Orders

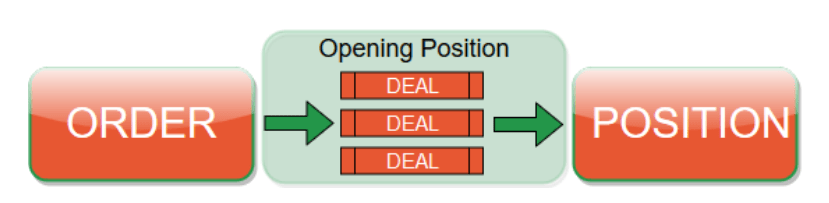

An Order is an investor’s request to a broker to buy or sell a security. When you create an Order in cTrader, you are sending instructions to your broker to execute a trade.

An Order gives instructions on what symbol to trade and under what conditions. Orders are executed by Deals.

While we refer to Orders, Deals, and Positions as different entities, you can think about them as representations of a single trade, but at different stages of its life cycle.

Please find the detailed information on the Positions and Deals in the respective section above.

Every market, whether it is the stock, forex, futures, or options market, has two prices - the Bid price and the Ask price.

The terms Bid and Ask refer to a two-way price quotation that indicates the best price at which a security can be sold and bought at a given point in time.

The Bid price represents the highest price that an investor is willing to pay for a security. The Ask price is the lowest price that a seller is willing to receive.

The difference between the Bid and Ask prices, or the spread, is a key indicator of the liquidity of an asset.

The liquidity describes the degree to which an asset or security can be quickly bought or sold in the market without affecting the asset's price.

In general, the smaller the spread, the better the liquidity. A trade occurs after a buyer and a seller agree on a price for the security.

Types of Orders¶

There are four types of orders to buy or sell the assets in cTrader: Market Order, Limit Order, Stop Order, and Stop Limit Order.

Note

Only Market Orders are filled immediately. All other types are Pending Orders and are filled only when certain conditions are met.

Market Order¶

A Market Order is the basic type of orders and the fastest way to open a real position at the moment.

A Market Order is a request to buy or sell a security at the best available price in the current market and it guarantees your entry into the market.

Market Orders are submitted immediately, but their execution price is affected by the asset liquidity and network latency.

Therefore, you may experience partial execution and/or [price slippage] from the requested price.

The slippage, in this case, refers to the difference between the expected price of a trade and the price at which the trade is executed.

Limit Order¶

A Limit Order guarantees to fill the order with a price equal to or better than the expected one.

For the Limit Orders, the price you set is the maximum or minimum price at which you are willing to buy or sell.

Your order will be filled either at the exact price you set, or a more favorable price for the direction of your order.

Use the Limit Orders to buy specified assets when the price is falling (and you expect the price to rise), or sell assets when the price is rising (and you expect the price to fall).

Orders of this type are not guaranteed to be filled, as there may not be enough buyers or sellers at that price.

On the other hand, you can be sure that you will get either the exact price you set or a more favourable one.

Example

Let’s suppose that EURUSD now trades at 1.2510 and experiences some market support.

We expect the price to rise and want to enter a long position (Buy), however, the current price slippage can make it unprofitable to open this position using a Market Order, so we create a Limit Order at 1.2505.

The Limit Order will ensure that we will pay no more than 1.2505 (5 pips lower than it is traded now).

If this condition is not met when the order is executed, we will not enter the market as the order will not fill.

Stop Order¶

A Stop Order (or Trigger Order) is the same as the Market Order, but it is filled only when the requested price is met.

With the Stop Order, once the symbol price reaches the entry price you set, a Market Order will be automatically sent and the order will be filled at the best available price.

That means that your order will sometimes be filled outside of the exact price you set, as the market may move in between the time it takes for your order to be sent and your order to be filled.

The Stop Orders are often used to confirm the direction that the market is moving, after breaking support or resistance, and following the trend.

Example

We plan on going short with EURUSD (Sell), which is currently traded at 1.2520.

We anticipate that the price, having dropped to this level, will continue falling, after it breaks through support, so we want to open a position as soon as this fall continues.

We create a Stop Order with a 1.2500 stop price to make sure that we will enter the market when EURUSD falls at least to this value.

Since a Stop Order is essentially a trigger for a Market Order, we might get a slightly unfavourable price, but this may be less important than actually entering the market.

Stop Limit Order¶

A Stop Limit Order is a combination of the Stop and Limit Orders. A Stop Limit Order is executed at a specified price (or better) after a certain stop (trigger) price is reached.

When using a Stop Limit Order you can set not only the market price that will trigger the order but avoid filling the order with an unfavourable price.

Stop Limit Orders provide the benefits of both stop and limit orders, however, depending on the market, there may be fewer chances of filling.

The Stop Limit Order offers to the investor much greater precision in executing the trade.

While a Stop Order can lead to trades being filled at less desired prices, combining it with the features of a Limit Order, the order is cancelled once the price falls outside of the desired range, based on the traders Limit Range.

Example

As in the previous example, we want to short EURUSD (currently traded at 1.2502).

