these success stories do not evoke trust. Opening a live account demonstrates the intention to trade, but the lack of further motivation challenges conversion in this case.

Yasmin is ready to trade but probably lacks manual trading skills and cannot interpret the market situation correctly. As a result, she faces a fear to take risks and lose funds. Sharing responsibility with an experienced trader would be a reasonable step for Yasmin to become an active trader.

Xiang seems to have acquired trading skills and accepts risks but has no time for trading. His conversion will reach an optimum if he increases the scale, both in terms of frequency and traded volume.

Brainstorm ideas¶

When you have identified the bottlenecks and their causes, you can now start brainstorming ideas for eliminating them. This section will introduce you to possible solutions, while specific use cases of promotional messages will be shown later in the article. Product-wise, we would like to highlight some features of cTrader that would contribute to conversion optimisation in the five typical cases.

You can prompt Henrik and similar leads that cTrader automatically opens in a guest mode if the user is not registered. With this feature on board, leads can navigate across different applications, open trading charts for different symbols and interact with other basic UI elements. Bearing in mind that some functionality (such as placing an order, creating a price alert, taking a Chartshot, etc.) opens the log in/sign up window, first-time users will be gently guided towards registration.

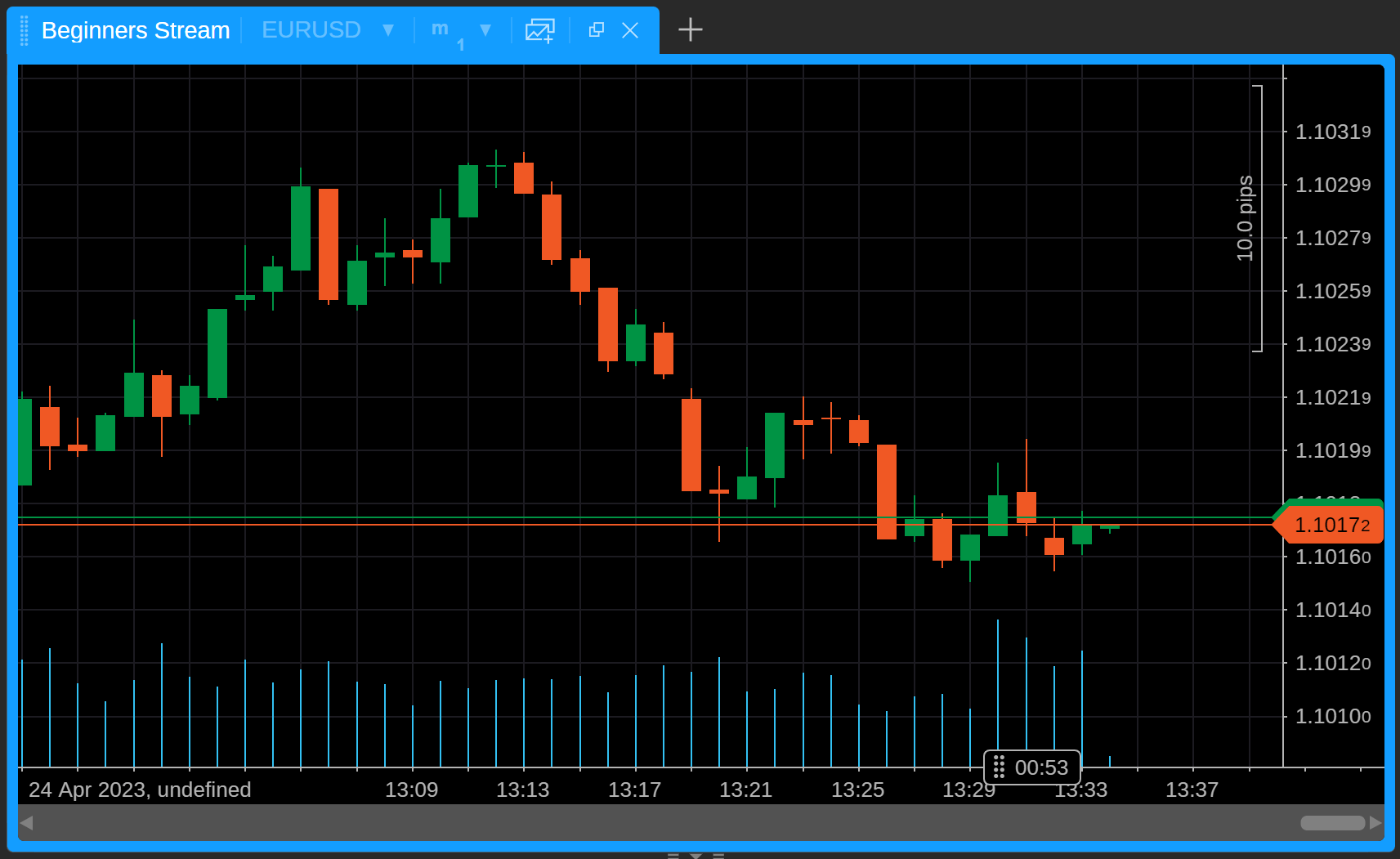

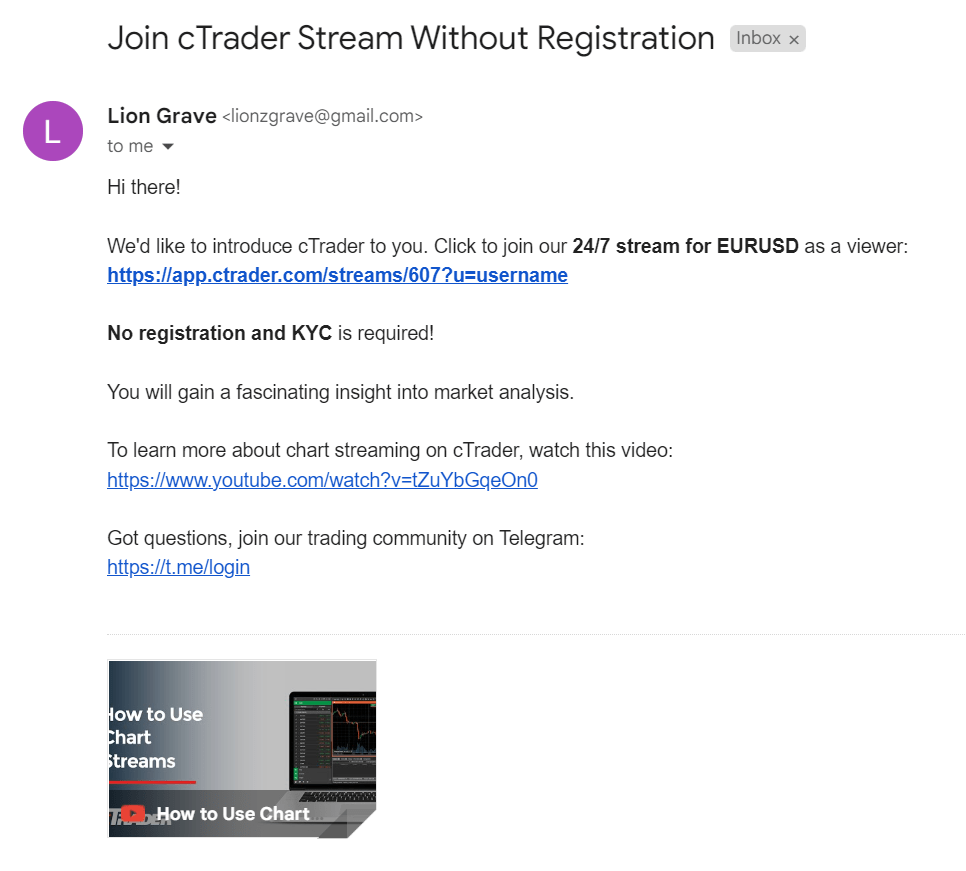

Even continuing as an unregistered user, such leads as Henrik can remain involved via Chart Streams. This feature involves live broadcasting of an experienced trader who performs technical analysis and shares insight about the market situation. When leads decide to react to certain market opportunities, they will be surprised to discover how quick and effortless the registration process on cTrader is (particularly in fully branded cTrader apps).

