Risk-reward¶

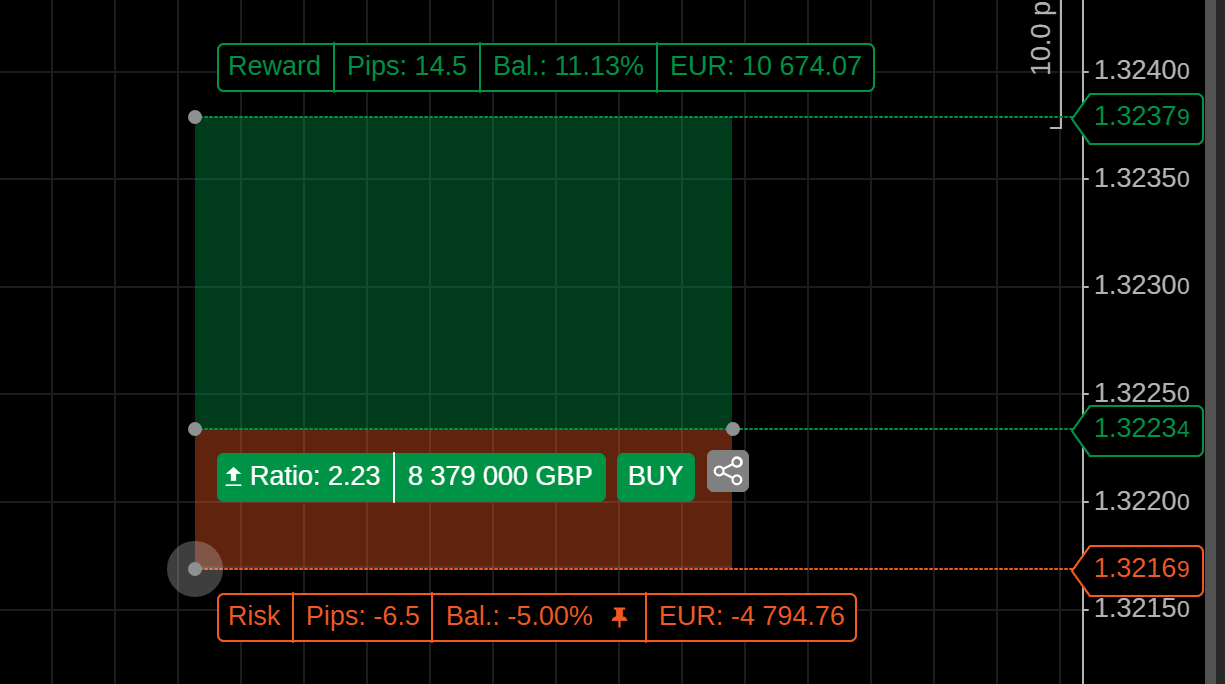

The risk-reward tool allows you to quickly calculate the trade volume directly on the chart, based on the amount you are willing to risk or your desired profit target per trade.