We anticipate that the market will fall and plan to open a short (Sell) position as soon as the market price drops to 1.2500, but this time we do not want to sell too cheaply.

Our goal is to fill this order only at 1.2498 or higher, so we create a Stop Limit order with 1.2500 Stop Price and Limit Range of 2 pips (1.2500 - 2 pips = 1.2498).

Considering the above-mentioned four types of orders supported by cTrader, depending on the position direction, we should distinguish:

Buy Limit Order - an order to open a Buy position at a lower price than the price at the moment of placing the order.

Orders of this type are usually placed in anticipation that the security price, having fallen to a certain level, will increase.

Buy Stop - an order to open a Buy position at a higher price than the price at the moment of placing the order.

Orders of this type are usually placed in anticipation that the security price, having reached a certain level, will keep on increasing.

Buy Stop Limit - an order to open a Buy position at a higher price than the price at the moment of placing the order.

Orders of this type are usually placed in anticipation that the security price, having reached a certain level, will keep on increasing.

The Buy Stop Limit orders are much more precise than the Buy Stop orders since they allow setting a limit range of the acceptable price for a trader.

Sell Limit - an order to open a Sell position at a higher price than the price at the moment of placing the order.

Orders of this type are usually placed in anticipation that the security price, having increased to a certain level, will fall.

Sell Stop - an order to open a Sell position at a lower price than the price at the moment of placing the order.

Orders of this type are usually placed in anticipation that the security price, having reached a certain level, will keep on falling.

Sell Stop Limit - an order to open a Sell position at a lower price than the price at the moment of placing the order.

Orders of this type are usually placed in anticipation that the security price, having reached a certain level, will keep on falling.

The Sell Stop Limit orders are much more precise than the Sell Stop orders since they allow setting a limit range of the acceptable price for a trader.

Note that when creating a pending order, the allowed size of the order is not associated with the available margin.

In case a pending order is triggered, and there is not enough margin to be executed, then the order is cancelled.

Creating Orders¶

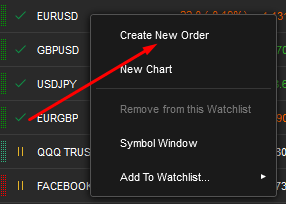

There are several ways to create orders in the cTrader:

- By clicking the New Order button (

) in the QuickLinks tab to the top of the screen, or in the TradeWatch panel (make sure that either Positions or Orders tab is selected). The New Order menu will pop-up.

) in the QuickLinks tab to the top of the screen, or in the TradeWatch panel (make sure that either Positions or Orders tab is selected). The New Order menu will pop-up. - By right-clicking on the corresponding symbol in the Symbols List to the left, or on its chart, and selecting Create New Order from the submenu. The New Order menu will pop-up.