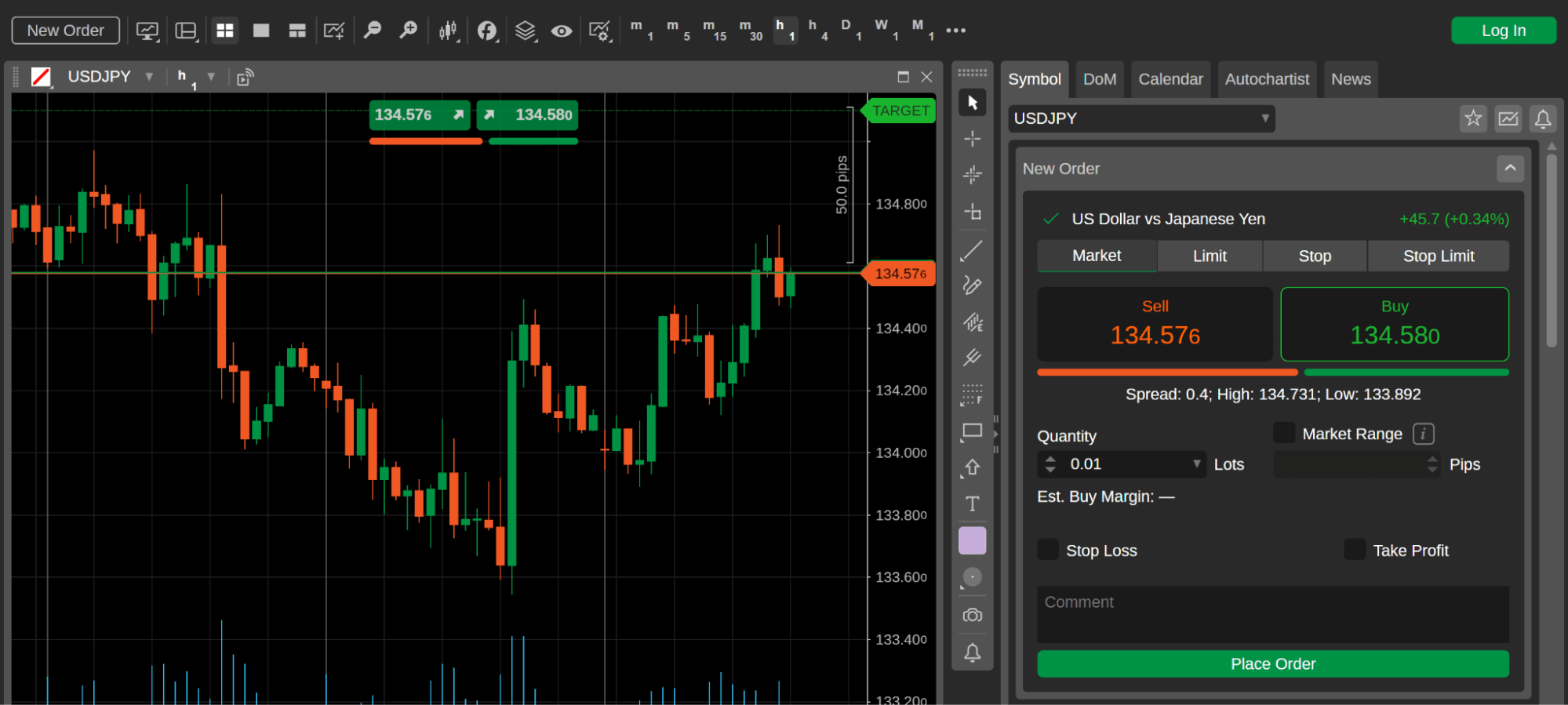

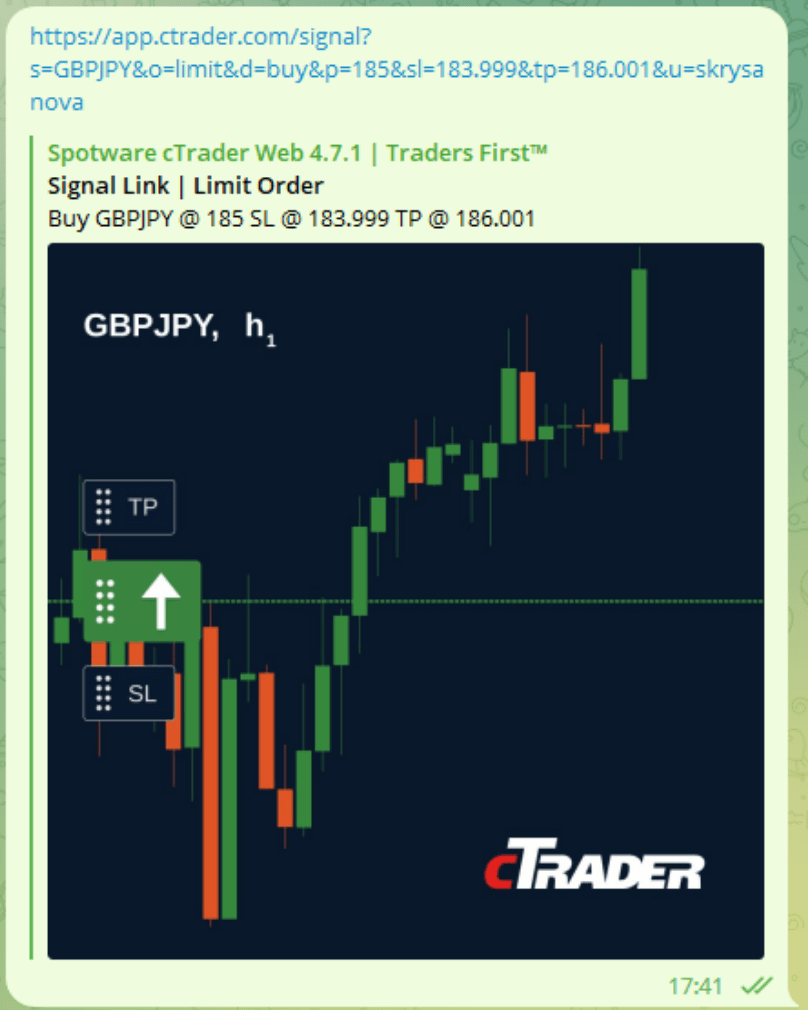

In Abdullah’s case, specific actions on the platform can be provoked by cTrader deeplinks that communicate a clearer call to action. For instance, leads can be directed to place a new limit order for the symbol currently shown on the active chart. Thus, leads will start acquiring trading experience on their demo account and their confidence will increase. It is also possible to spark off reactions with signal links distributed by signal providers.