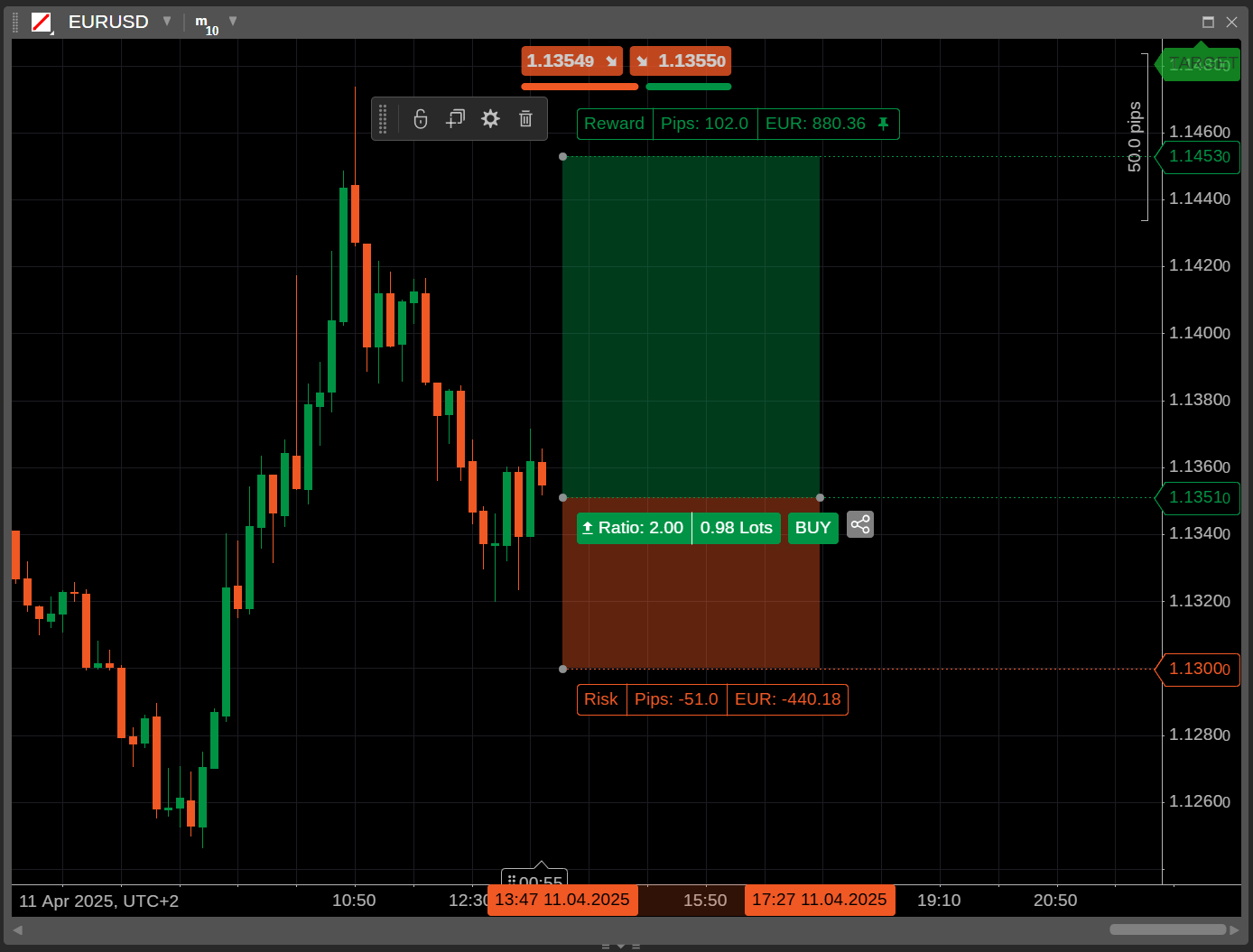

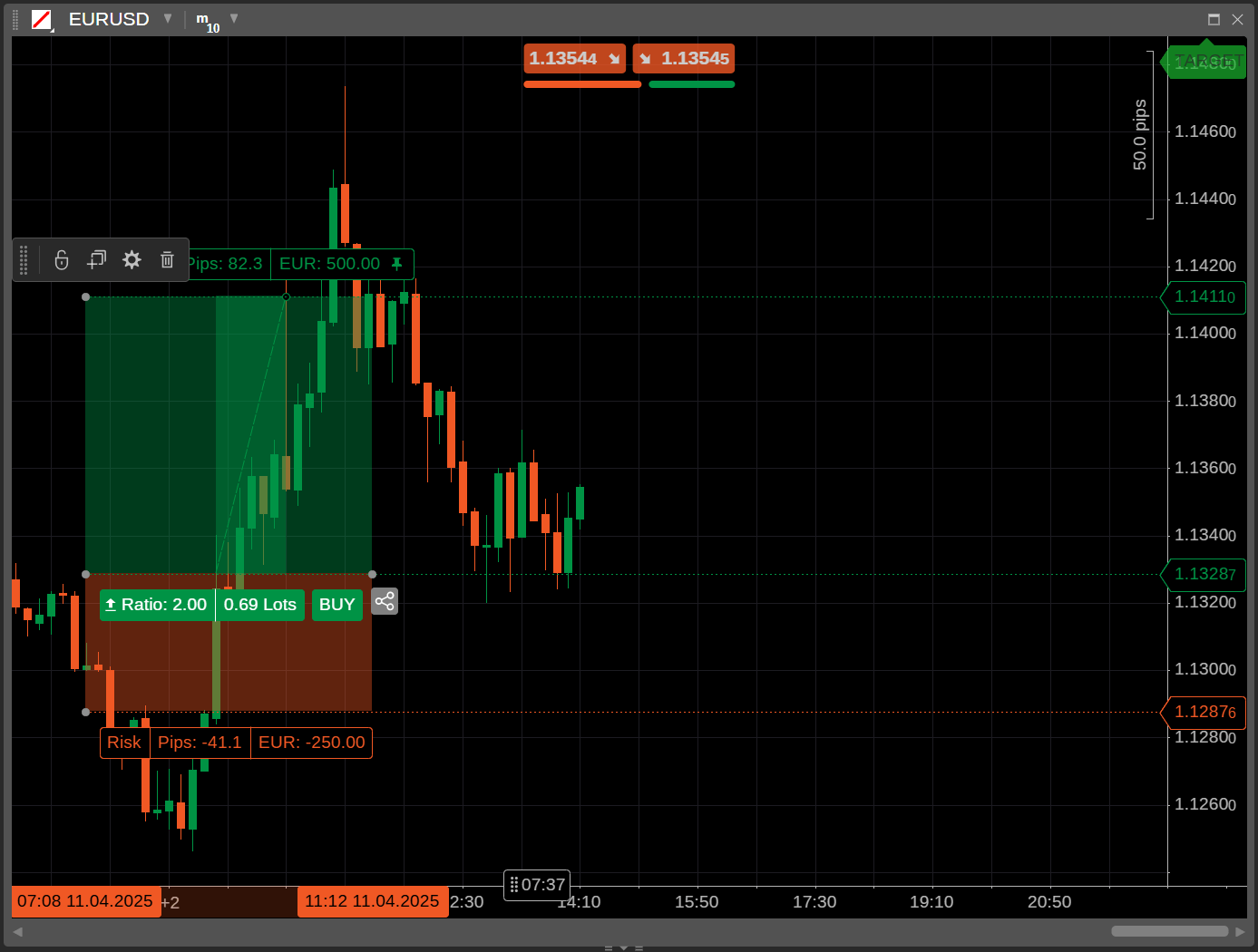

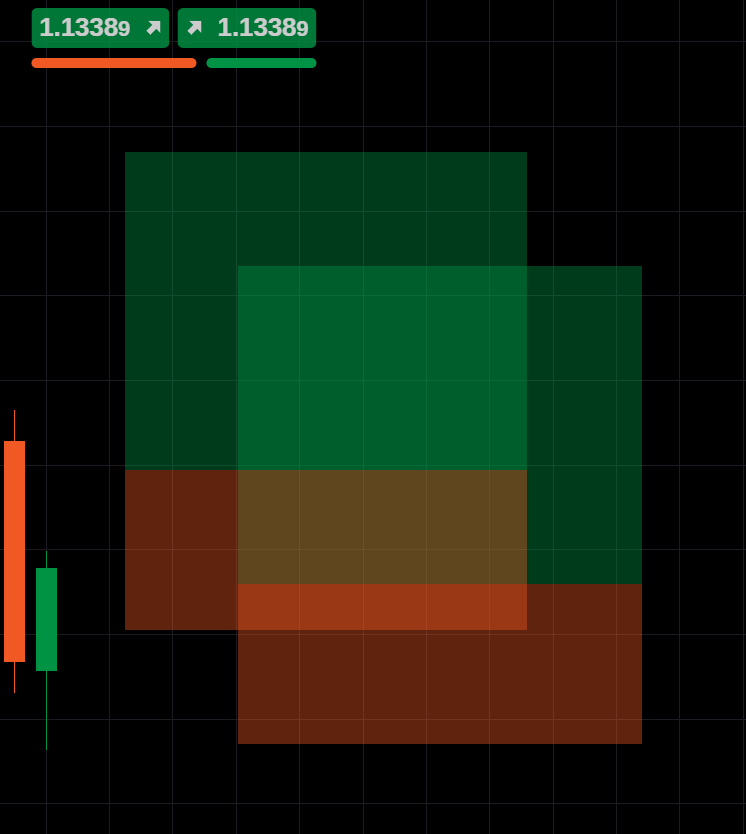

Risk-reward typically compares the potential profit (reward) of a trade to its potential loss (risk). The reward is visualised as the distance between the entry price and the take-profit level, while the risk is visualised as the distance between the entry price and the stop-loss level.

Risk-reward in one minute!

- Traders use risk-reward to quickly calculate the quantity or volume of their trade, and the potential profit-to-loss ratio is visualised on the chart.

- After adding risk-reward to a chart, users can choose a calculation mode to fix values for risk, reward or order/position size.

- For convenience, traders can specify the amount they are willing to risk or gain as volume in units, a percentage of their balance or a percentage of their equity.