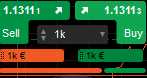

3. By using Buy or Sell QuickTrade buttons to the top of the chart of the desired symbol.

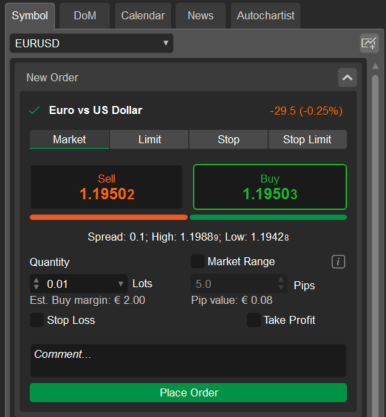

4. By using the New Order form in the Order tab of the Active Symbol Panel (ASP) to the right.

5. By pressing F9 on the keyboard.

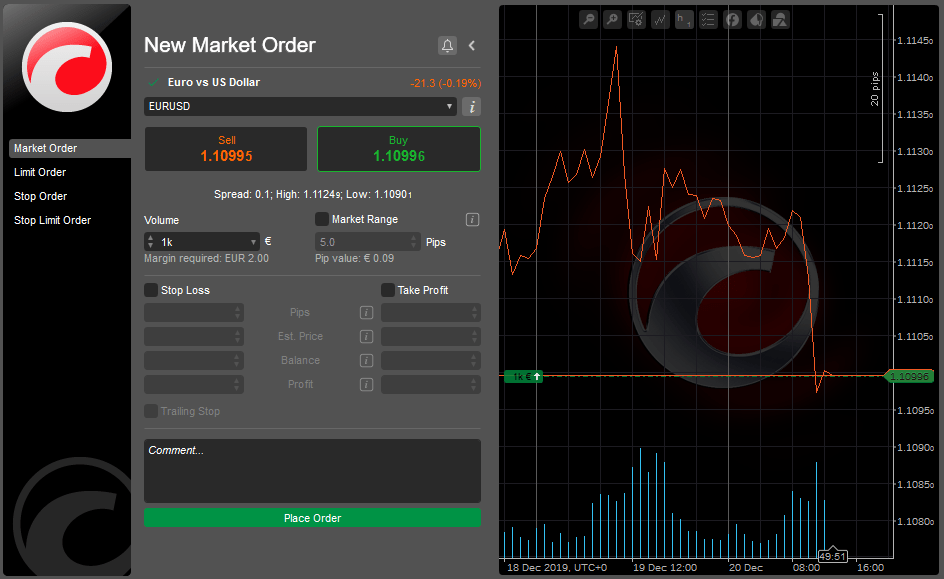

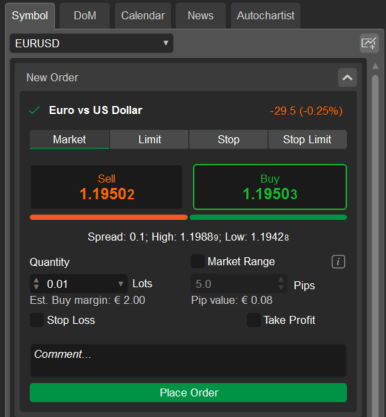

Creating a Market Order¶

- In the New Order menu select a Symbol to trade.

- Select a trading direction by clicking either the Sell or Buy buttons.

- Specify Volume - the number of lots to be traded using the drop-down, the toggles, or typing in the number.

- Change the Market Range to expand or narrow down the price range to which your order will be filled.

Note

Uncheсking the Market Range checkbox, or setting a zero (0) value will essentially create a Limit Order.

5. Check the corresponding boxes to set and configure the Stop Loss and Take Profit options (they will apply to the corresponding Position once the order is filled).

6. Optionally, type in your comment into the Comment box.

7. Click the Place Order button to create a Market Order.

Click the Price Alert button ( ) to set a Price Alert.

) to set a Price Alert.

Use the Collapse/Expand button ( ) to collapse/expand the Chart to the right.

) to collapse/expand the Chart to the right.

Click the Symbol info icon ( ) to open the complete Symbol details.

) to open the complete Symbol details.

Alternatively, select the desired symbol in the New Order menu of the Active Symbol Panel, select a trading direction, specify volume to be traded, optionally enable the Market Range and Stop Loss And Take Profit protections, and click Place Order.

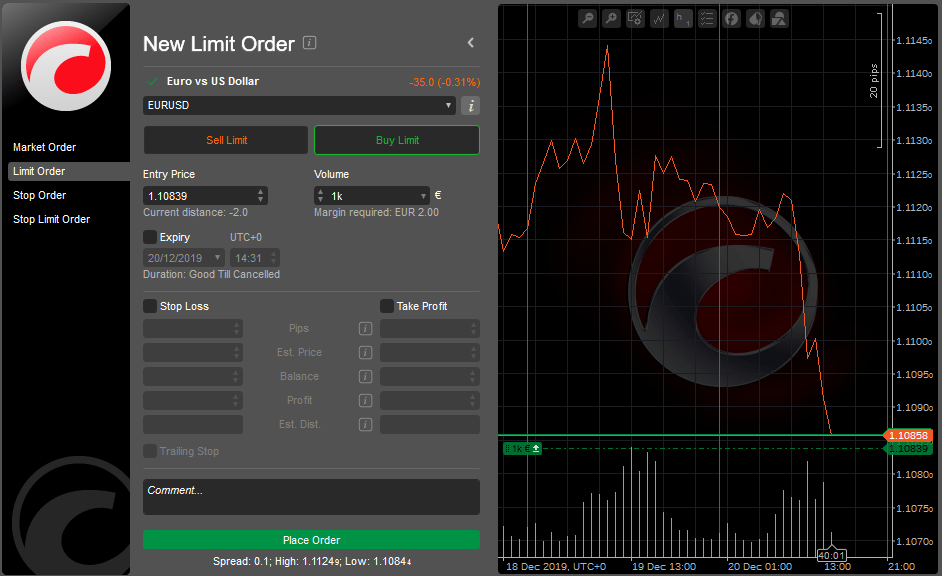

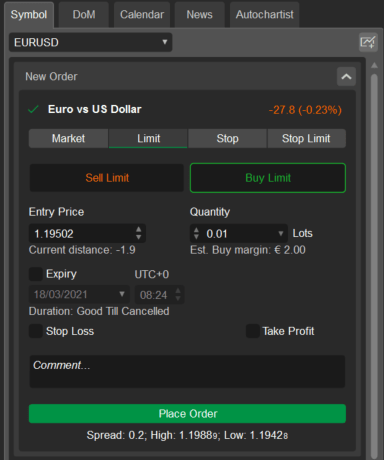

Creating a Limit Order¶

To create a Limit Order in the New Order menu select Limit Order to the left.

- Select a Symbol to trade.

- Select a trading direction by clicking either the Sell Limit or Buy Limit buttons.

- Specify Volume - the number of lots to be traded using the drop-down, the toggles, or typing in the number.

- Set the Entry Price at which you wish to fill your order. This price cannot be higher than the current Ask price on the market if going long (Buy), or lower than the current Bid price if going short (Sell). Buy Limit Orders can be executed only at the limit price or lower. Sell Limit Orders are executed at the limit price or higher.

- Check the Expiry box to set the time and date when this pending order will automatically expire if not filled. Otherwise, the order remains active until cancelled manually.