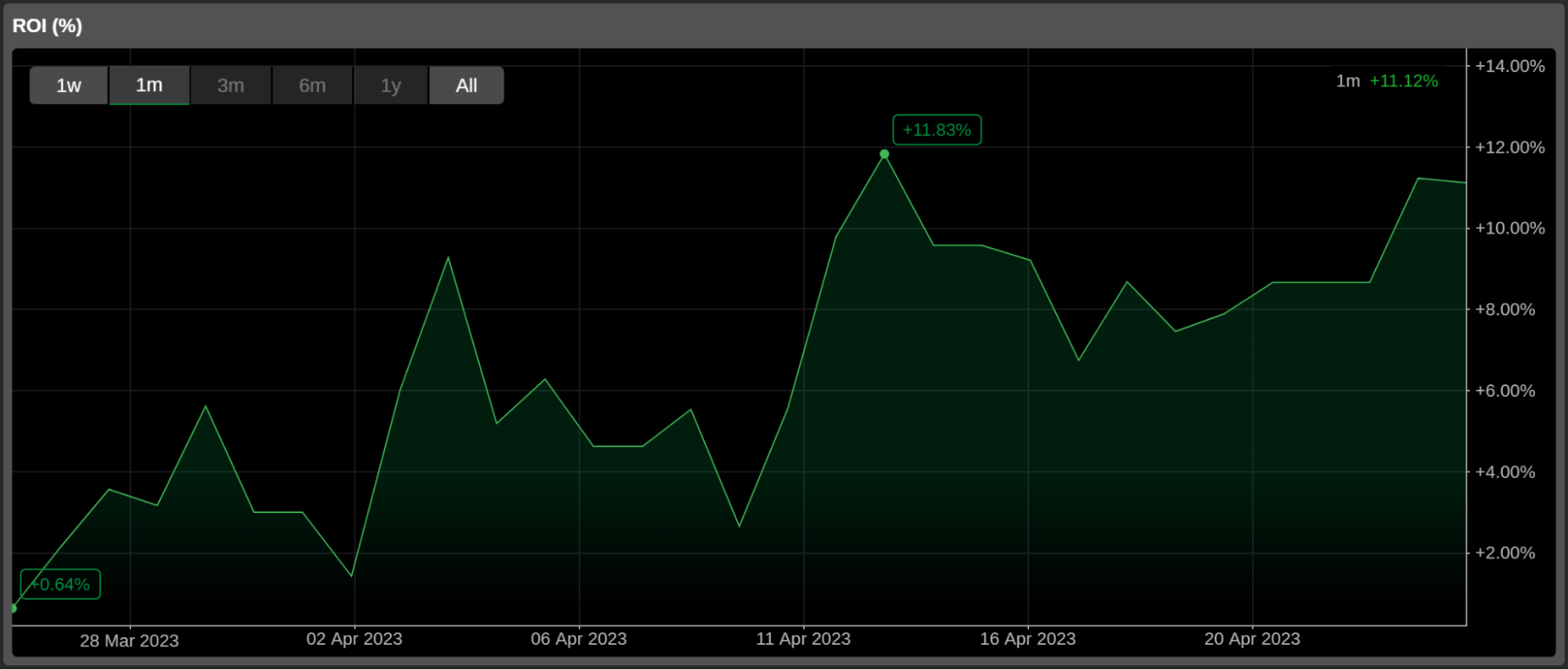

To eliminate Michael’s and similar bottlenecks, it is essential to inspire live account holders with convincing proof of profitable trading. Having checked genuine statistics of other traders on the same platform, inactive traders would be more willing to deposit real funds and start trading. The Investor Access feature of cTrader is ideal for this purpose, as the trader’s performance is difficult to fake, and the platform itself serves as a validator of credibility. Leads may be motivated to generate the same ROI as experienced investors.

