Trading Conditions

The majority of the conditions that you experience while using cTrader are influenced by your broker.

Each broker will have different settings. We have written this section to help you to understand trading conditions further and what influences them.

Commissions¶

Commissions in cTrader are charged based on the volume of the deal.

Your broker decides on whether to charge commissions, how much should be charged, and how they should be charged (USD volume, Lots, Basis Points).

The Commissions that are charged in a currency different from your account currency will be converted into your account currency.

Stop Out¶

Think of a Stop Out as a certain margin level (denoted in percent) at which your broker will start to automatically close your open positions.

Stop Outs (either Fair or Smart) are triggered when the Margin Level of your account drops to or below the designated Stop Out level. The Stop Out level can only be determined by your broker(s).

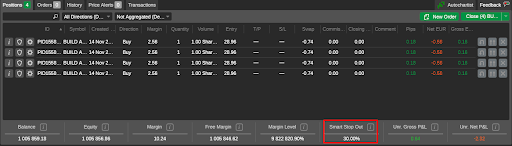

cTrader supports two Stop Out types, namely Smart Stop Outs and Fair Stop Outs. You can view your account Margin Level and the Stop Out level in the Balance bar in the TradeWatch panel.

The Balance tab also contains information about your account balance, equity, the available and used margin, and gross and net P&L generated by your positions. Hover over any field to see detailed information on how this value is calculated.

Fair Stop Out¶

Upon your account Margin Level dipping below the designated Stop Out Level, a Fair Stop Out automatically closes a position using the largest amount of margin. This position is closed wholly. Any unrealized P&L generated by a position does not affect whether it is closed when a Stop Out is triggered.

As an example of how Fair Stop Outs work, consider a case in which a trader wants to open three positions for three different symbols.

- The trader's account deposit currency is USD.

- The trader's initial account equity is 1,500 USD.

- The Stop Out level of the account is 30%.

- At the start of trading, the EUR-to-USD, GBP-to-USD, and CAD-to-USD exchange rates are equal to

1.0085,1.1594, and0.7466, respectively.

These are the three positions opened by the trader.

| Initial account equity | 1,500 USD | ||

| Stop out level | 30% | ||

| Position 1 | Position 2 | Position 3 | |

| Symbol | EURUSD | GBPJPY | CADCHF |

| Open volume | 100,000 units | 150,000 units | 150,000 units |

| Leverage | 1:500 | 1:300 | 1:200 |

| Used margin | 201.7 | 579.8 | 559.95 |

| Total used margin | 201.7 + 579.8 + 559.95 = 1,341.45 | ||

| Equity required to avoid a Stop Out | (1,341.45 * 0.3) = 402.44 USD | ||

| Account margin level | (1,500 / 1,341.45) * 100% = 111.82% | ||

There is some market movement, and the three positions generate the following unrealized P&L.

| Net Unrealized P&L | |

|---|---|

| Position 1 | -200 USD |

| Position 2 | +200.17 USD |

| Position 3 | -1117.04 USD |

At this point, the following events occur.

| Account equity | 1,500 - 200 (Position 1) + 200.17 (Position 2) - 1117.04 (Position 3) = 383.13 USD |

| Account margin level | (383.13 / 1,341.45) * 100% = 28% < 30% (Stop Out level). Fair Stop Out triggered. |

| Fair Stop Out | Position 2 is closed wholly as it has the largest used margin (579.8). |

Our hypothetical trader ends up facing the following conditions.

| Account equity | 383.13 USD | ||

| Position 1 | Position 3 | ||

| Symbol | EURUSD | CADCHF | |

| Open volume | 100,000 units | 150,000 units | |

| Leverage | 1:500 | 1:200 | |

| Used margin | 201.7 | 559.95 | |

| Unrealized P&L | -200 USD | -1117.04 USD | |

| Total used margin | 201.7 + 559.95 = 761.65 | ||

| Account margin level | (383.13 / 761.76) * 100% = 50% | ||

| Equity required to avoid a Stop Out | 761.65 * 0.3 = 228.50 USD | ||

| The next Fair Stop Out will partially close Position 3 as it now has the largest used margin. | |||

Smart Stop Out¶

Similarly to Fair Stop Outs, Smart Stop Outs are triggered when your account Margin Level goes lower than the Stop Out level specified by your broker. Smart Stop Outs close positions that use the largest amount of margin rather than positions generating the lowest unrealized P&L.