- Traders can enter order parameters, configure protection settings and place an order with a single click.

Add risk-reward to chart¶

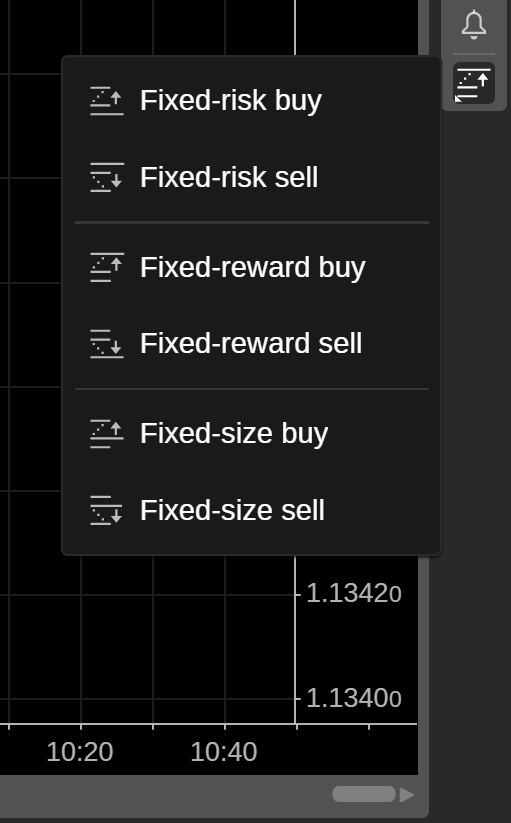

Click the Risk-reward icon in the chart instruments toolbar, then choose a buy or sell option with a fixed risk, reward or size.

Using the crosshair, click on the trading chart to specify your desired entry price. The risk-reward object will be placed at that level.

Note

When you add or move the risk-reward object to a past period along the price axis, a possible past deal (with profit or loss) is highlighted with a deeper colour.

Adjust risk-reward parameters¶

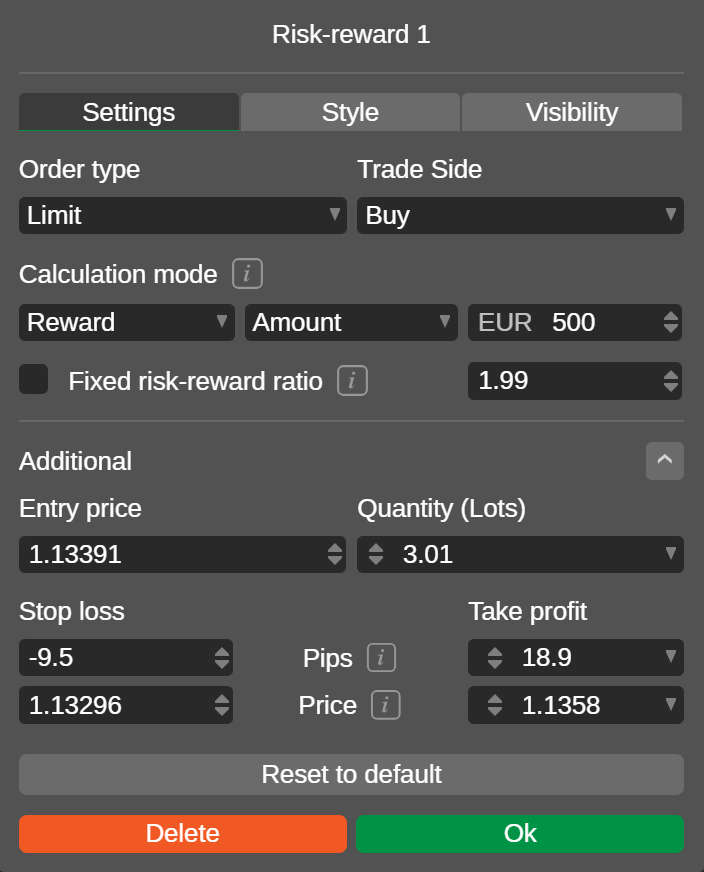

Right-click the risk-reward object or click the Settings icon in the risk-reward toolbar.