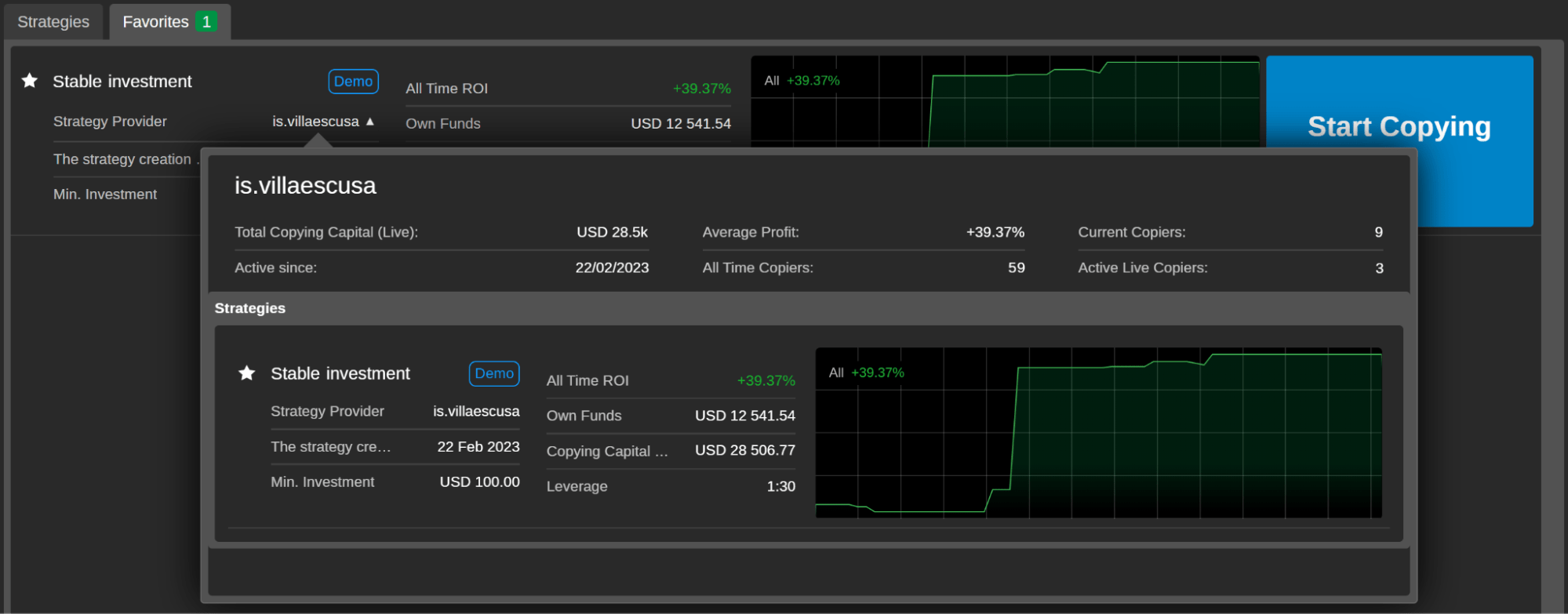

A lack of manual trading skills together with risk aversion prevents Yasmin and many other leads from converting into active traders. Copy is an integrated cTrader feature for investing in other traders’ strategies. Leads benefit from checking the performance of each strategy, thus estimating their own investment risks more realistically. Since users rely on the copying mechanism, the entrance barrier is low and this feature is particularly suitable for beginners.

The issue facing Xiang is scalability, and the Algo application of cTrader will allow for avoiding this bottleneck. cBots are automated trading algorithms that continue following a predefined strategy even when a user is outside the platform. The existing variety of free and paid algorithms one can attain from various sources satisfies even the most demanding traders.

Set up experiments¶

As the next step, you should start setting up experiments to validate your marketing hypotheses regarding the bottlenecks. Communicate tailored messages to your leads bearing in mind the conversion obstacles they are potentially facing. The choice of communication channels would depend on your networking best practices and the social media preferred by your audience.

Henrik and similar leads who are repelled by the registration process can be sent promotional emails.

Leads (including Abdullah) who have not been reached with a specific call to action, can be contacted via personal messages like this. If you do not send signals yourself, you can outsource signal links from signal providers trusted by the broker.

Tip

Any link from the cTrader ecosystem that contains a partner's nickname (u=nickname) also works as an invite link and executes trader attribution. Double-check if your nickname is present as a URL parameter in the signal, Copy strategy and Chart Stream links you are sharing to enjoy the benefits of cTrader Invite. You can manually replace other partners' names with yours to ensure trader attribution.

Those leads (such as Michael) who wish to witness a success story and need an emotional stimulus to start trading can be targeted with credible statistics from Investor Access.

Yasmin and other traders with live accounts who have remained inactive can be approached with a campaign nudging to try the Copy feature, which can be used even by beginners with developing trading skills.

Finally, the scalability issue experienced by Xiang and other community members can be resolved by offering Algo as a flexible and automated trading platform. The further you go down the conversion funnel, the more personalised messages and communication channels should be selected.

When setting up marketing experiments, it is important to remain creative and test where you come into direct contact with each category of your leads. For example, if you meet leads in person at events and expos, you can add a QR code leading to the Investor Access stats on your business card.

Examine data¶

As shown at the beginning of this guide, conversion optimisation is a cyclic process. This suggests that you should return to marketing metrics after each promotional campaign. Calculate your conversion rate again and make other quantitative measurements to track positive dynamics. You can also collect feedback from other stakeholders, such as the broker, signal providers, Stream organisers and others.

What is next?¶

With this promotional strategy, you can definitely achieve healthy conversion optimisation, but the rate will never reach 100%. You can still continue increasing your efficiency by expanding the boundaries of the conversion funnel. The utmost purpose of the flow should be generating partners who would be interested in attracting new traders. In such a way, you will build a self-sustained network and consequently boost your profit from the broker’s affiliate programme.