However, in contrast to Fair Stop Outs, Smart Stop Outs do not close positions wholly. Instead, the chosen position is only closed partially to free exactly the amount of margin that would place the account Margin Level above the Stop Out level. The smallest possible part of the selected position is closed rounded up to the minimum volume step of the symbol for which this position is opened.

For an illustration of how Smart Stop Outs work, we will return to our previous example in which a trader wanted to open three different positions. The starting conditions are the same as they were in the Fair Stop Outs example.

- The trader's account deposit currency is USD.

- The trader's initial account equity is 1,500 USD.

- The Stop Out level of the account is 30%.

- At the start of trading, the EUR-to-USD, GBP-to-USD, and CAD-to-USD exchange rates are equal to

1.0085,1.1594, and0.7466, respectively.

The below table details the three positions opened by the trader.

| Initial account equity | 1,500 USD | ||

| Stop out level | 30% | ||

| Position 1 | Position 2 | Position 3 | |

| Symbol | EURUSD | GBPJPY | CADCHF |

| Open volume | 100,000 units | 150,000 units | 150,000 units |

| Leverage | 1:500 | 1:300 | 1:200 |

| Used margin | 201.7 | 579.8 | 559.95 |

| Total used margin | 201.7 + 579.8 + 559.95 = 1,341.45 | ||

| Equity required to avoid a Stop Out | (1,341.45 * 0.3) = 402.44 USD | ||

| Account margin level | (1,500 / 1,341.45) * 100% = 111.82% | ||

The market moves so that net unrealized P&Ls for positions 1-3 are as follows. Note that these are the same P&Ls as in the Fair Stop Outs example.

| Net Unrealized P&L | |

|---|---|

| Position 1 | -200 USD |

| Position 2 | +200.17 USD |

| Position 3 | -1117.04 USD |

At this point, the following conditions take effect.

| Account equity | 1,500 - 200 (Position 1) + 200.17 (Position 2) - 1117.04 (Position 3) = 383.13 USD |

| Account margin level | (383.13 / 1,341.45) * 100% = 28% < 30% (Stop Out level). Smart Stop Out triggered. |

| Smart Stop Out | Position 2 is closed partially as it has the largest used margin (579.8). |

This is the final state of the trader's account and the three positions.

| Account equity | 383.13 USD | ||

| Position 1 | Position 2 | Position 3 | |

| Symbol | EURUSD | GBPJPY | CADCHF |

| Open volume | 100,000 units | 122,000 units | 150,000 units |

| Leverage | 1:500 | 1:300 | 1:200 |

| Used margin | 201.7 | 471.57 | 559.95 |

| Unrealized P&L | -200 USD | + 169.59 USD | -1117.04 USD |

| Total used margin | 201.7 + 471.57 + 559.95 = 1,233.22 | ||

| Account margin level | (383.13 / 1,233.22) * 100% = 31% | ||

| Equity required to avoid a Stop Out | (1,233.22 * 0.3) = 369.97 USD | ||

| The next Smart Stop Out will partially close Position 3 as it now has the largest used margin. | |||

Price and Spread¶

There are a huge number of variables contributing to the Price and the Spread. When trading in true market conditions the spread can become wider, or it can even become negative.

Factors that do influence it are your brokers' Liquidity Provider(s), your brokers' settings, the time of day (trading session), news announcements and market sentiment to name a few.

All of these things affect the prices that you are seeing.

Note

cTrader is a non-dealing desk platform. Your broker cannot manipulate pricing, charts, and history.

Slippage¶

cTrader fills orders using VWAP (Volume Weighted Average Price), this means that depending on the volume of your order, it will not necessarily be filled using the top of book price that you see on the charts.

Slippage is entirely possible when using Market Orders and is a genuine condition of trading in a true STP environment.

Generally, it is unavoidable and not something your broker can control, it is simply down to market conditions such as volatility when prices are rising or falling quickly.

If you want to avoid slippage you can use Market Range Orders or Limit Orders.