- Check the corresponding boxes to set and configure the Stop Loss and Take Profit options.

- Click the Place Order button to create a limit order.

Click the Price Alert button ( ) to set a Price Alert.

) to set a Price Alert.

Use the Collapse/Expand button ( ) to collapse/expand the Chart to the right.

) to collapse/expand the Chart to the right.

Click the Symbol info icon ( ) to open the complete Symbol details.

) to open the complete Symbol details.

Alternatively, select the desired symbol in the New Order menu of the Active Symbol Panel, select the Limit tab, select a trading direction, specify the Entry Price and the Quantity (volume) to be traded, optionally enable the Expiry time and date, and the Stop Loss And Take Profit protections, and click Place Order.

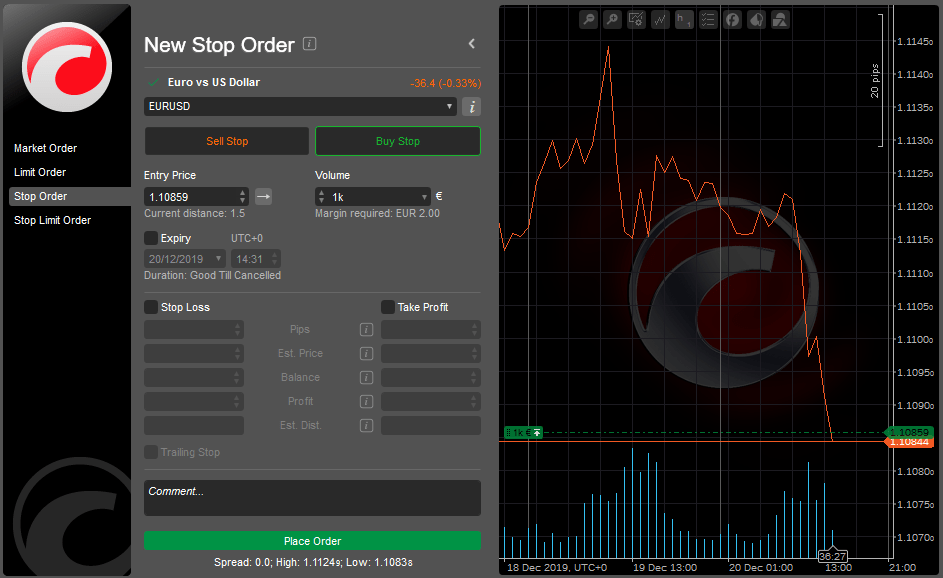

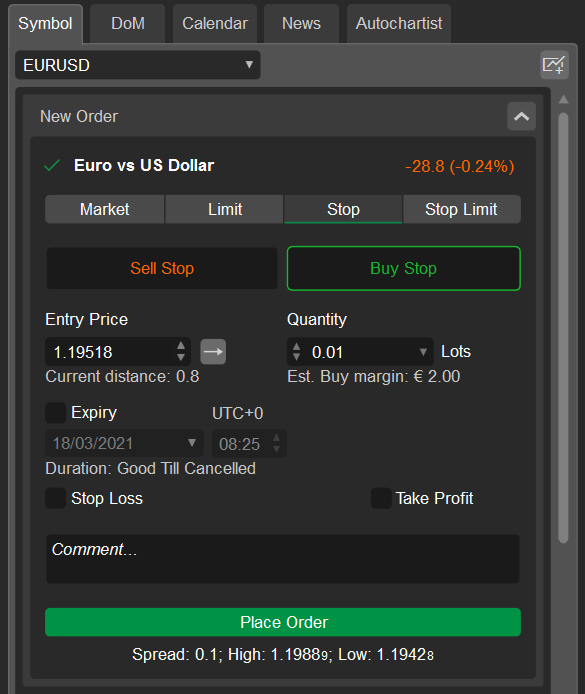

Creating a Stop Order¶

To create a Stop Order in the New Order menu select Stop Order to the left.

- Select a Symbol to trade.

- Select a trading direction by clicking either the Sell Stop or Buy Stop buttons.

- Set the Entry price that will trigger an order. The price cannot be lower than the current Ask price if you are going long (Buy), or higher than the current Bid price if going short (Sell).

- Specify Volume - the number of lots to be traded using the drop-down, the toggles, or typing in the number.

- Click the right arrow (

) to select a way to trigger the order.

) to select a way to trigger the order.

The right arrow (  ) is the Trade side. Buy Orders are triggered by the Ask price and Sell Orders are triggered by the Bid price.

) is the Trade side. Buy Orders are triggered by the Ask price and Sell Orders are triggered by the Bid price.

The left arrow (  ) is the Opposite side. Buy Orders are triggered by the Bid price and Sell Orders are triggered by the Ask price.

) is the Opposite side. Buy Orders are triggered by the Bid price and Sell Orders are triggered by the Ask price.

The double right arrow (  ) is the Double Trade Side. Similar to the Trade Side trigger, but two consecutive ticks of the respective price are required.