Here, you can configure the following parameters:

| Parameter | Value | Definition |

|---|---|---|

| Order type | Market, limit, stop, stop-limit | Choose an order type. |

| Trade side | Buy, sell | Choose a trade direction. |

| Calculation mode | Risk, reward, size | For risk and reward, specify the volume in units, a percentage of equity or a percentage of balance. For size, set the volume in units or the quantity in lots. |

| Risk-reward ratio | Any value (most traders prefer from 2 to 3) | Possible to lock the risk-reward ratio at a fixed value. |

| Entry price | Any value | Set the entry price (available for non-market orders only). |

| Quantity/volume | Lots/units | Specify your trade quantity or volume. |

| Stop loss | Pips, price | Set your desired stop-loss protection as a distance from the entry price or at a specific price level. |

| Take profit | Pips, price | Set your desired take-profit protection as a distance from the entry price or at a specific price level. |

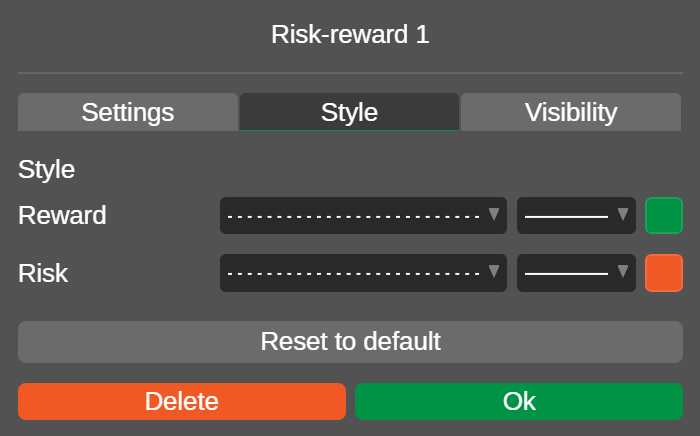

Confirm your settings by clicking OK. Otherwise, reset to default or delete the risk-reward object.

Alternatively, you can adjust some of these parameters directly on the chart. When the risk-reward object is active, move the entire object or drag its control dots along the price and time axes.

Use manual adjustments to do the following:

- Achieve a specific risk-reward ratio.

- Modify the entry price for non-market orders.

- Adjust the risk and reward areas, affecting stop-loss and take-profit parameters.

Note

Adjusting the risk-reward dimensions does not affect the pinned value of the selected calculation mode.

When the risk-reward ratio is fixed, dragging either the risk or reward area automatically adjusts the other area proportionally. The pinned value of the selected calculation mode remains unaffected.

Tip

Click the Share icon to copy a signal link containing the configured order parameters and protections to your clipboard. You can then share this link via social media, messaging apps or any other preferred communication channel.

Place orders with risk-reward¶

Click Buy or Sell on the risk-reward object to place an order with the configured parameters.

Warning

A market order is executed at the current price, regardless of the position of the risk-reward object on the chart.

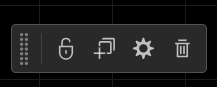

Manage risk-reward objects¶

Options for managing risk-reward are displayed in the risk-reward toolbar.

Customise style¶

Navigate to the Style tab of the risk-reward settings. Here, you can customise the risk-reward lines and areas separately:

- Select a line type.

- Set the line thickness.

- Choose a colour and adjust the opacity.

