Dynamic Leverage

This section explains how the Dynamic Leverage works as well as how the Margin Used is calculated in cTrader.

The Margin Used by open positions is related to the leverage given for each position opening. Dynamic Leverage can be set to work in two very different ways.

One method recalculates the margin requirements upon each event, the other calculates the margin requirements upon opening the position and is constant throughout the lifetime of the position.

This concept is explained in this section, everything on this page is important and it is urged all traders understand this.

Leverage is the ability to use borrowed money from the broker for investment. Using leverage, you can deposit your own money and use it as a collateral to borrow much larger sums from the broker for trading.

The leverage ratio is a ratio of the deposited to borrowed funds.

The Margin is the certain amount of your own money set aside and allocated as collateral, a “good faith” deposit, required to open a position with your broker.

The size of the margin depends on the leverage applied.

Exposure is the amount of the asset at risk. The exposure is calculated per symbol and depends on the direction of trading.

The positions of the same symbol in the same direction increase the exposure, while positions of the opposite direction decrease it.

Leverage Types¶

Account Leverage¶

Each trading account has certain leverage defined at the time of creation. However, when entering a trade, the actual leverage may differ because the different symbols can have different leverages.

For example, while the most of the time you can get 1:500 leverage for major currency pairs, the brokers offer much lower leverage for highly volatile pairs, stocks, natural resources, precious metals, and cryptocurrencies (1:10 - 1:50).

In such cases, account leverage is treated as an upper limit.

If the symbol’s leverage is smaller than account leverage, then the symbol’s leverage will be applied, if the symbol’s leverage is bigger – the account leverage prevails.

Different volumes of the same symbol can have different leverages depending on the volume.

Dynamic Leverage (Volume-Based Leverage)¶

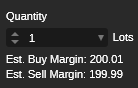

This is the symbol leverage that changes depending on the exposure. The higher the exposure is – the lower leverage your broker provides.

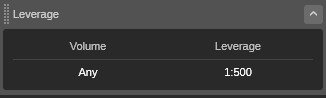

To check the dynamic leverage of a symbol, select the desired symbol in the Active Symbol Panel, and scroll down to the Leverage section.

Note that leverage volume is always noted in USD regardless of the symbol.

How the Margin is Calculated¶

The margin is calculated depending on the symbol’s leverage and exposure.

You can see a margin required for both directions before entering a trade in the New Order section of the Active Symbol.

The margin required is always displayed in the currency of your account and is calculated according to the current Ask and Bid prices on the market depending on the specified number of lots.

Note

The margin for cross pairs (symbols that do not include USD) is converted to USD before being converted to the currency of your account if the required symbol is not available with your broker.

Even though cTrader calculates the margin automatically, it is important to know how it’s done.

Example

For example, we want to open a position for 1,000,000 EURUSD with the dynamic leverage as in the Dynamic leverage figure above. As we already know, the leverage is always stated in the USD. EURUSD is currently traded at 1.21345.

- 1 million EUR is 1,213,450 USD. It falls within two dynamic leverage tiers.

- 1:500 leverage applies to 1,000,000 USD and 1:200 leverage applies only to 213,450 USD.

- 1,000,000 / 500 = 2,000 USD.

- 213,450 / 200 = 1,067.25 USD

- 2,000 + 1,067.25 = 3,067.25 USD

- Total Margin Required: 3,067.25 USD.

The total margin used to secure all open positions of the trading account (as well as other important financial details) is available on the TradeWatch panel.

Position Margin Recalculation¶

Reducing, increasing, closing, or reversing the positions change the exposure and may affect the margin.

Depending on your broker, your margin may or may not be automatically recalculated. Contact your broker to find out which method is used.

If you want to learn more about how the margin is recalculated, we will describe four cases to show what happens if your broker:

- Allows for the automatic margin recalculation;

- Does not allow for the automatic margin recalculation;

- Changes the dynamic leverage with the margin recalculation enabled;

- Changes the dynamic leverage with the margin recalculation disabled.

Case #1: Trading when Margin is Automatically Recalculated¶

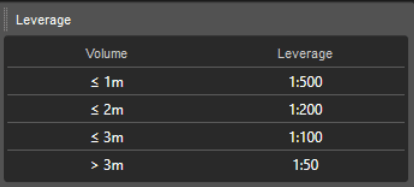

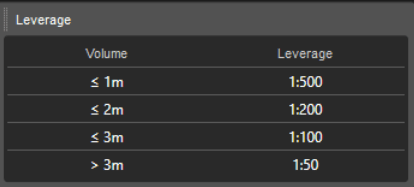

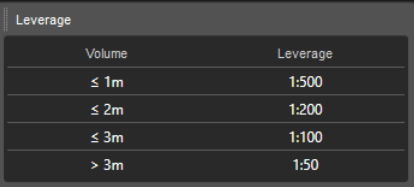

Account Leverage: 500 Account Currency: USD Dynamic Leverage:

Note

We have selected a symbol with USD as a base currency to avoid conversion when calculating the dynamic leverage tiers, which are always stated in USD.

Open positions:

1 2 3 4 | |

Step 1: Trader closes Position #2 by 500,000. This results in:

1 2 3 4 5 6 | |

Case #2: Trading when Margin is Not Recalculated¶

Account Leverage: 500 Account Currency: USD Dynamic Leverage:

Open positions:

1 2 3 4 | |

Step 1: Trader entirely closes Position #2. This results in:

1 | |

Step 2: Open one more position for 1,000,000 USDJPY (Position #4). This results in:

1 | |

Now we have three positions.

Even though the exposure is the same as before (3 million), the margin is significantly higher because the margin of Position #3 has not recalculated.

1 | |

Step 3: Partially close Position #4 and Position #1 by 500,000 each. This results in:

1 2 3 4 5 6 7 8 | |

Case #3: Broker changes Dynamic Leverage, Margin is Recalculated¶

Account Leverage: 500 Account Currency: USD Dynamic Leverage:

Open positions:

1 2 3 4 | |

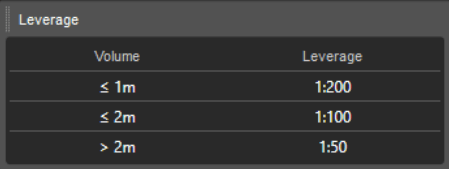

Step 1: Broker changes dynamic leverage for the symbol:

1 2 3 4 | |

Note

The broker will notify you about any upcoming changes in the leverage. You should carefully read and check whether these changes will affect you.

If the margin drops below the Stop Out level, your open positions might be entirely or partially closed to restore the required margin.

Case #4: Broker changes Dynamic Leverage, Margin is not Recalculated¶

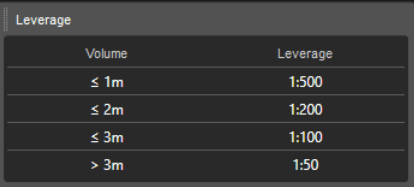

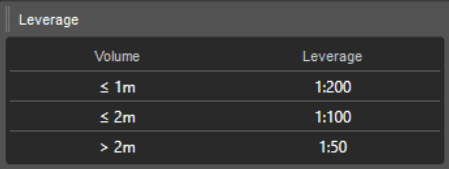

Account Leverage: 500 Account Currency: USD Dynamic Leverage:

Open positions:

1 2 3 4 | |

Step 1: Broker changes dynamic leverage for the symbol:

Step 2: Close Position #2:

1 | |

Step 3: Open Position #4 1,000,000 BUY USDJPY. This results in:

1 2 3 | |