) is the Double Trade Side. Similar to the Trade Side trigger, but two consecutive ticks of the respective price are required.

The double left side (  ) – is the Double Opposite side. Similar to the Opposite Side trigger, but two consecutive ticks of the respective price are required.

) – is the Double Opposite side. Similar to the Opposite Side trigger, but two consecutive ticks of the respective price are required.

6. Check the Expiry box to set the time and date when this pending order will automatically expire if not filled. Otherwise, the order remains active until cancelled manually.

7. Check the corresponding boxes to set and configure the Stop Loss and Take Profit options.

8. Click the Place Order button to create a stop order.

Click the Price Alert button ( ) to set a Price Alert.

) to set a Price Alert.

Use the Collapse/Expand button ( ) to collapse/expand the Chart to the right.

) to collapse/expand the Chart to the right.

Click the Symbol info icon ( ) to open the complete Symbol details.

) to open the complete Symbol details.

Alternatively, select the desired symbol in the New Order menu of the Active Symbol Panel, select the Stop tab, select a trading direction, specify the Entry Price and the Quantity (volume) to be traded, optionally enable the Expiry time and date, and the Stop Loss And Take Profit protections, and click Place Order.

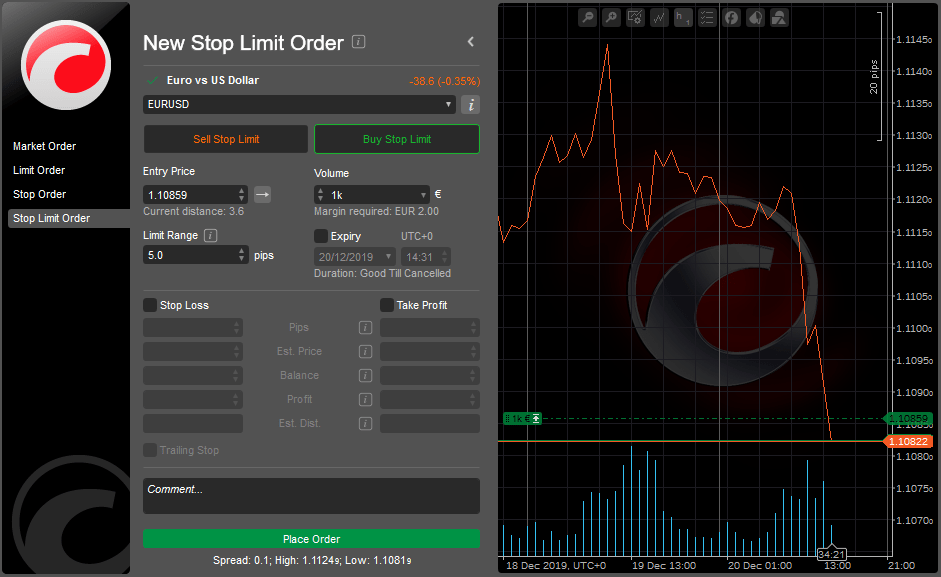

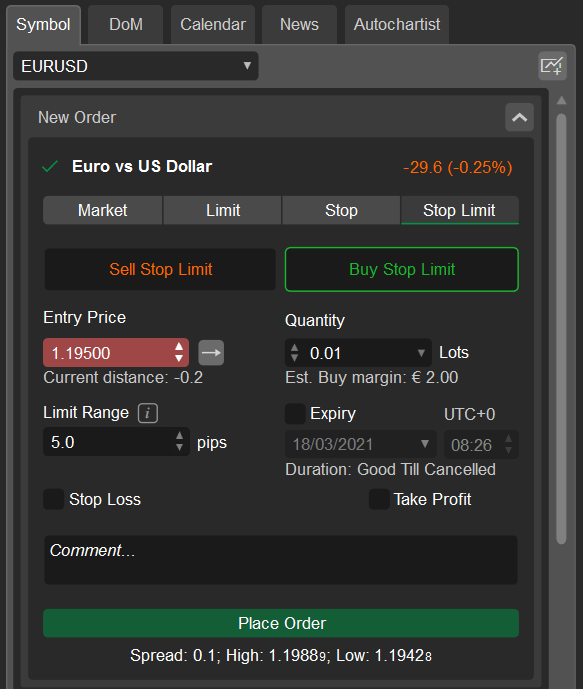

Creating a Stop Limit Order¶

To create a Stop Limit Order in the New Order menu select Stop Limit Order to the left.

- Select a Symbol to trade.

- Select a trading direction by clicking either the Sell Stop or Buy Stop buttons.

- Specify Volume - the number of lots to be traded using the drop-down, the toggles, or typing in the number.

- Set the Entry Price that will trigger the limit order.

The right arrow (  ) is the Trade side. Buy Orders are triggered by the Ask price and Sell Orders are triggered by the Bid price.

) is the Trade side. Buy Orders are triggered by the Ask price and Sell Orders are triggered by the Bid price.

The left arrow (  ) is the Opposite side. Buy Orders are triggered by the Bid price and Sell Orders are triggered by the Ask price.