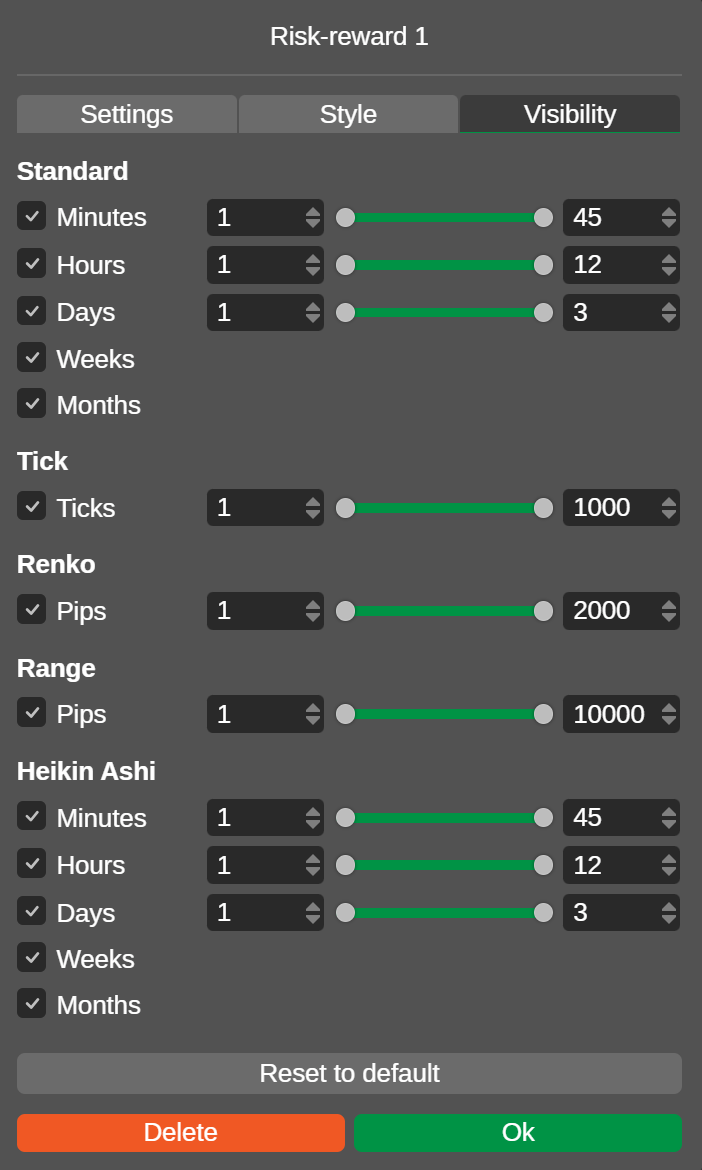

Set visibility¶

In the Visibility tab, you can specify the chart periods for which the risk-reward object is shown on the chart. By default, it is set to display on all periods.

Example

If you set the range to 3–25 minutes and 2–4 hours, the risk-reward object will be shown on the chart only when the selected period falls within the range (e.g., m3, m5, h2, h3). The object will be hidden when periods outside the range (e.g., m1, m30, h1, h6, d1) are selected.

Duplicate¶

Click the Duplicate icon, and an identical risk-reward object appears on the chart.

Lock¶

Click the Lock icon to lock the selected risk-reward object in its current position on the chart.

Delete¶

Click the Delete icon to remove the selected risk-reward object from the chart.

Note

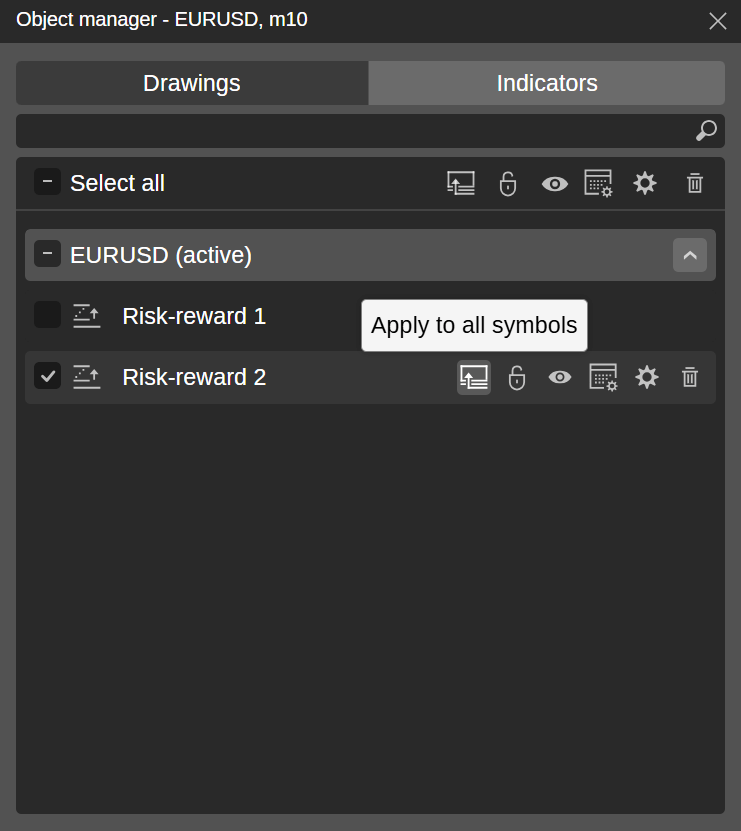

You can also manage risk-reward objects on the chart by opening Object Manager and then selecting Drawings.

In addition to the actions covered above, Object Manager allows you to do the following:

Apply to all symbols¶

Click the Apply to all symbols icon, and the risk-reward object will become visible on any symbol in the chart container.

Hide object¶

Click the Hide icon to hide the risk-reward object on the chart.