Symbols¶

cTrader is a Multi-Asset-Class CFD trading platform that supports a huge variety of markets, falling under a number of different asset classes, including Stocks, Indices, Commodities, Forex, Exchange Traded Funds and more.

If you want to trade symbols your broker isn’t offering, you should contact them directly and request via them. Adding new symbols is a decision that is made by your broker.

Swaps¶

Swap rates are applied by your broker. When you hold a position overnight your broker also incurs fees from their liquidity provider, the fees you are charged reflect the fees your broker is charged.

We recommend you contact your broker for more information about their Swap rates.

Liquidity¶

Brokers can have different configurations of counterparties and this acts as a variable between brokers, this affects many of the trading conditions listed above and others not mentioned such as market depth.

Some brokers may have two or three liquidity providers connected to their cServer, some may have twenty plus, it all depends on their model. You broker will have more information about this on their website.

Latency¶

While cTrader does have the capacity for processing orders within milliseconds, however, this doesn’t guarantee your orders will be filled within that time period.

Your brokers' Liquidity Provider can affect latency, mostly if the counterparty that is filling your order is located in New York, while your broker's cServer is located in London and you are located in Auckland for example.

Different brokers also have different configurations of proxies from Spotware’s global proxy cloud. Your broker can add as many as they wish from a selection of dozens of key locations throughout the world.

While the proxies provided by your broker help to improve latency and connection, the key factors affecting latency are your location and your internet speed.

Leverage¶

cTrader supports leverage of up to 1:1000 for all symbols and accounts. The amount of maximum leverage that your broker provides you is decided by them.

Your broker will likely give you a variety of options, allowing you to use a lower rate of leverage if you want.

Different markets are typically offered with different rates of maximum leverage.

We recommend that you check the info window of each market to know exactly what the maximum amount of leverage is offered with that market.

Do not just assume every market is offered at the same rate as your account.

Trading Sessions¶

Trading sessions can vary between brokers. This could be due to where they are located, any local public holidays or their Liquidity Providers trading hours.

Differences could be when they start or finish their trading week or trading day and gaps between sessions.

If you want to see the trading hours of a symbol, you can open the info-window to see when trading is available for each symbol.

Credit¶

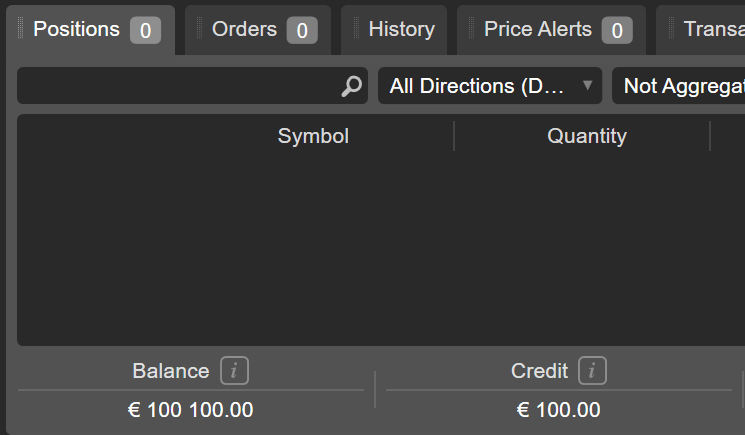

Credit is an amount of money that traders can use for trading even without having own funds in cTrader. Similarly to a real deposit, credit can be lost as a result of unsuccessful trading. In case your account has both balance and credit, the balance is lost first, and then the credit.

The displayed balance also includes the credit. If credit is equal to zero, it will not be displayed on the cTrader UI. Credit is deposited and withdrawn by your broker, and you receive a notification email each time. As a user, you cannot withdraw the credit, but you can withdraw all your profits earned on credit.

Example

If your own deposited funds equaled 40 USD, the balance will mount to 140 USD after the credit of 100 USD is added. As long as you do not have any unrealized net P&L, the equity will be indicated as 140 USD. And the free margin will constitute 140 USD on the condition that no margin was used.

The UI of cTrader Windows displays ‘Credit’ at the bottom of the TradeWatch panel to the right of your balance statement.