) is the Opposite side. Buy Orders are triggered by the Bid price and Sell Orders are triggered by the Ask price.

The double right arrow (  ) is the Double Trade Side. Similar to the Trade Side trigger, but two consecutive ticks of the respective price are required.

) is the Double Trade Side. Similar to the Trade Side trigger, but two consecutive ticks of the respective price are required.

The double left side (  ) – is the Double Opposite side. Similar to the Opposite Side trigger, but two consecutive ticks of the respective price are required.

) – is the Double Opposite side. Similar to the Opposite Side trigger, but two consecutive ticks of the respective price are required.

5. Set Limit Range (in pips) relative to the Entry Price. This means that stop limit order will be triggered only if the market reaches the Stop Price and will be filled only with the price determined by the Limit Range value (or a more preferable one).

Click the Price Alert button ( ) to set a Price Alert.

) to set a Price Alert.

Use the Collapse/Expand button ( ) to collapse/expand the Chart to the right.

) to collapse/expand the Chart to the right.

Click the Symbol info icon ( ) to open the complete Symbol details.

) to open the complete Symbol details.

Alternatively, select the desired symbol in the New Order menu of the Active Symbol Panel, select the Stop Limit tab, select a trading direction, specify the Entry Price and the Quantity (volume) to be traded,set Limit Range, optionally enable the Expiry time and date, and the Stop Loss and Take Profit protections, and click Place Order.

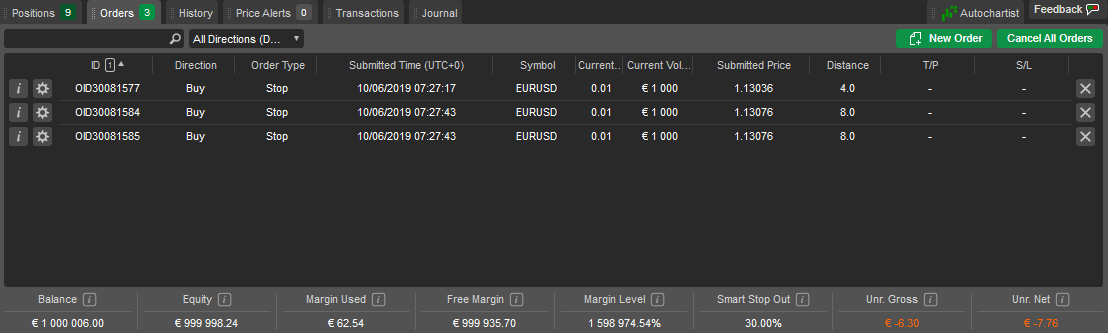

Managing Pending Orders¶

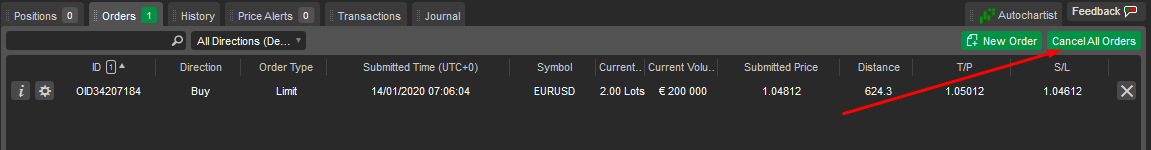

All the pending orders are listed in the Orders tab at the TradeWatch panel. Here you can manage, modify, and cancel the pending orders.

To filter the orders by their direction, type, symbol, or trading volume, type in the value, or its part, in the search box above the list of orders.

To filter the orders by their direction (Buy or Sell), click the Directions drop-down and select the desired direction.

Click the Order Info button (  ) next to the desired order to open the Order Info page. Click the Cancel Order button (

) next to the desired order to open the Order Info page. Click the Cancel Order button (  ) next to an order to cancel it.

) next to an order to cancel it.

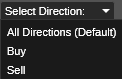

Right-click on an order in the list to expand the additional order menu. Here you can:

- Cancel Order - to cancel the order.

- Modify Order - to open the Modify Order menu.

- Open Chart - to open the current order symbol chart.

- Create New Order - to open the create new order menu.

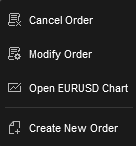

Modifying Pending Orders¶

To make changes to an existing pending order, click the Modify Order button (  ) next to the desired Order in the Orders tab of the TradeWatch panel.

) next to the desired Order in the Orders tab of the TradeWatch panel.

In the Modify Pending Order menu the following options are available:

- Entry Price - modify the Entry Price at which you wish to fill your order using the toggles, or just typing in the number. This price cannot be higher than the current Ask price on the market if going long (Buy), or lower than the current Bid price if going short (Sell). Quantity - modify the volume to be traded using the drop-down, the toggles, or just typing in the number.

- Expiry - set or modify the date and time when the order will automatically expire.

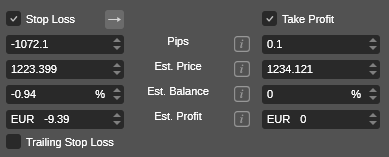

- Stop Loss - set or modify the Stop Loss protection.

- Take Profit - set or modify the Take Profit protection.

- Trailing Stop Loss - check to enable the Trailing Stop Loss. The Trailing Stop is a Stop Loss that automatically updates every time the price of the position moves in your favor. This is a handy tool if you initially have underappreciated the market. Trailing Stop Loss never readjusts if the market moves against you.

When done, click Modify Protection to save changes.

Note

You can not change the type of the existing order.

Canceling Pending Orders¶

To cancel a pending order, in the Orders tab of the TradeWatch, click the Cancel Order button (  ) next to the desired order, or right-click on an order and select Cancel Order from the drop-down.

) next to the desired order, or right-click on an order and select Cancel Order from the drop-down.

Alternatively, click Cancel Order in the Modify Pending Order menu.

To cancel all the pending orders at a time, click Cancel All to the upper right of the Orders tab in the TradeWatch.

Order Information¶

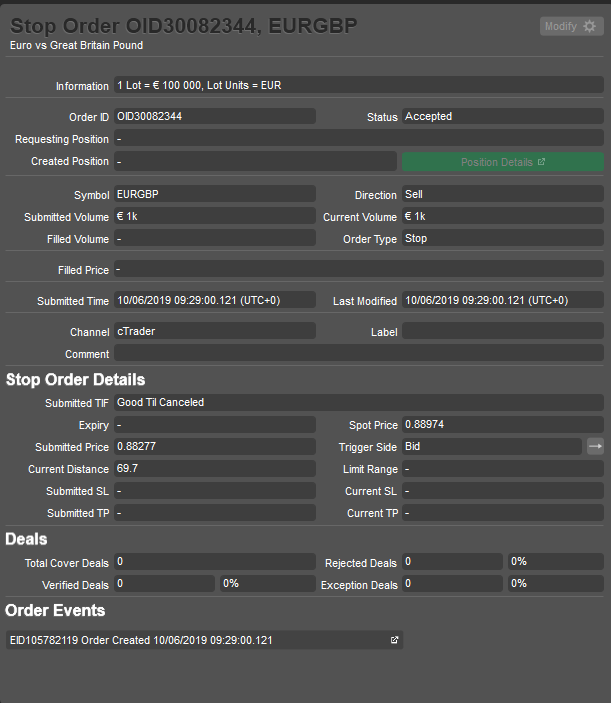

Click the Order Info button (  ) next to the desired order in the Orders tab of the TradeWatch to view the detailed Order information. The following information is available:

) next to the desired order in the Orders tab of the TradeWatch to view the detailed Order information. The following information is available:

- Information – the trading asset lot value and lot units.

- Order ID – the unique order identifier.

- Status – the current status of the order.

- Requesting Position – the position that has been requested for this order.

- Created Position – the position created by this order.

- Positions details – click to open Position Info panel (if the order resulted in a position).

- Symbol – the financial instrument of this order.

- Direction – the direction of the order (Buy or Sell).

- Submitted Volume – the initial volume requested.

- Current Volume – the current volume requested (volume left to fill).

- Filled Volume – the amount of the volume filled.

- Order Type – the type of the order.

- Filled Price – volume-weighted average price (VWAP) of the deals used to fill this order.

- Submitted Time – the exact date and time when the order was filled.

- Last Modified – the exact date and time of the latest changes made to the order.

- Channel - the platform used to open the current order.

- Label – the tag that may be added by the cBot (cTrader Algo).

- Comment – the custom user comment that may be sent with the order.

- Submitted TIF – submitted Time In Force.

- Expiry – the exact date and time when any unfilled volume of the order will be canceled.

- Spot Price – the current price of the traded symbol on the market.

- Submitted Price – the initial price set for the order.

- Trigger Side – the current order trigger side (Bid or Ask price).

- Current Distance – the difference between the spot price and submitted price.

- Limit Range - the specific price range at which the limit order will be executed.

- Submitted SL – the initial Stop Loss value set with the order.

- Current SL – the current Stop Loss value.

- Submitted TP – the initial Take Profit value set with the order.

- Current TP – the current Take Profit value.

- Total Cover Deals – the total number of deals attempted to fill the order.

- Rejected Deals – the total number of the rejected deals.

- Verified Deals – the total number of the accepted deals.

- Exception Deals – the total number of deals that have encountered an exception.

Note

Availability of the fields depends on the order’s type.

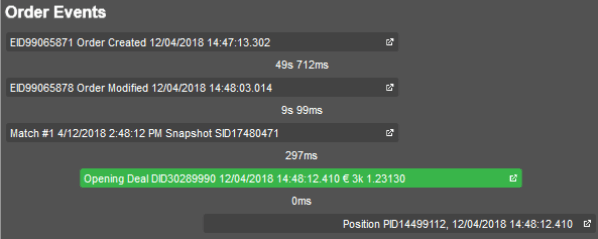

Order Events¶

Order Events section containing all the events of the order is displayed to the bottom of the Order Info section.

It shows all events experienced by the order in chronological sequence: creation and modification, match with liquidity providers, the executed deal, and created position.

Here you can see how much time has passed between these events.

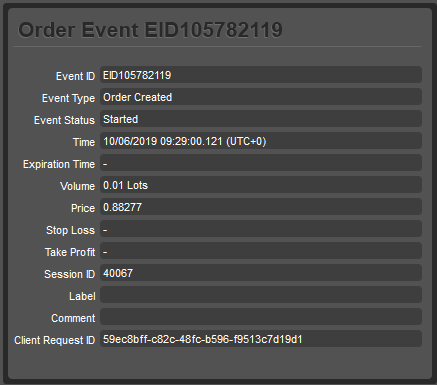

Click on an event to open the respective panel with all information about the order, deal, or position. The following details are presented in the grid:

- Event ID - the unique identifier of the event.

- Event Type - the type of the event (Order Created, Order Closed, etc.)

- Event Status - the current status of the event.

- Time - the exact date and time of the event.

- Expiration Time - the exact date time when the event is expired.

- Volume - the exact number of lots involved in the event.

- Price - the current price of the number of lots involved in the event.

- Stop Loss - the Stop Loss level.

- Take Profit - the Take Profit level.

- Session ID - the unique identifier of the session.

- Label - the tag that could be sent with the event.

- Comment - the custom user comment that could be added to the event.

- Client Request ID - the unique identifier of the client request.

Stop Loss and Take Profit¶

The Stop Loss is an option that automatically limits investor’s losses for an open position if the market moves unfavorably.

If a security falls to the specified level, the Stop Loss order is triggered and the position is closed for a loss.

The Take Profit is an option similar to Stop Loss, but it will close an open position when a predetermined level of gain is reached.

If a security rises to the specified level, the Take Profit triggers and the position is closed for a gain.

Stop Loss (SL) and Take Profit (TP) are often used together and are essentially the same thing but on the opposite sides of the order or position.

The benefit of using Stop Loss And Take Profit options is that a trader doesn't have to worry about manually executing a trade or second-guessing themselves.

On the other hand, Stop Loss and Take Profit orders are executed at the best possible price regardless of the security behavior.

cTrader provides relative and absolute protection options for stop loss and take profit:

- Relative protection - stop loss and take profit are set as values in pips relative to the opening price.

- Absolute protection - stop loss and take profit are set as values in price.

Set up Stop Loss and Take Profit¶

You can set up and modify the Stop Loss (SL) and Take Profit (TP) securities for the existing positions or pending orders in the Modify Order or Modify Position menu explained above, or when creating an order in the Create Order menu.

Check the ST and TP boxes to set them.

You can set the trigger value in pips, the symbol price, the balance percentage, the profit value, or the distance - all the values will be recalculated automatically relatively to the value you set.

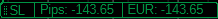

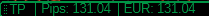

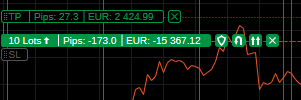

For the pending orders or positions, you can see the distance to the Stop Loss and Take Profit triggers in pips from the current price of the symbol.

It’s easy to switch the Stop Loss trigger from Ask to Bid price (and vice versa). Click the right arrow (  ) to change the current trigger:

) to change the current trigger:

The right arrow ( ) is the Trade side (default). The Stop Loss will trigger by the Ask price for the Sell orders and by the Bid price for the Buy orders.

) is the Trade side (default). The Stop Loss will trigger by the Ask price for the Sell orders and by the Bid price for the Buy orders.

The left arrow ( ) is the Opposite Side. Stop Loss will trigger by the Bid price for the Sell orders and by the Ask price for the Buy orders.

) is the Opposite Side. Stop Loss will trigger by the Bid price for the Sell orders and by the Ask price for the Buy orders.

The double right arrow ( ) is the Double Trade Side. The Stop Loss will trigger after two consecutive ticks of the Ask price above the SL level for the Sell orders, and by two consecutive ticks of the Bid price below the SL level for the Buy orders.

) is the Double Trade Side. The Stop Loss will trigger after two consecutive ticks of the Ask price above the SL level for the Sell orders, and by two consecutive ticks of the Bid price below the SL level for the Buy orders.

The double left arrow ( ) is the Double Opposite Side. The Stop Loss will be triggered by two consecutive ticks of the Bid price above the SL level for the Sell orders, and by two consecutive ticks of the Ask price below the SL level for the Buy orders.

) is the Double Opposite Side. The Stop Loss will be triggered by two consecutive ticks of the Bid price above the SL level for the Sell orders, and by two consecutive ticks of the Ask price below the SL level for the Buy orders.

Also, the Stop Loss and Take Profit can be activated directly in the chart within an open position.

Hover over an open position in the chart, then drag and drop the SL ( ) or TP (

) or TP ( ) items to set the respective SL and TP values.

) items to set the respective SL and TP values.

Stop Loss within the spread is not allowed. Check the Chart Trading section for more details.

Note

You can preview the Stop Loss and Take Profit values in pips and the account currency.

The Stop Loss and Take Profit are active and can trigger even when cTrader is closed or disconnected.